Calculating your net worth can tell you a lot about your personal finances. As with many topics in personal finance, it can be shrouded in layers of mystique and unnecessary jargon. That’s why we’re here to break it down in simple terms. Here is everything you need to know about the all-important money term net worth!

I like to think of net worth as a summary of what’s going on with your money. It doesn’t tell the full story, but it does function like the Sparknotes of our personal finances, and can give us a snapshot of how well we are doing financially. However, like anything else, net worth is not the end all be all. It doesn’t reveal the whole story.

In this post we’re going to break down what net worth is, how to calculate it, and help you understand what it does and doesn’t tell us about our finances.

What Does Net Worth Mean?

Simply put, your net worth is a snapshot of exactly how much money you’d have if you sell everything you own and pay off all your debts. It’s your assets minus your liabilities.

Net worth can be negative if your debts outweigh your cash and investments. That’s likely to be the case for a recent college grad, for instance. It’s also important to mention that your net worth can fluctuate a decent bit if you are invested in the stock market or in real estate.

Why It’s Important To Know (And Track) Your Net Worth

Understanding and tracking your net worth has so many benefits. It can give you a general picture of how well you are doing and how much progress you’re making on the money front. And tracking it can tell the story of how your finances grow (or decline) over time.

For example, your net worth might not always go up. Since your investments play a big factor, if the market has a particularly bad year, you could see your overall wealth drop significantly. However, if you track your net worth over the course of a few years, you could see that, despite occasional drops, your wealth is still overall increasing over time.

You can also look at your net worth to glean information as to what you should be focusing on at this point in your financial journey. For example, a negative net worth could push you to focus on paying off some debt and investing more each month. Conversely, if you’ve got abundant wealth, you might decide that it’s time to prioritize enjoying the fruits of your labor a little more.

While it’s definitely important to look at your net worth over time, remember that it is not the only indicator of how well you are doing.

For example, if you decided to go back to school and take on student loans, you could see a big drop in your wealth temporarily, even though that new degree could help you to earn more for years to come. It’s pretty normal for young people with student loans to have large debts. But that degree is likely to be a boon to your lifelong earning potential. So it’s a good idea to also look at a few other factors to see how well you’re doing.

Looking at your budget can also provide helpful insights into how well you’re doing financially. If you’re saving more each month than you’re spending, investing a good chunk of your money, and spending intentionally on the things that matter to you, that’s a sign that you’re on the right path! You’re doing the right things and your net worth is bound to increase if you keep those habits up.

How To Calculate Net Worth

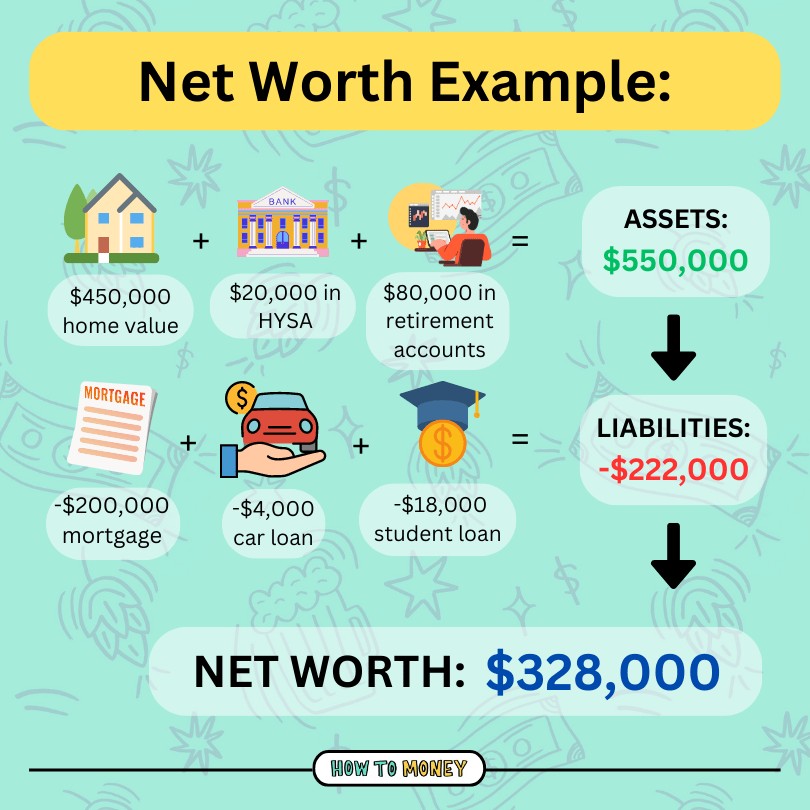

Calculating your net worth is easier than you might think. You can remember it as “assets minus liabilities.” Simply add up anything you own with significant value. Then, subtract from it your debts, like student loans, credit card debt, or car notes.

To keep things simple, try rounding numbers to the nearest hundred or thousand dollars. Knowing your net worth down to the penny isn’t necessary (although fun to calculate if you really want to get nerdy 😉)

Example of Net Worth Calculation:

In this example we’ve rounded to the nearest thousand dollars. All of the assets equal $550,000, and the debts equal $328,000. In total this gives us a current net worth of $328,000.

Remember, this is just a snapshot of the values right now. If we were to track these same assets and liabilities month over month, we’ll get a better picture of how things are changing. In a perfect world, the assets would continue to grow in value, and the liabilities would slowly be paid off. Thus, the net worth total would grow higher and higher over the coming months and years.

Assets vs. Liabilities

You might be thinking, “so what are assets and what are liabilities?”…

Assets are things that you own which have value. Things like cash, investments, real estate, or your two million dollar Beanie Baby collection.

Liabilities on the other hand, are debts are what you owe to various entities. Things like a car loan, student loans, credit card debt, or mortgages.

Here are some examples of assets and liabilities…

Note that this is not an exhaustive list, and there may be other assets or liabilities that are relevant to your personal situation. For example, if you own something that would have a high value if you sold it, like a classic (and paid off) vintage Mustang worth $40,000, go ahead and factor that in!

But, don’t go crazy adding in everything you own. You don’t need to factor in your beater vehicle, or estimate the value of everything in your sock drawer. If you’re tracking your net worth, you’ll need to repeat this process every few months, so keep it simple!

Ways To Track Your Net Worth

If you want to keep tabs on how your net worth is changing over time, there are a few different ways to do it.

The Old Fashioned Way

If you don’t mind crunching the numbers each time you want to check your net worth, you can do it with some pen and paper. Simply follow the formula above and get your total.

Write it down somewhere you’ll remember, or keep a basic spreadsheet on your computer. Remember, the goal is to track this over time (like every couple months) so you can look out for trends.

Use Apps to Track Net Worth

There are plenty of apps out there that automatically track and keep tabs on your net worth. They do this by connecting with your banks and loan providers and regularly updating the values for you.

Here are some of our favorites…

- Empower: This one’s a community favorite. It’s free and everything is displayed in a cool looking dashboard!

- Credit Karma: CK (used to be called Mint) is also free and displays you net worth in the top left corner of the app anytime you log in. It has a range of expense tracking features but isn’t the best for budgeting or goal setting.

- YNAB: You Need A Budget (YNAB) is one of our favorite budgeting apps. This one does cost money, but it features a “net worth report,” and can easily help you save the difference if you’re new to budgeting. Most new users save over $800 in the first year using YNAB!

Related: 5 best Mint alternatives to check out

How To Grow Your Net Worth

Unfortunately, short of finding a magic genie, there is no quick fix for growing your net worth. It takes time, patience, and consistent effort overtime. Luckily, growing big riches in life is totally manageable with the right knowledge and some dedication.

As you’ve probably figured out, to grow your net worth you need to increase your assets ⬆, and decrease your liabilities ⬇. Here are some strategies that will have the most impact…

1. Pay Down “Bad Debt” ASAP

If you have any high interest debt, like credit card debt or anything over a ~7% interest rate, you’ll want to focus on paying that down as quickly as possible. Having bad debt while trying to build wealth is like running up an escalator that is traveling downwards. All your money-saving progress is squandered by interest and penalties.

Here are some posts that may be able to help you pay off debt faster and grow your net worth quicker:

- Creating a Debt Payoff Plan

- Debt Snowball vs. Debt Avalanche methods

- Understanding good debt vs. bad debt.

However, debts with lower interest rates, like student loans or a mortgage, require a more nuanced conversation. While paying down these debts may increase your net worth, it might not be the fastest way to grow wealth.

2. Increase Your Savings Rate

Another way to increase your Net Worth is to save more money! If you haven’t calculated your savings rate recently, we suggest you do it ASAP. Your savings rate is the most important number in wealth building.

Take a close look at your budget and see if there is any way to cut back in any categories to save more each month.

Negotiating your bills can be a great way to keep more of your hard earned cash, as well as implementing mindful spending techniques into your everyday life.

Here are some posts that may be able to help you save more:

- Ways to slash your grocery bills

- Choosing the best cheap cell phone plans

- How to save money (in ALL areas of life)

- Should I buy it?

As you sock away more in savings, your net worth grows. Every dollar you don’t spend has an immediate impact on your bottom line.

3. Earn More Money

If you’ve squeezed out all your unnecessary spending, the only way to increase your savings rate is to earn more income. You can do this by asking for a raise, switching jobs, starting a side hustle or starting a business.

It’s amazing how little side gigs really can increase your net worth over time. As long as you are saving the extra money that’s coming in, and avoiding lifestyle creep as much as possible, you are adding to your wealth.

Let’s say you start driving for Uber just one night per week. If you earn a quick $50 each night, that’s $200 per month you can save. After 365 days of doing this, you’d have an extra $2,400 in savings to add to your net worth assets.

Another great way to earn extra money outside your 9-5 is to rent stuff out that you own. Rent that spare room in your house on AirBnB, rent out your car on Turo, etc. Gig apps are easy to learn and start, and quickly add to your savings and net worth.

4. Buy More Appreciating Assets

Appreciating assets are things that grow more valuable over time. Things like real estate, stocks, and commodities. On the flip side, depreciating assets are things like cars, boats, or cash under your mattress. These things will deteriorate in value over time.

The more appreciating assets you have, the faster your net worth will grow. If you have a lot of depreciating assets, your net worth may actually be shrinking!

As you track your net worth over time, pay attention to all your assets and how they are growing. It might make sense to sell some depreciating (or slow growing) assets and move that money into faster appreciating ones. For any new savings you are adding to your net worth, make sure that money is being invested properly so that it can grow healthily for the long term.

It’s important to learn the difference between saving vs investing. Saving money is a brilliant move! But without investing that money into appreciating assets, you’re missing out on the magic of compound interest and organic growth. It’s crucial to have a cash cushion on hand to help you weather potential financial storms. But you avoid investing at your own peril!

5. Combine ALL of the Above

To supercharge your wealth building journey, try and implement all of these strategies together. This will be the fastest way to grow your net worth.

You’ve probably heard stories of some people going from “broke → rich” in just a couple short years. Actually one of our buddies Grant Sabatier did this – he went from having $2.26 in his checking account to becoming a millionaire in just 5 years! It’s the combination of all these tactics that got him there.

While we do want you to prioritize building wealth, don’t let being money hungry hold you back from enjoying life. Growing your net worth is not a competition or a race. If you’ve got good money habits, your overall wealth will naturally increase over time.

Net Worth Isn’t Everything

Now that we’ve discussed all the reasons why you should be tracking your net worth, it feels important to mention that it is not the end all be all way to measure financial success. Net worth does have some shortcomings, and there are other ways to check in on your financial wellbeing.

For example, if a large amount of your money is tied up in investments, they can have big ups and downs depending on what’s going on in the market. Similarly, if a lot of your net worth is tied up in home equity and the value of your home takes a dive, it’s not necessarily the best indicator of how you’re doing.

In situations like this, it’s important to also consider other factors, like your budget, your salary, retirement contributions and overall happiness.

One of the biggest downfalls of net worth is that it doesn’t indicate overall quality of life, or the ways in which you spend your time. You can still live a beautiful and rich life without having built up a massive net worth.

Your net worth does not define your worth, or the value of your life. Time freedom, doing meaningful work, and developing meaningful relationships with the people around you are not dictated by how much money you have, or the value of your assets.

Frequently Asked Questions:

Here are some of the most frequently asked questions when it comes to figuring out your net worth:

Should you include your primary residence in your net worth?

Since your primary residence is an asset, yes it should be included as part of your net worth report. As long as you also include any associated mortgage debt as a liability, your home equity will be accurately represented within your overall net worth.

That being said, if the majority of your net worth is tied up in home equity, you may be “house poor”. This means that the majority of your paycheck is being spent on your home. And while building home equity is a noble long-term goal, it’s also important to prioritize investing in other assets for diversity.

Your home is an investment, but it’s not a particularly good one. It doesn’t provide cash flow (unless you rent it out), and it costs money each month to maintain. Having a healthy mix of different assets will allow you to grow your wealth faster and this route also comes with less risk too.

What does “liquid net worth” mean?

Liquid net worth is the amount of money you have that’s easily accessible. Think: all your cash, quick sale items, or investment accounts you could liquidate quickly if you need to. Also, you would subtract any consumer debts or personal loans you carry.

Real estate or retirement accounts would not be included in your liquid net worth number. Those assets aren’t very flexible. Cashing out a portion of your 401k before you’ve reached retirement age will come with tax consequences (and a penalty too!). Selling a home takes time and comes with steep transaction costs as well.

What if my net worth is negative?

Having a negative net worth is more common than you might think! Millions of people graduate from college every year with a boat load of student debt, and not that much in the way of savings.

The good news is, getting out of debt and building wealth is definitely possible. Check out our longer post on creating a debt payoff plan. Yes, it’s hard work. Yes, it will take time. But it’s 100% a goal worth prioritizing so that you can climb out of debt ASAP.

If you are drowning in debt, and need expert help, there are some amazing non-profit organizations that can help. Money Management International and the NFCC are great (and free!) places to start.

What is A Good Net Worth To Have By My Age?

Having clearly defined personal finance goals is a great way to make more accelerated progress. Setting a goal to achieve a certain net worth by a certain age can certainly motivate you to pay down your debt and save and invest more for the future.

However, we all start our financial journeys in different places, so it’s important to take these comparisons with a grain of salt. For example, if you’ve had student loan debt, just reaching a net worth of $0 can be a huge milestone. Just because your net worth is lower than than average for your age group doesn’t mean that you won’t be able to be wealthy in the future, and if you’re above average it doesn’t mean you’re off the hook and don’t need to put any more effort into your finances.

When evaluating how you stack up to your peers, it can be helpful to take a look at the median net worth by age in the United States. While averages can also provide helpful insights, often these numbers are skewed by the wealthiest Americans, and may not be indicative of what is most common for the average person.

Median Net Worth By Age:

34 and younger: $14,000

35-44: 91,110

45-54: 168,800

55-64: 213,150

65-74: 266,070

75 and older: 254,900

Everyone has different lifestyles which require varying amounts of money to sustain, so it’s nearly impossible to dictate exactly how high of a net worth you should have by a certain age. However, a good goal to shoot for is to have about six times your salary, or twenty five times your annual expenses in net worth by the time you retire.

Should I Include My Salary In My Net Worth?

The short answer is no. Your salary is not an asset or a liability.

The truth is, even if you had a million dollar salary, if you spent ALL of it each year you wouldn’t be accumulating any wealth. Factoring your salary into your net worth would be the financial equivalent of counting your chickens before they hatch.

Should I Include My Spouse’s Assets?

Yes and no. It depends on what you’re trying to calculate!

If you’re trying to come up with a figure for your “individual net worth,” you would only include your share of any jointly owned assets. However, you can add your spouse’s assets into your “household net worth,” which is important to track as well.

We wrote a great post on getting on the same page financially with your partner. Combining your money & assets is a personal choice every couple gets to make. However I will say that tackling your money goals *together* is certainly more effective than working individually. Here’s also a great post on making a joint budgeting system when merging money.

The Bottom Line:

Tracking your net worth is an important part of personal finance, and making sure it increases over time is a worthy endeavor. Knowing your net worth can allow you to plan for retirement and can help you to make more informed financial decisions in your everyday life.

At the end of the day, while net worth is important, it’s just one piece of the financial puzzle. There is so much more to your finances and to you as a person!

Related Posts:

- Who Wants To *Literally* Be A Millionaire?- Episode 662

- DIY Will or Lawyer Up? Your Guide to Creating a Will

- The Rule of 173: The True Cost of Small Expenses

Feature pic by Isaac Smith on Unsplash