If you’ve spent any time online in the personal finance space, you might find that many people tend to fall into one of two camps:

- Those who focus on earning more money and maximizing their income…

- And those who focus on slashing expenses and living a more frugal life.

After a few minutes of scrolling, you’ll probably be left wondering where you should focus your energy… Is it more important to earn more or spend less?

Well, we’re here to break it down for you in this post! The truth is, BOTH strategies have awesome benefits. But if you take either one to the extreme, it could leave you feeling quite miserable. A healthy dose of both is in order.

Earning More Vs. Spending Less

Spending less and earning more are two totally different beasts, each with their own unique ability to aid your finances.

The truth is, when we neglect one in the pursuit of the other, we overlook a ton of benefits that we could be taking advantage of.

Here’s a summary table with high level points…

Benefits of Earning More

You don’t need to be a billionaire to reap the benefits of earning more money. Especially with rising costs and inflation, even small increases in income can go a long way in making your life more comfortable. Here are a few ways that making more money can benefit your life.

1. You have a greater ability to meet your needs

Perhaps the best advantage to making more money is that, when handled well, you’ll have an easier time meeting your needs. When you make more money, small price increases and surprise expenses won’t strain your finances the same way it can if you’re living paycheck to paycheck.

Plus, more income will likely mean that you’ll have more money to spend on things other than necessities. Having a little extra cash on hand to enjoy some of those wants can totally enrich your life!

Of course, if you’re blowing all of your money the minute it enters your bank account no matter how big your paycheck is, lifestyle creep will constantly be getting the better of you. Developing good money habits like mindful spending and knowing the difference between needs vs. wants will ensure that you’re actually able to enjoy the benefits of that higher income.

2. Earning more usually increases personal growth

Another benefit of earning more is that it is often accompanied by massive personal growth.

Whether you’ve earned a raise at your 9-5 because you’ve made yourself more valuable at your job, started a side hustle, or pivoted to a higher earning field, increases in income are often the result of learning new skills and becoming more experienced.

The awesome part about this is that whatever the future holds, you get to keep that growth forever. No matter where you decide to take your career, you’ll remain an improved, more skillful version of yourself!

3. An abundance mindset can help your finances

In his book, “The 7 Habits of Highly Effective People,” Steven Covey discusses the ways in which an abundance mentality can enrich your life.

Believing that there is enough success and wealth out there for everyone stems from feelings of self worth and security, which can take you far.

Having a confident and optimistic view of money can certainly help you to have a healthy relationship with your finances, take more healthy risks, and explore creative solutions to problems you face. And we all know that being confident can help us to open more doors for ourselves and advocate for ourselves in the workplace.

However, having an abundance mindset can have a few drawbacks as well. More on that in a sec…

Drawbacks Of Earning More Money

As a wise man once said, “mo money, mo problems.” While focusing on earning more is typically a good thing, there are a few negatives that can come from only attempting to increase your income.

1. You can’t “always make more money” (even if it feels like you can)

Not to kill the vibes here, but even if you feel super secure in your job or career, there is always a chance that you could fall on hard times. Having an overly optimistic mindset can leave you underprepared in the case that disaster strikes, which is why it’s important to make sure you keep your spending in check and prepare your finances for a rainy day.

Counting on money that hasn’t hit your account yet is basically like counting your chickens before they hatch. Until that cash is in your hands, it isn’t really yours yet.

That’s why if you’re focused on earning more, it’s important to make sure you’re still prepared in case of an emergency. Having a fully funded emergency fund, being prepared for economic downturns, and keeping your spending under control are still important, even if you’re crushing it right now.

Related Posts:

2. It Can Lead to Overworking

Earning more money is great, but doing so at the expense of a good work-life balance can have catastrophic effects on your life!

It’s no secret that overworking can cause stress, leading to a slew of health problems like headaches, heart problems, and diabetes. Plus, it can put a strain on your relationships, and cause you to miss out on making memories with the people you love.

Working hard is important, but we still have to make sure we put work in its proper place, and don’t let it take over our entire lives.

3. You’ll pay more in taxes…

One of the other negatives about earning more is that you will pay taxes on every dollar you make.

When you make more, you’ll inevitably pay more in taxes. Now, that’s definitely not a reason to forgo any efforts to increase your income. No one has ever turned down a raise because they didn’t want to pay tax on that money. However, it is important to be aware of this, because it contradicts one of the superpowers of saving more…

The Benefits of Saving More

Now that we’ve seen the ways that earning more can supercharge your finances and discussed what downsides to look out for, it’s time to investigate the pros and cons of becoming more frugal, of saving more money.

1. You get a dollar for dollar return

One of the best things about saving more money is that you get to enjoy all of the money you saved. On the flip side, when you make more money you have to pay tax on those extra earnings. Turns out Benjamin Franklin was right, a penny saved truly is a penny earned. Although let’s be honest, who uses pennies anymore!?

While paying tax on extra income is certainly not a reason to forgo the pursuit of making more money, it’s definitely an argument in the camp of saving more. You can feel the full effects of that money you saved on your life without having to cough any of it over to the government.

Related: 27 ways to save money!

2. You enjoy a double benefit when you save…

When you cut down on your spending, you get to “double dip.”

If you’re able to drastically lower your living expenses, it has a twofold effect. Not only do you have more money on hand, but you also are able to live on less if you can keep your consumption in check. This means that your salary or income can stretch that much further!

That’s why being able to live on less money and being content with what you have can be such a game changer when it comes to your finances.

3. Can help build willpower and discipline

If constantly being bombarded with ads and feeling pressured to get the latest and greatest things leaves a sour taste in your mouth, then you might seriously enjoy this benefit of cutting back on your spending.

When we choose not to make a purchase or not to act on an ad that’s being pushed on us, we are making a choice to not get wrapped up in consumerism.

Let’s face it- we live in a society where it’s easy to feel like we’re expected to spend money on certain things just to keep up with the people around us. Especially with social media playing a big part in our lives, it’s easy to feel like you need to spend money to fit in.

Truth is, trying to keep up with the Joneses is a one-way ticket to financial ruin. Social media only tells a part of the story. While we might see things like shiny new cars, extravagant vacations and designer clothes all over our feed, we don’t know what is funding that lavish lifestyle. And it could be mounds of debt. Or even just a charade.

While we understand that there are some purchases that can greatly enhance your life, being able to say no to things that you don’t need and that won’t move the happiness needle is a skill that can reward you time and time again.

4. You’ll need less money to retire

Perhaps the best benefit of focusing on saving more and minimizing your spending is that you’ll need less money to retire!

That means you can spend more years enjoying your life, spending time with the people you love and exploring your hobbies instead of working to support your lifestyle.

The more income you can sock away into retirement accounts, the quicker you’ll be able to retire and reach financial independence! But it is still definitely possible to build wealth on a small salary, too!

Making the decision to cut out a couple of subscriptions, go carless, or move to a cheaper city can have a massive impact on the amount of time freedom you’re able to enjoy in your life. Since time is our most important resource, this is a big check mark in favor of frugal living.

5. Immediate Gratification

While earning more money can take weeks or even years of hard work, you can do a few things today that will save you a decent chunk of change.

Canceling subscriptions, calling your utilities or insurance companies and asking for a discount, and just saying no to some of the more frivolous expenses in our lives can all be accomplished in a matter of minutes. So, if you’re looking for some instant margin in your life, cutting your expenses is the way to go!

Related: 10 Ways to Save Money Doing Laundry

The Downsides of Saving More

While saving more of your money can help you to accelerate your progress on some of your biggest financial goals, it isn’t without its pitfalls. Make sure to watch out for these red flags that indicate you may be placing too much of an emphasis on saving.

1. You might be missing the bigger picture

If you’re overly focused on pinching every penny, you could be “missing the forest for the trees.”

While you’re fighting an internal battle over whether or not you should buy that $5 dollar Starbucks coffee, you could be forgetting to take a look at some of the big picture financial decisions in your life.

Are you living in a particularly high cost of living area? Does your family have two cars but really only need one? Are you struggling to make ends meet no matter how much you save because you’ve maxed out the potential income for your job field?

These are all questions you should be asking because getting some of the big ticket items right can make your life that much easier in the long run.

That’s not to say that you shouldn’t put just as much thought to the smaller purchases in your life. We know from the rule of 173 that cutting small expenses from our monthly budget can actually have a huge impact on how much money we end up with. So take the both/and approach. Don’t overlook the big things in pursuit of small savings.

2. You can only cut back so much

Another downfall of focusing too much of your attention on saving more is that you can only cut back your expenses so much.

Sure, you could pack up your life and move into a tiny house in the middle of the woods to save money, but that could put a big cramp on your lifestyle if you aren’t into that sort of thing. Plus, it would be much more difficult to do with a family.

Being frugal within reason can certainly help you to get your expenses really low, but you’ll need a place to live, a way to get from point a to point b, and you’ll need to eat. These are non-negotiable, and once you slash your budget to a certain point, it’s nearly impossible to pare back even further.

On the flipside, there isn’t really a limit to how much money you can make. The world is really your oyster here. That doesn’t mean it’s easy, of course.

Your earnings are going to be limited by how far you can move up the ladder, but if you’re an entrepreneur or have a side hustle the sky is really your limit here. Plus it’s never too late to switch careers to something with more earning potential.

Related: How to fix a failing budget

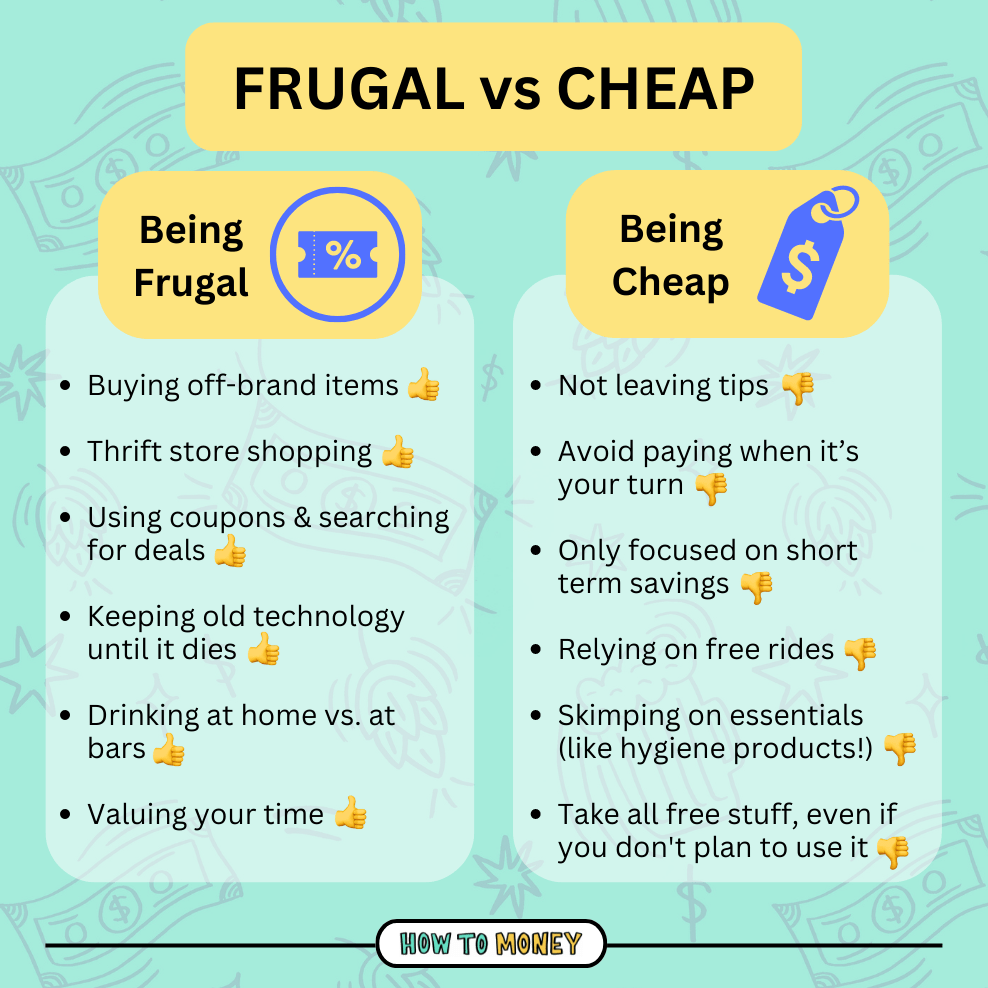

3. You could end up being cheap

Being frugal is a super power. Being cheap – not so much.

If you put all of your efforts into cutting expenses and saving money, you might be at risk of falling into “cheap territory.” What’s considered cheap is different for each person, but here are two surefire ways to know you’re being cheap.

Here’s an example of being cheap: If you were to drive 20 minutes out of the way to save 10 cents a gallon on gas, we would argue that the money you’re spending on gas to get there completely negates the potential savings. You’re inconveniencing yourself and not really saving much at all, so this is a cheap move.

If you tend to do stuff like this, it might be time to refresh the way you think about money.

Consider committing to giving away a percentage of your income to worthy causes. Giving generously can enrich our lives in so many ways. It can deepen our relationship with our community, make us feel like we’re a part of something bigger, and help us to build a healthy relationship with money.

If you want to find out more about the ways in which giving can totally change your life, be sure to check out How to Give Away Money (And Why it’s Awesome!).

4. You can miss out on a lot of fun

This is a mistake that a lot of people make when they’re pursuing FIRE. Sometimes we get so caught up in the pursuit of savings that we say no to opportunities to make great memories.

Not to get all existential on you, but you’re never going to have this day again!!!

It’s totally fine if you want to frontload some of your financial efforts into your younger working years, but the truth is that you’re not promised tomorrow. This means that you shouldn’t be waiting until you retire to do some of the things that you’ve always dreamed of.

If there’s something you’ve always wanted to do, like traveling to Europe or trying out a new hobby, like pickleball which is so hot these days, find a way to incorporate it into your life now, even if you have to do it on a budget!

At the end of the day, when you’re older you’re going to want to look back on your life with fondness for the memories you created, not just the time spent grinding it out at the office. That’s actually one of the five regrets of the dying, so learn from their mistakes! Make a commitment to yourself today to find a way to work the things you love into your life right now. You won’t regret it.

5. You might develop a scarcity mindset

Having a scarcity mindset is when you believe that there are not enough resources to go around. And while this can have some benefits, as Matt and Joel discussed in this interview with Kristy Shen, it can also lead to some pretty negative consequences.

Developing a scarcity mindset might prevent you from taking necessary risks with your money. If you’re too afraid of losing money, it might prevent you from investing for your retirement, which is necessary if you want to build up enough wealth to stop working some day.

The Bottom Line:

So where should you place your focus… Earning more or spending less?

If you haven’t figured it out by now our answer is… a bit of both! These two aspects complement each other perfectly and prevent you from going too far to either side. Pursuing both allows you to enjoy the benefits of each, without becoming unbalanced!

If you find yourself leaning too much to one side, we challenge you to take a look at the strengths that the other can offer you. Try and find a few ways to implement different wealth building strategies into your everyday life.

Related Posts:

- The Diminishing Returns of Frugality- Episode 680

- Maximizing Your Income in 2023- Episode 623

- 14+ Saving Money Challenges to Try This Year

Beer tasting notes:

While talking about earning more vs spending less we enjoyed a Bad Bunny Pie by Tripping Animals! And as we’ve ramped up the podcast with an additional Friday episode every week, we could really use your help to spread the word- let friends and family know about How to Money! Hit the share button, subscribe if you’re not already a regular, and give us a quick review in Apple Podcasts or wherever you get your podcasts. Help us to spread the word to get more people doing smart things with their money in these difficult times!

Best friends out!