Frugal living is a superpower. When you start to adopt mindful spending into your everyday life, you’ll notice that you’re holding onto more of your cash, all while maintaining a stronger focus on the things that really matter to you. Mastering the basics of frugal living can help you totally slash your monthly expenses. Here’s how:

What is frugality?

At its core, frugal living is simply being thrifty and efficient with your money. It’s all about paying attention to what truly matters, and working to spend less money on the things that don’t. Frugal living is a core lifestyle value which encourages you to be more conscious about what you purchase, making sure that every dollar spent brings value and joy to your life!

There’s a common misconception that being frugal is boring, or too restrictive. But the opposite is often true. Creativity can peak when you impose restrictions, forcing youf to think outside of the box. The reality is, frugality actually expands your thinking and capabilities. Frugality can act like a creative spark!

However, being frugal is not the same as being “cheap”. Frugal folks pay attention to value, rather than just purchasing items at the lowest price point. This also includes valuing your time. For example, frugal folks wouldn’t drive an extra an extra 15 minutes to save 5 cents a gallon on gas! 🤣

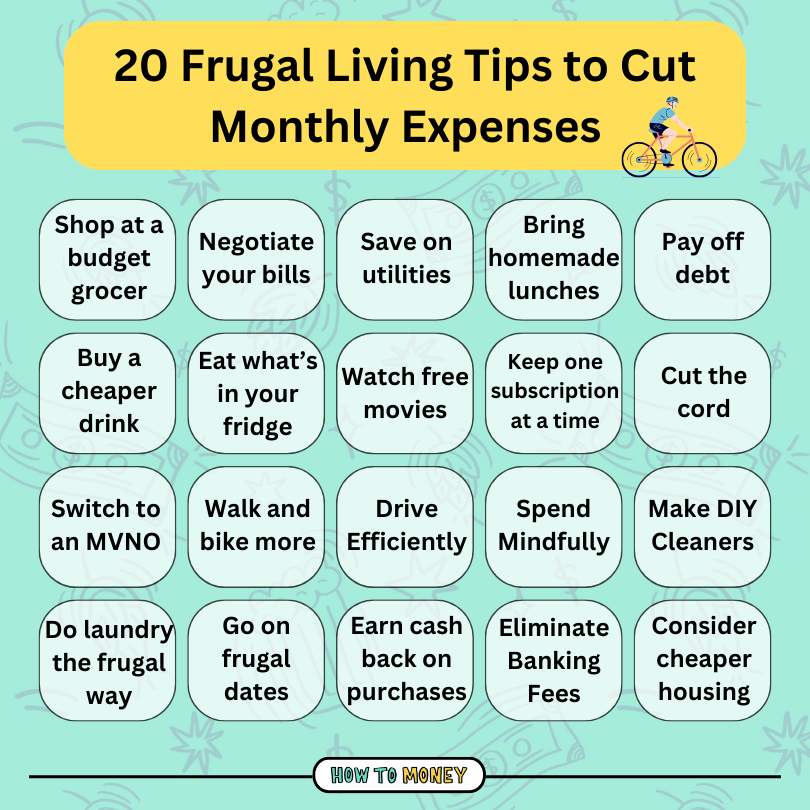

20 Tips for Frugal Living

Simple actions can result in serious recurring savings, and that’s what these frugal living tips are all about. Implement some (or all!) of these into your weekly routine to reduce your monthly spending and live in line with your values.

1. Start shopping at a budget grocery store

True story: I went to my local grocery store the other day, even though I typically prefer the more affordable Trader Joe’s a few miles away. Some of the prices I saw that day completely blew my mind!

The price of oatmeal at this store nearly sent me into a coma. $5.99 for one of those 18 oz tubes of oats!! 🫨 What made me even more upset was when I remembered that my local Trader Joe’s sold a 32 oz bag of oatmeal for $3.99. That means that the exact same oats were nearly three times the price at my local grocer. Yikes!

A lot of people underestimate just how much money they can save by shopping at a budget grocery store like Aldi, Lidl, or Trader Joe’s. Even the 99 Cent store and Dollar Tree have good frozen food sections, cheap dry foods and condiments. Some locations offer fresh produce too! These stores are able to drastically reduce prices on the basics because they mainly offer store brand products. Because of this, you can change practically nothing about your shopping habits, and save a ton!

For example, this writer at CNET compared the prices of 50 items at Trader Joes and Stop and Shop, and found that you could save around 33% by shopping at Trader Joe’s.

No budget grocer by you? No problem! Even switching to store brand items at pricier grocery stores can save you up to 40% on your grocery bill.

Estimated Savings: ~$100 per month or more!

2. Negotiate your bills

Another frugal living tip that can slash your monthly expenses is setting aside time to negotiate your bills. You may not realize it, but as a consumer you have more power than you think over how much you pay for things like cable, internet and insurance.

Set aside time this week to call your service providers, and ask them if they have any new customer promotions you can take advantage of. If the representative on the phone is unable to assist you, try asking for the customer retention department. They may be able to offer you better deals, because their job is to try and convince you to stay with your current company!

Remember that if you want to lower your monthly bills, you’ll need to be willing to walk away from companies that refuse to discount your current rate. If you can’t secure a discount, try switching to another company to snag a new customer offer. The small amount of hassle is typically worth the significant savings.

Estimated Savings: ~$50/month or more!

3. Pay attention to your utilities

One of the best ways to live frugally is to start paying more attention to your utility bills. Being more mindful about your energy and water use can result in significant monthly savings. Plus, it’s a great way to be less wasteful and look out for our environment!

For example, did you know that you could expect to save $140 each year by replacing your inefficient toilet with a low flow Watersense unit? Plus, most water companies offer a rebate for the cost of that new toilet too. Or that a 5-7 degree adjustment on your thermostat could save you 10% or more on your heating and cooling costs?

Small everyday decisions can significantly affect our bottom line. Adjusting our habits to become more efficient can help us to conserve energy while also building wealth for the future.

Looking for more tips on how to reduce what you pay on utilities? Be sure to check out our posts below on how to reduce your gas, water and electric bills.

- 9 Ways to Reduce Your Monthly Gas Bill

- 11 Ways to Save Money On Your Water Bill

- 13 Tips to Save Money on Electricity

Estimated Savings: ~$20/month

4. Bring lunch from home

If you work in an office, it may be tempting to grab lunch out every day, but bringing it from home makes for a healthier diet and a happier wallet!

Recently, Forbes found that the average home cooked meal costs $4.31. But the cost of a meal out can vary greatly. If you’re living in a metropolitan area, it’s not uncommon to spend around $15 on a grab and go sandwich or salad. By simple meal planning and packing lunches you can bank a quick $10 per meal!

Not to mention, when you eat food made at home, you have more control over what goes into your body.

Estimated Savings: ~$200 per month

5. Pay off debt

Another great way to embrace frugal living is to work towards becoming completely debt free. Debt can weigh your finances down at best, and be absolutely catastrophic at its worst.

If you have any “bad” high interest debt, like credit card debt, it’s important that you work to pay this off as quickly as possible. This is because a high interest rate causes your debt to skyrocket over time, making it even more difficult to pay off.

Plus, using a credit card and paying it off over time essentially makes our purchases cost more. For example, if you buy a $4,000 vacation package on your credit card and pay it off over a year, that trip will actually end up costing you $4,515 when you factor in the interest paid.

Debt payments can eat up a large portion of our monthly budgets. In fact, the average American allocates $1,583 per month towards debt payments! While mortgages do account for some of that debt, things like auto loans, personal loans, and credit card debt also make up a large chunk. For example, the average monthly auto loan payment for new cars is $728, while the average payment for used cars is $533. Imagine what you could do with an extra $500-700 in your monthly budget!

How to Pay Off Your Debt

Two popular methods of paying off debt are the debt snowball and the debt avalanche.

Utilizing the debt snowball, you focus your efforts on paying off loans with the smallest balance first (all while continuing to make the minimum payments on all other debts). After the smallest balance is taken care of, you progress to the debt with the second lowest balance, and so forth. This can help to create positive momentum and to get some small wins under your belt quickly.

The debt avalanche is technically more financially savvy, although it might take a little longer to get a ”quick win” under your belt. It works by prioritizing paying off the debt with the highest interest rate first. Then, after you get rid of that one, move on to the debt with the next highest interest rate.

Both methods have their own pros and cons. But the thing that matters most is sticking with your plan once you start. Living debt free makes everything in life cheaper!

Estimated Savings: Could be any amount depending on the amount of debt you currently carry!

6. Buy a Cheaper Drink

Sure, I could tell you that skipping out on a $6 coffee each morning could save you around $132 each month, but you already know that. Plus, frugal living is about spending more money on the things that matter to you… And if that morning drink brings you joy, more power to you!

However, have you ever thought about how much money you could save simply by adjusting what drinks you order at your coffee shop of choice? Opting to grab an iced or hot coffee instead of a latte can drop the price of your order by around $2. Or, consider minimizing your drink customizations, and instead find a stock drink you enjoy to save some money!

Or hey, maybe don’t! If it really makes you happy, I say go for it. However, I’ve recently switched to ordering iced coffees, which I like just as much. And I’ve found that it reduces the financial impact of my little coffee habit.

Pro Tip- If you live in an area where Dunkin’ is present, you need to get the Dunkin’ app. They have tons of coupons each month on the app for different drinks. For example, they had a recent promotion where from January-February 2024, they offered $2 medium hot and iced coffee every day for two entire months!

Estimated Savings: ~$44/month

7. Stop throwing away your food…

We’ve all been there. We tell ourselves that we’re going to stop eating out and start cooking all of our meals at home. Then, life gets busy, we get takeout, and all that produce in the fridge turns to sludge. It is then eventually thrown in the garbage.

Americans waste a lot of food. In fact, the average American throws out nearly $63 worth of food every week! While eating out can be more expensive, buying and wasting groceries on top of eating out will result in even higher spending.

Sometimes, instead of going all or nothing, we need to focus on setting smarter goals. Instead of cutting out restaurants cold turkey, buy enough groceries for five days and schedule in some wiggle room to grab takeout on those busier days. Avoiding the “double dipping” of buying excess groceries and eating out can help to greatly reduce your food spending.

Estimated monthly savings: ~$252/month

8. Take advantage of free movies!

Now we’re not telling you to do a Google search for bootleg movies online and ultimately give your computer an irreversible virus. However, there are some totally legit ways to enjoy your favorite movies for free without visiting a sketchy website.

Your local library is a great place to turn! The Kanopy app can allow you to watch some recent and well known movies without paying a dime. Amazon Freevee, The Roku Channel, Sling Freestream, and Tubi are other great options!

Compare that to the cost of renting a movie online and you can save up to $20 per watch! Replace a streaming service with these freebies and you’ll be looking at even greater savings.

Estimated Savings: ~$20/month

9. Only pay for one streaming subscription at a time

Speaking of subscriptions, it’s time to change the way you think about them! One of my favorite frugal living tips is to challenge yourself to only pay for one streaming service at a time.

I’ve seen videos on TikTok and Instagram where “finance gurus” shame others who are paying off debt while also paying for Netflix. I think this message really misses the mark.

When under control, paying for a streaming service can generate a lot of cheap entertainment for a household. If you watch a movie every weekend on Netflix instead of actually going out to the movies, it could save you ~$104 each month for a household of two people. Plus, it’s cheaper to have friends come over for a movie night than to go out for drinks and dinner!

However, things get hairy when you start to pay for 7 different streaming services every month while you really only enjoy watching 1-2 of them mostly. The average person pays $46 per month a month for streaming content. That may not sound like an absurd amount, but the issue is that they likely aren’t getting use out of every single streaming service they’re paying for.

Instead of paying for ALL of the streaming service subscriptions every month, try putting them on a rotation. If a new season of your favorite Netflix series drops this month, pause or cancel your Hulu subscription. Wanna watch that new Disney+ show? Ditch Netflix for a month. One of the best parts about streaming vs cable is that there are no contracts. There’s no shame in canceling your subscription and signing back up again later. It could save you bigtime!

Estimated Savings: ~$31/month

10. Cut the cord

Another frugal living tip is to ditch cable altogether – if you’re still one of the 70 million households that still pays for a cable package. With all the great content on streaming services out there, do you really still need live TV?

If you do want to watch live TV like sports games, you could still potentially save by switching from cable to a cable alternative like Hulu + Live TV or Youtube TV. While the average cable package is around $217 per month, Hulu + Live TV is only $76.99 per month, and includes Disney +!

Estimated Savings: ~$140/month

11. Switch to a low cost phone provider

If you’re still paying one of the big phone companies for cell service, what are you doing!? You could be missing out on some serious savings for the same cell service. MVNOs lease wireless network infrastructures owned by the big phone companies, like Verizon and T-Mobile, which means you can enjoy the same network at a steep discount.

| MVNO Carrier | Cell Network | Cheapest Plan | Unlimited Plan |

| Mint Mobile | T-Mobile 5G network | $15 | $30 |

| Visible | Verizon 5G network | $25 | $25 |

| Boost Mobile | T-Mobile’s 4G LTE and 5G networks | $8.33 | $25 |

| Google FI | T-Mobile’s 4G LTE and 5G networks | $20 + $10/GB | $50 |

While the average phone bill is around $160 per month, some low cost MVNOs are changing the cell service game. For example, Mint Mobile offers a $30/month unlimited plan, which could make sense for you if you need to use a lot of data on the go. If you use very little data, you may even be able to get by with Boost Mobile’s cheapest plan, coming out to just $8.33 per month!

Estimated Savings: ~$130/month

12. Walk or Bike More

Another frugal living tip is to start using the legs that God gave you on the reg! Driving less and walking or biking more is great for your health, your wallet, and the environment.

A little over 10% of daily car trips are taken just to go one mile or less. And 50% of car trips are, on average, within 4 miles of your home. These are distances easily walked or biked by many folks. Opting to walk these trips instead comes with a plethora of health benefits, and can help you to keep more of your cash. Plus, you’ll have the opportunity to discover new things about your community you may have never noticed!

If you live close enough to walk or bike to work, your savings could be even further amplified.

For example, if you live 10 miles away from work, and opt to bike there instead of drive, you could save nearly $1,000 annually! Ditch your car altogether, and you could be looking at a savings of up to $9,282 every single year!

Obviously, not everyone can ditch their car, or lives close enough to commute to work. But, the less you use your car the more you’ll save on gas and maintenance costs. Even walking or biking a few times each month can result in significant savings.

Estimated Savings: ~$20-773.50/month

13. Drive better

We all know that speeding puts us in danger, but it also costs us more!

First, arriving at work two minutes faster probably won’t feel very worth it when you get slapped with a $100 speeding ticket. Second, driving around like Dom from Fast and Furious creates some serious engine wear, and uses a lot more gas.

According to the US Department of Energy, for every 5 mph you drive above 50 mph, you’re effectively spending $0.30 more on each gallon of gas. This means, if you’re driving 70 mph, you’re making each gallon of gas “cost” you $0.90 more. If your commute requires you to drive 20 miles per day on the highway, and you speed by 15 mph, you could increase your monthly commute costs from around $47.66 to $60.86!

Estimated Savings: ~$13/month (and points on your license!)

14. Stop saving your credit card information

With the ability to store your credit card information on shopping websites like Amazon, it’s never been easier to spend money without a second thought! This can make it easier to act on impulse since there is virtually no friction preventing you from clicking that ‘buy now’ button!

One of my favorite mindful spending tips that can allow you to live more frugally is to stop storing your credit card information on shopping websites. This gives you some time to think twice about your purchase before the deed is done. Sometimes, needing to walk to the other room and get your wallet is all it takes to curb your desire to actually complete that transaction.

You could also create a 24 hour wishlist for all online purchases. This means that if you decide you want to buy something online, add it to your cart and wait a full day before placing that order. You’ll often find that you no longer want that t-shirt or kitchen gadget as much as you did the day before.

Estimated Savings: ~$20-100/month

15. Make your own cleaners for cheap

The costs of keeping a clean home can add up. On weeks when you need to replenish your bathroom cleaners, glass cleaners, and other multi-purpose sprays, it can feel like your grocery store budget has been completely busted.

But fret not, because if you’ve just run out of all your cleaning solutions, you probably have all the ingredients you need at home to make your own! Using simple ingredients like vinegar, water, lemon juice and baking soda, you can follow these recipes to create your own all purpose cleaner, glass cleaner, toilet cleaner, and floor cleaner.

Bonus Tip- If you want to spend even less on cleaning supplies each month, try cutting up some old t-shirts or towels to create reusable cleaning rags!

Estimated Savings: ~$5-10/month

16. Do your laundry the frugal way

Did you know that there are tons of frugal laundry hacks that can tchange your laundry game? Doing laundry the frugal way not only can cut back on energy usage, but also will protect your favorite outfits, saving you money over time.

If you step out to run a quick errand, it can be tempting to toss your clothes into the hamper instead of hanging them back up and putting them away. However, over washing your clothes when you’ve only worn them for a few hours (unless you did something messy or got really sweaty!) can cause unnecessary wear and tear on your favorite threads.

You’re also probably burning through detergent more quickly than you need to. When washing clothes, you really only need to use about 2 tablespoons of detergent. Any more than that is wasteful, and it can even make your once soft clothes scratchy or crunchy. Plus, detergent is expensive!

Lastly, take advantage of off-peak energy times to start your load of laundry. If your utility provider offers this perk, make it a habit to run things like your dishwasher or washer and dryer overnight to save some money on your electricity bill!

By doing things like washing your clothes less, line drying clothes, and using off peak energy times, you can help to reduce your laundry costs!

Estimated Savings: ~$5/month

17. Go on frugal dates

According to Moneygeek, the average cost of an date in the USA costs $123! Luckily, there are plenty of cheap date ideas to help cut back on the cost of your weekly date night without sacrificing fun!

Here are 10 of our favorite date ideas that you can enjoy for under $10:

- At home spa night

- Follow a Bob Ross painting tutorial

- Visit a local museum

- Make ice cream sundaes

- Go thrifting

- Trivia night double date

- Board game night

- Visit a local bookstore

- Go to the beach

- Bonfire hangs

Estimated Savings: This might sound crazy, but if you have a weekly date night, you can expect to save around $452/month!

18. Earn cashback on your purchases

Another frugal living tip is to get rewarded for your everyday spending! You can earn cash back with some of our favorite credit cards for spending as you normally would, which you can then use to reimburse yourself for your spending.

Which credit card is the best for you will depend heavily on how you spend.

For example, if you spend a lot of money on gas, the card_name allows you to earn 4% back on gas purchases. Or if you spend a lot on groceries, the card_name offers 6% cash back at grocery stores. However, if no spending category in particular stands out, a standard 2% cash back card, like the Citi Double Cash Card, might be your best bet.However, this tip should only be used if you can follow the best credit card practices. This means avoiding overspending, and paying off your balance in full and on time each month. If you get hit with interest, it completely negates any and all rewards you’ve earned. So make sure you can handle your cards responsibly before trying out this frugal living tip.

Estimated Savings: ~$80/month

19. Eliminate Banking Fees

I don’t need to tell you that fees are the worst! Over the past few years, a lot has changed in the banking world, and you don’t need to pay ridiculous fees to your banks anymore just to have an account with them.

Let us be the ones to tell you that you deserve better! We recommend going with one of the best online banks like Ally, Capital One, and CIT Bank. These high yield savings accounts offer fantastic interest rates and have eliminated those sneaky fees that big banks tend to slam you with each month.

Estimated Savings: ~$24/month

20. Consider more affordable housing options

Lastly, a great way to live more frugally is to rethink your living situation. I know, not everyone can just up and move to a cheaper home or apartment. But, if your lease is ending in the near future, or if you’re looking to purchase a home soon, it could be a good time to weigh whether or not you are willing to make any compromises on your living situation to save some extra cash.

Ask yourself if you could live in a slightly smaller apartment. Perhaps you could negotiate your rent, get a roommate, or try house hacking. Or even start taking the DIY route on simpler home maintenance tasks to save money.

Often, we focus most of our time trying to cut back on smaller purchases, like eating out or online shopping. When added up over time, these cuts can save you a ton. You’ll often have a greater impact by getting a few of the big ticket budget items right. By significantly lowering the cost of expenses like housing, transportation, and food, you’ll have more freedom to stop sweating the small stuff!

Estimated Savings: ~$100-500/month

Is Frugal Living Worth it?

So what if you decided that today was the day you were going to completely up your money saving game, and implemented all 20 of the above frugal living tips? How much could you save?

Working off the lower end of each estimate, using these tips you could unlock $1,706 of potential savings each month!!! But the real magic happens when you take these monthly savings and invest them in low cost, highly diversified index funds.

Using the rule of 173, we can estimate how much a monthly investment could be worth in ten years. If you were to save and invest $1,706 per month for ten years, you’d be looking at a whopping $295,138! That’s enough to buy a condo or starter home in cash in many areas!

Okay, okay, but all of these tips might not apply to you. We get it. But even if you adopted half of these frugal living tips and saved and invested $853 per month, it could be worth $147,569 in just a decade. That’s not chump change!

The Bottom Line:

Frugal living isn’t about spending nothing and never having any fun. Its more about directing your dollars into things that actually provide you joy and holding back on the things that don’t. It’s also about reaching financial freedom more quickly. Being a bit more mindful can drastically reduce your monthly expenses and compound your savings faster.

So, what are you waiting for? Pick a handful of these frugal living tips and let us know what you think!

Related Posts:

This is great . I been practice same of this ways to save money and is incredible how much I been saving . Thank you

Wow I’m already doing most of those. But how do you leave electric companies when you only have one here. I like my hometown bank there’s no way I’m changing.