Have you ever been accused of being cheap? If so, how did it make you feel? In our society it seems like nobody ever wants to be labeled a cheapskate—it’s an insult and brings all sorts of negative connotations with it.

However, being a frugal person has become a badge of honor and something worth striving for. There is a temptation to become cheap when you are looking to get your finances in order, however we would encourage frugality over cheapness.

Fun fact: 92% of Americans think frugality is an attractive quality!

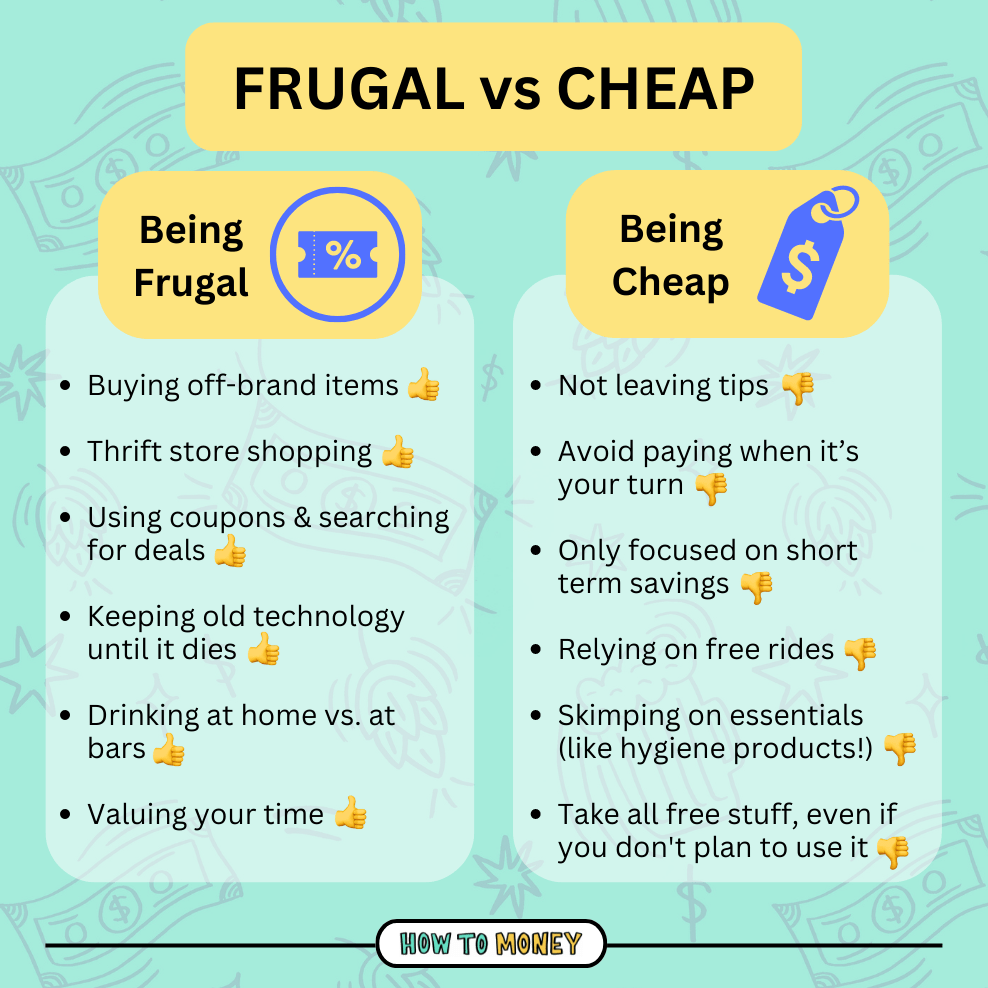

Differences Between Being Frugal vs Cheap

Frugal and cheap are often used interchangeably, but they are definitely not the same. Although cheap people and frugal people seem to have similar characteristics, they actually develop out of very different money mindsets.

- Cheapness – is only focused on getting the cost down. From a decision-making standpoint, being a cheap person is really easy because you’re only considering the numbers.

- Frugality – questions the value. There’s more thought involved in making the decision of whether something is a good purchase if you’re a frugal person because you have to weigh the cost against the value it brings you as an individual. Frugal people have balance.

More specifically, frugal folks are concerned about not being wasteful, while cheap folks focus on spending the least amount of money. Of course, you could achieve both goals at the same time, but often you’ll make different choices based on your highest priority.

Cheap is defined with words like poor quality and little worth—descriptions that people typically don’t want to be associated with. Perhaps you’ve heard other less flattering words for cheap people such as tightwad, tight ass, cheap ass, stingy, cheapskate, penny-pincher, or miser.

When making a purchase, are you trying to spend as little money as possible? Or are you taking other things into consideration?

Let’s break it down with some examples of frugal vs cheap activities.

Examples of being a Frugal Person

- Keeping and using old electronics

- Watching movies and cooking meals at home instead of going out

- Drinking alcohol only at home

- Shopping at second-hand/thrift stores

- Collecting credit card points and rewards

- Buying off-brand/generic food products

- Regularly tracking the home thermostat and electricity use

- Using your local library

- Brown bagging your lunch to work

- Eating leftovers to save money on groceries

- Not buying a gym membership (work out for free at home!)

Examples of being a Cheap Person

- Always asking to see the lowest-priced item when talking to salespeople. (Remember George Constanza in Seinfeld opting for the cheapest wedding invitations)

- Driving out of your way to save a few pennies on a gallon of gas

- Buying particle-board furniture

- Saving $20 on a cheaper pair of shoes, even though they’ll wear out quicker

- Taking office supplies from work, or sauce packets from restaurants

- Buying items with the intention of using and returning them

- Buying things just because they’re on sale

- Cutting coupons for two hours to save $3

- Skimping on personal hygiene

- Not leaving a tip

- Eating expired food

- Regifting worthless items

Why a Frugal Lifestyle is Better than Cheapness

As you can see, being a cheap person has some negative consequences. Besides being short-sighted and inconsiderate, a cheapo will likely waste money and resources in the long run.

While a frugal person also desires to spend less money, most people recognize frugality as an admirable trait. This is because being frugal isn’t just about saving the most money possible, it’s about managing money efficiently and effectively also. If you’re choosing to spend less in some areas so you have more money for things you really value, then you’re being frugal!

The key to being frugal without feeling cheap is to know your money is being spent on what you value the most. We talk a lot about this on Episode 421 with Carl Jensen – an awesome role model for living a frugal (yet wealthy) life!

Did you know that humans use more natural resources each year than the Earth can generate? Therefore, being frugal can also have a positive impact on our environment. Buying less stuff results in having to manufacture and produce less. When we manufacture and consume less stuff, we use less of the Earth’s dwindling natural resources.

Additionally, frugality can spark community and bring people together. A big aspect of being frugal is sharing, swapping, giving, and receiving. All these activities improve social relationships. For instance, consider Buy Nothing groups, co-op organizations, and even joining fellow frugal friends for potluck meals. Sharing is caring!

Fun fact: 90.4% of Americans reported using frugal hacks!

Real-Life Frugal vs Cheap Example

Mike buys tickets to a concert ($100), food ($25), adult beverages ($20) and some items at the theater gift shop ($55). In total, Mike spends $200 for the concert experience.

John is more mindful with his spending. He buys tickets to the same concert ($100), but eats at home beforehand ($0) and doesn’t buy souvenirs ($0). Then, the following weekend, John buys tickets to another concert ($100).

Both concert goers spend the full $200, but John’s frugal habits allow him to experience two concerts where Mike can only experience one.

As you can see, there is a huge lifestyle difference between frugal vs cheap. Spending less on things that don’t provide long-lasting value means you can spend more on things that do provide you value. Frugal people often possess good financial habits.

Tips for Frugal Living:

Sometimes it’s a fine line between frugal and cheap and sometimes it might seem like you’re being both at the same time. For instance, is it frugal or cheap to grab a handful of ketchup packets from a restaurant to stock your kitchen? Some might say that’s cheap while others think it’s worth their time and energy to pull off such a feat. Many of the previous examples can be debated as a matter of perspective—one person’s cheap might be another’s frugal! That’s personal finance.

To help navigate through the grayness of it all, here are five guiding frugality principles that might help provide some additional clarity between a frugal vs cheap approach:

1. Think Long Term

Cheap people are thinking about the short-term benefits while frugal folks are playing the long game. As a result, being cheap can actually cost you more in the long run because you buy certain items more often. We’re talking fast fashion items that last for a single season vs time-tested wardrobe staples.

2. Practice Mindful Spending

Cheap individuals fall into the trap of trying to avoid spending altogether, or they employ a “Black Friday mindset” and buy too much junk they don’t need. Frugal folks are instead willing to spend on the things they care about. They budget properly and allocate the funds they need to spend intentionally on their favorite categories.

3. Value Your Time

Cheap peeps don’t take their own time and energy into account when they see a deal or when they attempt to DIY a project. Frugal folks have a better understanding of what their time is worth and can decide whether or not they should try and save a buck by changing the oil in the car themselves or trying to fix something around the house that might be above their pay grade.

4. Do Your Research

Frugal folks are interested in well-researched purchases, using tools like Consumer Reports or Wirecutter to gather information before they spend money. For example, a frugal person will be willing to pay more for a particular well-reviewed product because they are buying from a reputable merchant with a great return policy.

Being cheap by not doing your due diligence could lead to more costs down the road. For example, a cheap person might skip a home inspection ($300) and find out later the house needs a major repair ($30,000).

5. Consider Others

Individuals who are frugal balance saving a buck with all aspects of life, especially when it comes to relationships. While frugal people are considerate of those around them, cheap people can hurt the people they love and damage relationships by imposing their cheapness on them (most blatant example: not tipping).

Cheap people can also miss out on meaningful events and relationship development to avoid spending money. We see this all the time in the financial independence community. Cheap people set a really low bar for the amount of money needed for retirement. Once they achieve it, they feel a sense of loneliness because they’ve often placed the accumulation of money over crucial elements that bring joy to life like family, community, and giving.

Related posts:

- 30+ cheap date ideas (ummm… we mean FRUGAL date ideas 😉)

- 10 Money Etiquette Tips Everyone Should Know

Things You Should Never to Skimp on

Saving money is a priority for most people. But that doesn’t mean you need to pick everything according to the lowest price. Product quality, safety, and the health of friends and family always should come first. Here’s an example of items and services it might be worth paying a higher price tag for:

- Auto insurance

- Quality tools

- A reliable and safe vehicle

- Mattresses (you spend ⅓ of your life on one!)

- Long lasting clothes and shoes

- Baby and toddler car seats

- Professional movers

- Health care/health insurance

Frugal vs Cheap FAQ:

As we’ve alluded to, personal finance is personal so you’ll need to determine how best to live your life. That being said, here’s a few frequently asked questions we might be able to help with.

How can I be frugal but not cheap?

The first step is to figure out what you truly value in life. Then align those things with your spending. You’ll find that you’ll naturally start spending less on the things you don’t value (being fugal) and start spending more on the things that mean more to you (opposite of cheap). We’ve developed a worksheet to help you develop a Money Mission Statement that can be massively helpful in this endeavor.

Another thing to consider is your impact on other people, the environment, and your personal time. Being frugal means thinking about the bigger picture, considering more than just yourself and how much is in your wallet.

Lastly, you can learn from others who practice modern frugality, while also tackling massive savings goals. These people are frugal, not cheap.

How do I know if I am stingy?

Running through the list of frugal vs cheap examples we noted earlier in this article, which ones do you identify with more?

If you are the type of person who never shares, never leaves a tip, takes everything for free (even if you know you won’t use it), then you definitely have some stingy habits. BUT – remember being stingy is not a personal quality you are cursed to exhibit in perpetuity. You can reprogram your mentality fairly easily by studying frugality and working.

If you truly don’t know if you are stingy, try asking your friends and family to be brutally honest with you. See what they say. (Brace yourself, you might not like the answer!)

Should I always leave a tip?

In our opinion, tipping is not optional. It’s important to leave a tip if it’s customary for the location and establishment you are visiting.

That being said, tips are being requested at more places than ever before. It’s ideal to have a plan for where, when, and how much you like to tip before you go out. It’s not necessary to leave an “excessive” tip. Don’t feel compelled to give more than what you planned – normal tipping amounts are fine. Typically 15-20% is a solid tip. You might also want to budget for more generous tips when you receive spectacular service.

The Bottle Line: Frugal vs Cheap

Frugal means something slightly different for everyone, but at the crux of it, cutting back on excess expenses and spending within your means is at the heart of living a frugal existence.

Being cheap isn’t a personality trait. It’s a mindset. It’s something you can learn, and unlearn. Getting a good deal doesn’t mean scoring the lowest price on the cheapest item. If you think you’ve been living the life of a cheapskate and you want to break free, all you have to do is start changing your perspective, working towards handling your money more intentionally.

It’s one thing to want to get out of debt and save as much as you can. But, it’s also important to consider how you can maximize your dollars to create more joy and fulfillment, rather than just getting by. That’s the secret to enjoying the journey and achieving happiness before and after financial independence.

At the end of the day, ask yourself if you’ve aligned your spending with your frugal values. As long as you’re being motivated by what matters to you most, you can feel good about spending less (or more!)

Related:

Great article!!

Hi Jason,

Some good points about the difference between frugal and cheap! I like your example of the two concert-goers. Frugality means being smart about how you spend. Eating at home before a concert is frugal and not cheap as you’re still getting the same thing as someone who goes out to eat – a filling meal.

On the other hand, a cheap person skimps out on important stuff that can impact their health, finances and relationships with others. I like your point about not skimping out on home inspections. When one doesn’t invest in the proper tools and services, it can really cost them financially in the long run.

Another example of being frugal vs. cheap is that a cheap person will buy the lowest-priced clothing items – for example, a t-shirt. This t-shirt wears out once a year and costs the person $20 to replace each time. On the other hand, a frugal person invests in a $50 t-shirt that lasts 10 years. Over time, the cheap person spends 4x as much as the frugal person. Frugality means smart spending.

What’s the number one product or service you think someone should not be cheap with and why? I personally think you should not skimp on health insurance.

– Jani, Frugal Fun Finance