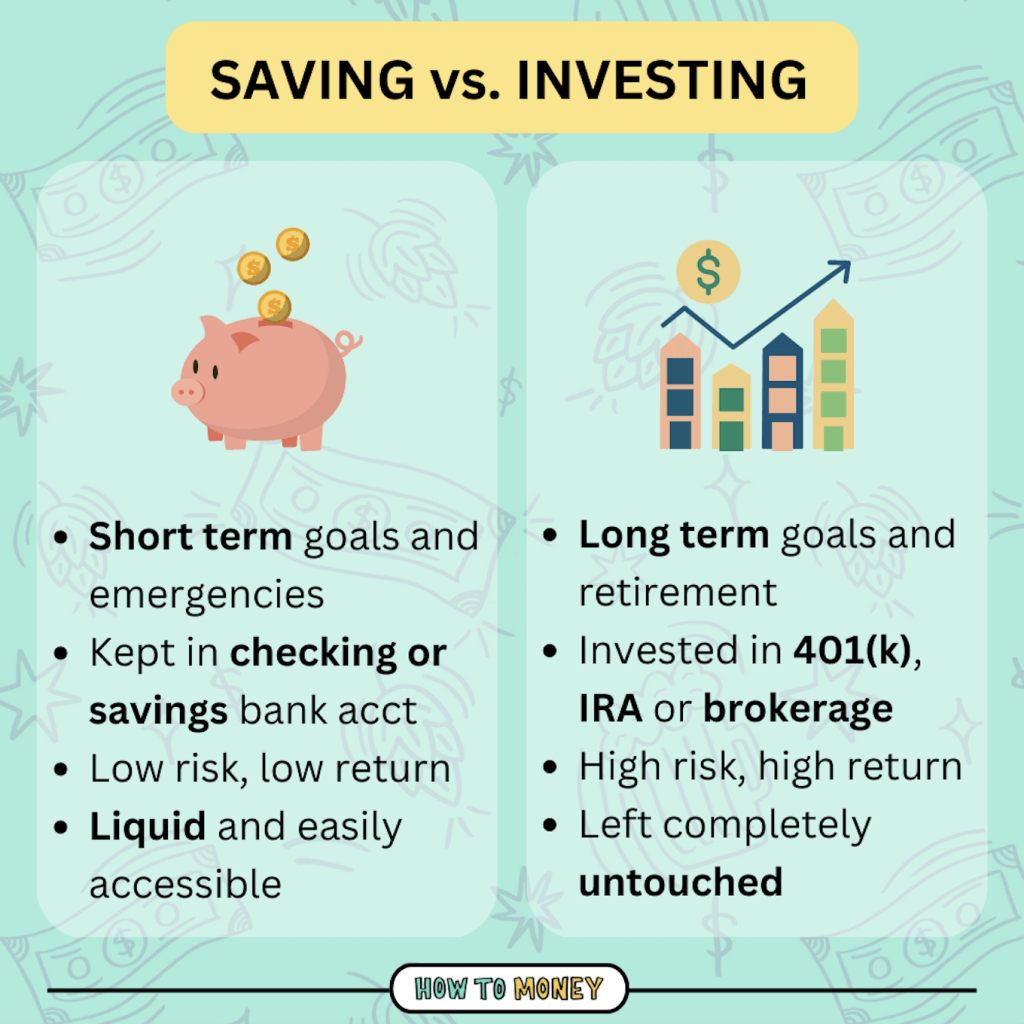

Have you ever received a large sum of unexpected money and wondered, “should I save or invest this?” Saving and investing are both important depending on the situation. It’s best to think of saving vs. investing like this:

- Saving → is protecting your money

- Investing → is growing your money

In a perfect world, it’s ideal to do both simultaneously in order to meet your separate goals.

Saving is putting money aside until you need it, while investing is socking your money away into something you believe will increase in value over time.

The truth is, everyone should have an emergency savings fund for protection during hard times – like a global pandemic! Increasing your savings gives you more financial margin so that you can better navigate the financial bumps on the road that eventually occur. Even if you’re pumped to get started investing, it’s crucial to have some plain old savings stashed away first.

But what about investing? When and where should you get started? We’ve developed a financial order of operations called ‘Money Gears’ that should help. You’ll want to hold off getting started on your investing journey until you have at least $2,467 socked away in your savings account. After that, you’ve got a green light to get started!

One of the easiest ways to begin investing is through an employer-sponsored 401(k) plan. It’s especially beneficial if your job offers a match, which is essentially free money.

In this article, we’ll examine the differences between saving and investing and help you determine which one is right for you.

Differences Between Saving and Investing

It’s easy to get confused as the terms saving and investing are often used interchangeably, but they are very different. For example, we call it “saving for retirement” when we are actually “investing for retirement.” That seemingly small distinction is crucial!

Saving and investing are both important and have their place, and so the trick is knowing when you should be doing each one.

- Saving — setting aside some of your money for the future. This is generally done gradually and stored in a bank account. Individuals typically save for a specific goal, like paying for a car, a down payment on a house, or any emergencies that might come up.

- Investing — is another way of setting aside money for the future by buying assets that might increase in value, such as stocks, real estate property, or shares in a mutual fund.

| Reasons to Save | Reasons to Invest |

| Down payment on a house | Retirement planning |

| Pay cash for a car | Lower taxable income |

| Go on vacation | Building wealth & passive income |

| Build an emergency fund | Reaching financial freedom |

If you’re not sure whether it’s time for you to start investing, or if you should focus on saving, the answer depends on your goals, risk tolerance, and financial situation.

How to Prioritize Saving vs. Investing

When trying to determine how to prioritize saving versus investing, it might be helpful to consider four main categories: your time horizon, liquidity, rate of return, and risk. Let’s break down these four aspects further.

1. Consider Your Time Horizon

Knowing *when* you need to use the funds is the main indicator of whether you should be saving or investing.

- Saving – If you need the money within the next five years, then you should save it. There’s just too much fluctuation in the market if you need the money back in a shorter amount of time. Markets can swing wildly in the short-term (this is normal market behavior) although the ultimate trajectory over longer time periods is up and to the right.

- Investing – If you don’t need the money in the near future, you’re wanting to grow it to use 5+ years from now, investing is usually a wise option. Leaving those funds untouched in a low cost, diversified investment portfolio (like an S&P 500 ETF) for many years is a proven way to grow wealth. The longer you intend to leave your investments invested, the more compounding growth will occur.

2. Liquidity of Funds

Another major thing to consider before you decide to save or invest your money is how readily accessible you need your money to be.

- Saving – Popping your funds in a savings or checking account means you can grab it at basically any time. There are no hoops to jump through – you don’t have to sell anything to liquidate that money. You can just grab your cash when you need or want it. This is great if you’ve been house hunting and you’re looking for the perfect deal to pounce on. **Beware: this is also the biggest downside to money in savings – it’s ready to go! It will require more self-control and discipline to not blow it.**

- Investing – Investing your money will make it harder to access. Retirement accounts have rules that prevent you from treating them like a piggy bank/savings account. You’ll be subject to taxes and fees if you pull money out of your Traditional IRA or 401(k). For all intents and purposes this money is under lock and key for decades to come. Be sure that you are fine with not touching any money you invest in these tax-advantaged accounts before you choose to stick it there. We certainly want you to be investing your hard-earned dollars into these accounts – but only if you can resolve to leave it alone! The more that you are able to contribute to these accounts and invest inside of them the more your money will be able to work on your behalf, growing your net worth in a meaningful way over time.

**Side note: Investing inside a Roth IRA offers a bit of middle ground here. That’s part of the reason it is one of our favorite retirement accounts – the flexibility is fantastic. You can withdraw *contributions* at any time, for whatever reason you like without penalty. This doesn’t mean you should. It’s not an ideal choice. But technically, you can. We are not fond of taking money out of retirement accounts (until retirement, of course!). Again, the best thing to do is to consider that money untouchable.

3. Expected Rate of Return

Another major difference in determining whether to save or invest is the rate of return you’re hoping to see.

- Saving – putting all your money into a savings account won’t make you wealthy. Fortunately, rates for savers have gone up in recent months. Interest rates on savings accounts are quite attractive compared to what they’ve been over the past decade. Online banks, in particular, offer the best returns for money you’re saving up. But even as rates have climbed, you can’t expect money that you’ve saved to fund your retirement. The expected rate of return on your savings is vastly inferior to what you are likely to achieve investing in the stock market.

- Investing – is attractive because you can earn much higher rates of return (usually over long periods of time.) For example, over the last 100 years the S&P 500 returned an average rate of 10% growth each year. (A good short-term comparison is back in 2019 when the S&P 500 had a 29% return while money in your savings account made less than 2%.) However, no one can predict the immediate future. The pandemic made 2020 a crazy year for the stock market. Overall market returns were historically bad last year also, so it’s important to match your expected rate of return with your investment time horizon.

Pro tip: Get to know the rule of 173. Use it to calculate potential savings when slashing things from your budget and investing the money instead.

4. What is Your Risk Appetite?

The reason you can make a higher rate of return by investing your money (stock market or real estate) is because of the associated risk. More risk is often accompanied by higher potential reward.

- Saving – There’s no risk if you only do business with banks that have FDIC insurance and keep your saving assets under the FDIC insured minimum (usually $250,000!) The biggest risk here is opportunity cost and seeing your savings get gradually eroded by inflation. The incessant reality of inflation is actually the number one reason you should be investing for your future, not just saving.

- Investing – There’s a lot of short-term risk on the investing front. The stock market returns for any given year are impossible to predict. And you could see your balance drop precipitously over the course of a few weeks, months, or years. But here’s the thing, the longer you’re able to sit tight and stay invested, the less risky investing becomes – if, that is, you’re investing in a diversified manner. If you’re primarily investing in single stocks, your risk levels increase dramatically, even if you’re investing for decades down the road. The best way to combat that is to take the boring approach and to stick to widely diversified, low-cost, index funds.

Best Accounts and Methods to Save or Invest

There are several different types of saving and investing accounts that would prove beneficial. Here are some ideas to consider:

- Saving – a bank or credit union. But don’t turn to just any ol’ bank. The biggest ones (like Wells Fargo) are often the worst! Online banks are our favorite spots because the competition is robust. These banks often offer the best combo of competitive interest rates, stellar customer service, and a modern user interface. CIT Bank is one of our favorites that is well worth checking out.

- Investing – As previously mentioned, your work retirement account is a good place to start (if you have one). At a minimum, invest enough to qualify for the company match. Additionally, research low-cost investment houses such as Vanguard, Fidelity, Schwab, and M1 where you can open a Roth or Traditional IRA and invest in low-cost funds.

**Side note: Like we mentioned previously, a happy medium is a Roth IRA. It can provide a little flexibility, allowing you to invest on a slightly shorter time horizon since you can always access the original contributions. But, in a savings account you can’t lose your principal. Unfortunately, you can when invested in a Roth.

Bottom Line/Final Thoughts

As you can see, there are benefits to both saving and investing. But carelessly doing either without thinking can get you in trouble.

If you save your money and never invest it for decades, you are missing out on huge growth opportunities and you’ll inevitably see your savings get eroded by inflation. Conversely, if you invest all your money without keeping cash on hand in your savings account, you won’t be prepared for those financial emergencies that pop up, and you may have to sell assets at an inopportune time.

The best approach is to do both! Over time we want to see you amass a blend of both saving and investing dollars. Typically, you’ll want to prioritize saving more for more short-term goals and then invest for those longer term goals (like retirement) that future you will be excited to partake in.

Saving vs. Investing Checklist

| SITUATION | RECOMMENDATION |

| Do you have enough cash on hand to cover up to 6 months of living expenses? | Yes – Invest No – Save |

| Do you have other short-term goals requiring quick access to cash (travel plans)? | Yes – Save No – Invest |

| Are you on track to reach your retirement goals by your desired age? | No – start investing |

| Do you understand the risks involved in investing for a long-term goal such as retirement? | Yes – start investing |

| Are you comfortable waiting to access your money to take advantage of compounding? | Yes – start investing |

**Feature pic by Towfiqu barbhuiya on Unsplash