Have you ever heard of lifestyle creep? It’s this almost instinctual human phenomenon in which people tend to spend more as they earn more. While upgrading your lifestyle is totally fine (in moderation), if you don’t implement some crucial frugal habits, you may find that all the money you’re bringing in slips right out the door.

The real money magic of wealth building happens when you not only earn more, but when you simultaneously integrate sustainable frugal habits into your life. Frugality is a super power!. And in this post we’re going to share all the frugal living tips that can help you keep more of your hard earned dollars in your pocket.

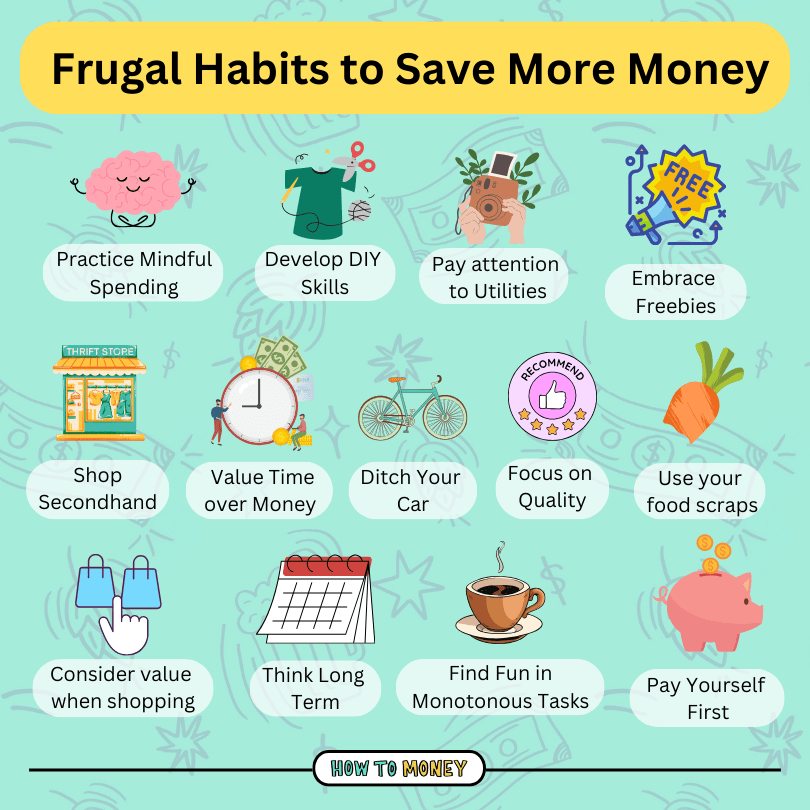

1. Practice Mindful Spending

If you’ve ever bought something and regretted that purchase a few weeks or even days later, chances are you could benefit from the practice of mindful spending. Mindful spending is being intentional about the ways in which you spend your money. It’s making sure that dollars flowing out of your life do so in a way that aligns with your values.

Think about it this way: You could easily spend $100 today on miscellaneous purchases without much thought… You forgot it was supposed to rain, so you run into a drugstore and buy an overpriced umbrella. A subscription you forgot about auto-renews, and you get lunch out at work at a mediocre grab and go restaurant. Then, at night, you find yourself on Amazon with a glass of wine ordering a few things you don’t really need.

It’s so incredibly easy to “accidentally” spend money these days!

But with more mindful spending, you could avoid blowing that $100 on random events. Instead, you could spend that cash on something you value, like your favorite hobby or on a day out with your family. Or saving up for that vintage motorcycle you’ve been wanting for ages. Which of these scenarios do you think will leave you feeling more fulfilled?

Frugal habits aren’t about saving all your money and not doing anything fun. It’s about shuffling your spending around so you can get more value out of the dollars you earn.

A few tips to implement mindful spending:

Mindful spending takes practice, but once you start to do it enough, it becomes second nature. Here are a few mindful spending techniques you can implement into everyday life to save money and live more intentionally:

- Identify your spending triggers and work around them. If you tend to spend when you are stressed, or ill-prepared, find ways to work around it by developing healthier coping techniques or planning ahead.

- Stop spending to impress others. Spending because you seek the approval of those around you will leave you unhappy, just with less money. Take the time to start appreciating what you have.

- Make a 24 hour wishlist. When you’re shopping online, go ahead and add stuff to your cart…but then wait 24 hours before checking out. You’ll be surprised at how many of the items you “needed to have” suddenly don’t seem as tempting after a good night’s sleep.

- Think about your purchases in terms of hours worked. Before you make a purchase, think about it in terms of your hourly rate. To calculate this, take your annual salary and divide it by the weeks you work in a year, then by 40 hours per week. Suddenly, that fancy dinner out might not seem as appealing knowing it would take you 6 hours to earn that same amount of money.

- Consider buying used. Instead of always springing for a brand new item, why not save money and give a used item a second life? Facebook Marketplace is your friend.

2. Develop DIY Skills and Resourcefulness

In a world where you can replace a broken item in approximately 4 clicks and have it arrive the next day, it’s no wonder why we typically look to buy something new instead of repairing what we have.

While we can’t repair everything we own, developing just a few specific DIY skills can help us save a lot of money. And send less of our belongings to landfills!

Try this: The next time you get a small hole in one of your favorite garments, try stitching it up before tossing it out. You don’t need a fancy sewing machine to repair your clothes. Just grab a needle and thread, and whip out one of these easy stitch fixes.

Another quick DIY hack is getting stains out of your favorite clothes, instead of just tossing them and buying new. A quick Google search for the stain type and fabric type usually helps you remove most unwanted stains. When in doubt, a little Dawn dish soap can help out in a pinch.

And before you look to replace a broken household item, why not head to YouTube first and see if someone has posted a tutorial on how to repair that specific item. You’d be surprised at what DIY skills you can learn in just a few minutes online.

Frugality and sustainability go hand in hand. Plus, less money spent on replacing the items you already have means more money that can be spent on the things that actually bring you joy!

3. Pay More Attention to Your Utilities

It can be tempting to stay in the shower for a few extra minutes, or to leave your TV on all day for background noise. But these habits can have a massive impact on your utility bills, and in turn, your bottom line.

Things like taking shorter showers, lowering your thermostat in the winter, and performing routine maintenance on your appliances can save hundreds of dollars each year!

Like anything else, cutting down your utility bills comes from consistent frugal habits. Like remembering to turn down your thermostat when you leave for work, or turning off the water while you brush your teeth. However, seeing the savings on your bill at the end of the month will motivate you to keep it going. You could even gamify your utility bills, and challenge yourself to reduce them each and every month!

For more ideas on how to save money on utilities each month, be sure to check out these articles:

- 11 Ways to Save Money on Your Water Bill

- 13 Ways to Save Money on Electricity

- 9 Ways to Reduce Your Monthly Gas Bill

4. Buy Used

A recent report from CouponFollow found that secondhand shoppers save an estimated $1,760 each year!

Who wants an extra $1,760 in their bank account each year? Meeee! 🙋🙋♀️

Frugal folks are second-hand savvy, and their wallets benefit greatly from it. You can find lots of hidden gems for a fraction of the price at local thrift stores, consignment shops, and online marketplaces. Ebay, Facebook Marketplace, or Craigslist are a great place to start.

Thrifting not only saves money, but also gives perfectly good items a second life. Plus, with everything available online these days, it’s just as easy to browse secondhand items at home without even needing your house. Even Goodwill has a nationwide online store these days!

Pro tip: Taking your kids thrifting is also a fun family activity. It helps them develop frugal habits, and teaches them to reduce, reuse, and recycle stuff for a better planet in the future.

5. Value Time When Making Money Decisions

There’s a big difference between being frugal vs. being cheap.

Even though we’re trying to save money, frugal folks won’t do anything just to save a buck. Adopting frugal values means considering (and prioritizing) your time over saving an extra couple of dollars.

For example, if gas prices are a few cents cheaper all the way on the other side of town, it might not make sense to drive an extra ten minutes, burning gas along the way, for those savings.

Or, if a home repair is well beyond your current skill level, or extremely tedious and time consuming, it could be worth it to hire a professional, instead of spending countless hours on that task. Oil changes are a great example. They’re only ~$45 at the local oil change shop. But it would take you a few hours (and $20 in oil) to do it yourself.

One of the best frugal habits you can develop is valuing your time as much as, if not more than, your money. Remember, you can always make more money. But no amount of money has ever bought a second of time.

6. Drive less. Bike more!

Cars are not only wealth killers, but owning one can encourage laziness.

While most people really do need a car to get back and forth from work, that doesn’t mean all trips in your life should involve driving by default.

According to America Bikes and the league of American Bicyclists, approximately 28% of trips made are under one mile. This is a distance that can be easily biked or walked by most folks. The less time you spend behind the wheel of your car, the more money you save.

On average, Americans spend ~$9,282 annually just to own a car. Between maintenance, taxes and insurance, the costs of owning a car can really add up. Even worse, many households have 2, 3 or even 4 cars. Most of the day, these cars sit idle in the driveway.

Deciding to bike, walk, scooter, carpool or even take public transport can help you drastically cut back on car costs. If you own multiple vehicles, ditching one of them completely will help a lot too.

Plus, walking and biking more is not only great for your wallet, but also for your body! Getting more exercise – even just a few times a week – comes with great benefits for your overall physical and mental health!

7. Focus On Quality, Not Quantity

More isn’t always better. Now I’m not saying you need to go full minimalist, paint all your walls and furniture white, and start perfecting your capsule wardrobe. But the truth is that everything in your home has a dollar value, and takes up space. Buying less in general will help you to save money and eliminate unnecessary clutter.

Try this: Look around the room you’re in right now, or maybe at the back of your closet or junk drawer, and ask yourself… Would you rather have those items, or would you rather have the money you spent on them back?

Do you really need twenty pairs of shoes? Or would you be better suited to purchase three really nice pairs that go well with most of your wardrobe? Do you really need thirteen different kitchen gadgets? Or would it make sense to invest in one appliance that does it all?

We’re big fans of the Buy It For Life movement (BIFL). This is a group of frugal enthusiasts who share brands and items that last “forever”. They would rather pay $300 for a winter jacket that lasts 20 years than pay $50 for a jacket that they have to replace every couple of seasons.

At the end of the day, opting to allocate more of your money towards quality and durable items can reduce clutter in your home, and save you meaningful amounts of money.

8. Think Long Term

Have you ever woken up one day and decided that you were going to start taking your finances seriously? You cut out any and all treats, cancel all your subscriptions, and basically don’t leave the house at all to try and avoid overspending…

However, after a few weeks when you finally can’t take it anymore, you go totally overboard and blow your budget like there’s no tomorrow. Anyone? Just me? 🙈

Just like maintaining a healthy diet or an exercise routine, you need to adopt frugal habits in a sustainable way. Your need to keep long term goals in mind, not just making quick changes on a whim. Otherwise, you’ll just ping pong back and forth from one extreme to the other.

When it comes to making changes to your lifestyle, small changes over time will often have the greatest impact on your life over the years.

If you eat out six times each week, don’t try to cut restaurants completely out of your life overnight. Instead, try limiting your take out to just two or three nights a week. By picking a more attainable goal that works for you, you’ll get some quick wins under your belt. This in turn will encourage you to keep up your new frugal habits!

Frugal people think long term. They’re less concerned with instant gratification, and more excited about ongoing, long term success.

Remember, it’s still important to enjoy your life now, while also saving for the future. When you’re older, you’ll want to look back fondly on this time, even during your most frugal years, so make sure you are still finding ways to treat yourself on the cheap!

9. Find the Fun in Monotonous Tasks

Sometimes, overspending can stem from a lack of contentment. You spend an afternoon in your friend’s fancy remodeled kitchen, and suddenly you feel like your own brown cabinets have lost all their charm. Or you see a bunch of work friends upgrade their cars, and suddenly the daily commute in your old Honda isn’t exciting enough.

It’s okay to make improvements to your life, or to want more for yourself. In fact, having dreams of finer stuff is a good thing! But you need to find a way to be content and grateful for the life you have now. This means finding fun in the monotonous, everyday tasks.

The more content you are with just living your life, the less you’ll feel like you need to spend in order to generate higher levels of short-term happiness.

Daily appreciation works wonders. It’s one of the most underestimated frugal habits. Being content with little, means you’re not constantly chasing more.

Take a moment today to think through a few small ways you can elevate your everyday life to make it more enjoyable. Spend some extra time playing with your kids, listen to some music while you work, or try getting outside on your lunch break to get some sun. Some of the most “boring” things in life are actually the most enjoyable.

10. Pay Yourself First

If you’re struggling to build wealth in life, you need to start paying yourself first. Here’s why:

Most people wait until the end of the month to save “whatever is leftover”. But after rent, paying bills, spending on entertainment and other random things, most individuals find that there’s not much usually left over to save.

By paying yourself first at the beginning of the month (by contributing money to your retirement accounts and transferring money to savings), all your other expenses take a back seat. You’ll need to make do with the money left in your checking account, which helps you prioritize needs vs. wants. It means you’ll always be building wealth, AND you’ll naturally cut out some of the unnecessary items in your budget.

Pro tip: This is one of those frugal habits that doubles as a time management technique, too. By getting up one hour early each day (paying yourself first in time), you are never short-changing yourself on time. It helps you prioritize your stuff over everyone else’s.

11. Cooking at Home

Did you know that nearly 30-40% of the food supply in the US is wasted? Yikes!

According to the EPA, the average four person household wastes $1,600 worth of food each year. That’s money you could use to help you max out your Roth IRA, or take your family on a fun trip! Here are a few ways you can reduce your own food waste at home to save money!

- Try a pantry challenge. Skip a trip to the grocery store this week and try a pantry challenge. Grab all those cans from the back of your fridge, and use a website like SuperCook to find recipes you can make with what you have.

- Make and stick to a meal plan. Oftentimes we throw away food because we forget we have it! Try planning out what recipes you’ll make each week, and shop with a list to ensure you use up what you have.

- Use your vegetable scraps. Save scraps to make broth, blend them up into soups, or try one of these 7 ways to use vegetable scraps.

- Stop Double Dipping- Sometimes, we stock our fridge with a plan on eating home every day of the week. But even though we have good intentions, when life gets busy, we find ourselves grabbing takeout on the way home. Instead of buying groceries for all 7 days, leave some wiggle room. Account for at least some quick bites on the go.

- Have a dedicated leftovers night. If you struggle to remember to eat your leftovers, set up one night each week where you will clean out your fridge and take down what’s already in there. You’ll save money, and save the time it would take to cook an entirely new meal.

12. Start Embracing Free Things

No matter what city you live in, I bet there are a ton of freebies that you don’t even know about.

Whether it’s free courses offered by your local library, community events at a public park, or picking up a new piece of furniture from the local Buy Nothing group on Facebook, why pay for something when you can get it for free?

Finding cheap or free activities, like free days at museums, or an evening of entertainment brought to you by Hoopla, can bring a ton of value to your life without you needing to spend a dime! You can even find free education online on websites like Coursera and Udemy. These are sometimes even brought to you by real accredited universities!

Are Frugal Habits Really Worth It?

Okay, so we’ve just gone through a bunch of frugal habits, and you might find yourself wondering- is it really worth it to go through all this effort to save a few bucks?

The short answer is yes! Small savings really can add up, especially when invested and compounded over time.

Using the Rule of 173, we can estimate how much a monthly expense would be worth if invested that money instead over a ten year period. If these frugal habits saved you just $50 each month (and they would honestly likely save you even more), you’d be looking at a total of $8,650 after 10 years. Compounded over 30 years, these savings could amount to over $70,000!

Keep in mind, easy and immediate savings is only one of the benefits of frugality. Practicing frugal habits will make you feel less stress, have greater life satisfaction, and you’ll be playing a part in building a more sustainable world.

The Bottom Line:

Frugal habits aren’t just hacks that save you a few bucks once or twice. They’re part of a greater lifestyle change, and represent a shift towards a simpler, more content lifestyle. Working to implement these frugal habits can make you happier, and help you save more money throughout your financial journey.

Related Posts:

As a young wife I invested in professional stainless steel cookware. It was a big purchase for people on a tight budget, but 30+ years later I am happy to report that my pot and pans still look & cook great. I don’t foresee ever having to replace them.

I wish I could say that going to a thrift store is always a good idea. Though I’ve always loved second hand clothes we made a big mistake by regularly going to Thrift stores. We ended up with bed bugs in our home which cost us $10,000 to get rid of. I will never buy clothing at a thrift store again. Too risky.

What a good message to young & old people. Lots of ideas & information to

apply in life. I am frugal myself & it’s a good practice, you save a lot of money for rainy days & also invest in high yield savings account for retirement for the young

who are starting their long life journey. Thank you for sharing.

Agreed with this breakdown grocery overload is something I watch.

This is one of the best articles I have read on saving money. Had dinner with my 55 year old friend recently, while I’m retiring at 60, she was telling me she will be living on social security. May I add the fact she chooses $$$ restaurants constantly?

Would love to send her this article.

An eye opener. Thanks!

Great article! I’m not an especially frugal person, but I do practice mindfulness when out shopping and pay myself first. The online basket also translates will to a shopping trolley – sometimes I put an item in the trolley to remove it later when I’ve realised that i really don’t need it after all. I really like the outside links to back up knowledge imparted here. I’m comfortable financially but do need to downsize the “stuff” and clothes I have accumulated. This article will definitely be saved and read over again, and I’ll share it with my family.

PS. I noticed that not a word was wasted in your writing style, a different type of frugality that brings clarity with no fuss!