I’m convinced that everyone goes through a phase where they are constantly transferring the same $100 in and out of their savings account. Unfortunately, constantly dipping into your savings account can hinder your financial progress.

It can be so empowering to deposit money to your savings account. That feeling of prioritizing your future and making progress on your biggest financial goals is exhilarating. But if you’re constantly having to tap into your savings to meet your expenses, it’s a sign that you might be going about it wrong.

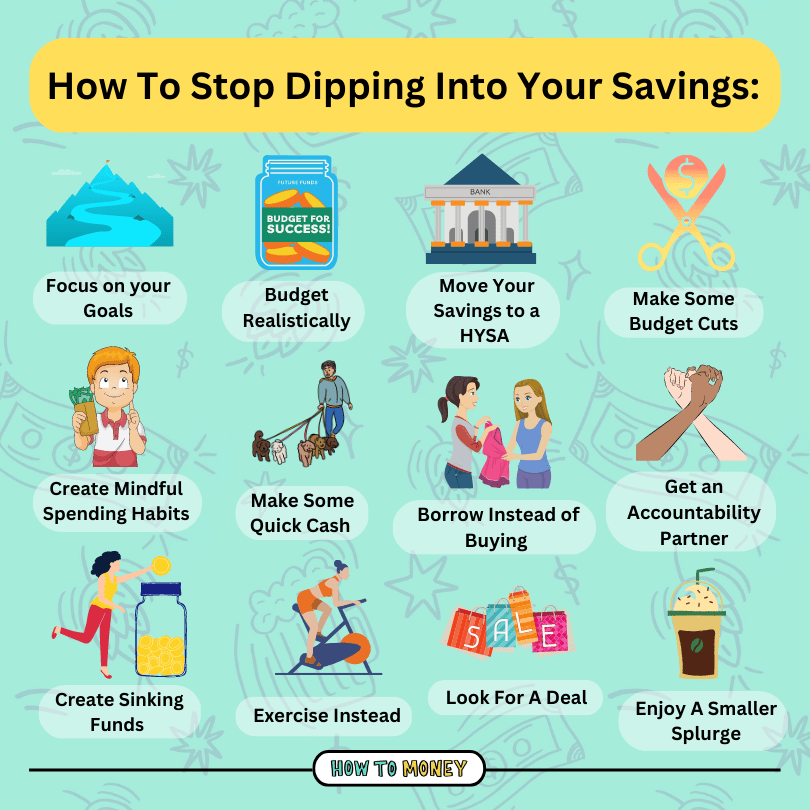

12 Ways To Stop Dipping Into Your Savings

Failure to properly save can leave us unable to reach our goals or vulnerable in the case of an emergency. The good news is that with a little mindfulness and a few of these tips, you can make positive changes to your money habits and stop dipping into your savings.

1. Focus On Your Goals

If you want to stop dipping into your savings account, it’s important to look at the bigger picture. Where do you see yourself financially in the coming years? Do you want to own a home? Become financially independent? Finally go on that big trip you’ve always dreamed of?

Having a bigger goal to weigh your purchases against can help you think twice before transferring money out of your savings, or making an impulse buy. Once you have a solidified goal, you can think about just how much you could accomplish if you cut out mindless spending. Having a bigger reason behind why you’re saving can actually get you excited about handling your money in a way that reflects your values.

Be sure to check out our episode on “The Why Behind Money” if you need some guidance when it comes to figuring out what’s important to you. We’ve also written a whole post on setting SMART money goals, which gives you more likelihood of achieving them!

2. Budget Realistically

We all remember that kid from middle school who wasn’t allowed to drink soda…

When we are overly restrictive, we can tend to get fed up and go absolutely off the rails. The kid who wasn’t allowed to drink soda goes WILD in college. We try to stick to a strict diet and end up eating an entire pint of Ben & Jerry’s Salted Caramel Core ice cream (not speaking from personal experience here…😅). The same thing can happen with our budgets!

First, a failing budget may not be due to overspending. You might just not realize how much your monthly expenses are costing you. With inflation, it’s not uncommon to find yourself busting your grocery budget each month. Sit down with your expenses from last month and see how they stack up against your budget. Is it even possible to stick to your current budget? Have some of your expenses gone up without being accounted for?

You could also be suffering from a case of “budget-too-strict-ivitis,” and it could be the reason that you’re overspending. We want you to save money, but we don’t want you going overboard and not taking the time to enjoy your life today. Life is short, and you should strive to enjoy some treats along the way on your journey to financial wellbeing.

We always recommend finding a budget style that suits your personality type. If you have a strong Type A personality, you might like the zero-based budget. For a more loosey goosey personality, the 80/20 budget might be better. Here’s a post on a few different budget types.

All in all, we recommend budgeting more realistically for yourself, and making some room for spontaneity or small mistakes. That way you’ll end up sticking to it more and stop digging into your savings.

3. Move Your Savings Account

Sometimes the best way to keep from touching your savings is to pretend that you’ve never even seen that money.

If you have a hard time stopping yourself from dipping into your savings, consider making it significantly more difficult to do so by moving it to an account with a different bank. Goodbye instant transfers! Now, if you want money from your savings, you’re going to have to wait a few business days to see that money show up in your spending account.

It’s proven that when we take more time to consider our purchases, we’re less likely to impulse buy. Switching bank accounts practically forces you to put your wants on a multi-day waiting list. You might find that by the time the money hits your checking account, you don’t even want the item you were planning on purchasing.

We recommend moving your cash to a high yield savings account. By stashing your dollars in an HYSA, you can earn a significant return that will aid in fighting back against inflation. You’ll also cut down on any pesky bank fees.

4. Start Practicing Mindful Spending Techniques

Another great way to stop dipping into your savings is to start implementing mindful spending techniques into your everyday life. Mindful spending is all about being intentional with how you spend your money, and making sure that you’re spending in accordance with your values.

Some people might assume this means restricting your budget and cutting out any unnecessary spending, but it actually does the opposite. By cutting out spending in categories that don’t move the happiness needle for you, you free up your budget for spending on the things that really matter to you.

5. Create Sinking Funds

If you find that you’re dipping into your savings to cover expenses like new tires on your car, home maintenance repairs, or holiday gifts, then you’re probably missing this super important part of financial planning.

Sinking funds are money you set aside for a specific future expense or goal. These are for expenses that occur somewhat regularly, but not monthly. Since you can generally predict these expenses, they are not emergencies. And therefor should be planned for as opposed to using your emergency fund to cover them.

A sinking fund for gifts is a common example. We all know we need to buy gifts at the end of the year for the holiday season. But if we don’t plan ahead, we won’t have the money to buy anything. That leads to dipping into savings. Instead, if we create a sinking fund and contribute $50 per month into it starting each January, we’ll have $550 by the end of November for gifts.

6. Make Some Budget Cuts

If you want to keep from cleaning out your savings account, it’s a good idea to go through your budget and see if there are any expenses you can lower (or cut altogether).

Chances are, if you’ve been with your insurance or phone companies for a while, you could be overpaying by sticking with them. Look into cheaper cell phone plans, cheaper insurance options, and get quotes from other providers. For example, if you’re paying $75 each month for your phone bill, you could switch to Mint Mobile and slash your phone bill to just $15 each month. Congratulations- you just saved $720 over the course of this year! That’s $720 you can spend on things that you value a whole lot more!

Taking the time to negotiate your bills and cut out things that don’t bring you joy from your budget will free up a significant amount of money too. And it’s not all that hard to do either.

Related: Best MVNO carriers for cheap cell service!

7. Make Some Quick Money

Tempted to dip into your savings for that weekend trip? Why not challenge yourself to make the money you’ll need for it instead?

Not only is this a great way to experiment with adding some side hustles to your life- it’s also a fun way to gamify your money goals. Creating a time limit and a goal can motivate you to make that extra cash.

A quick way to make money is to sell your old stuff. Look around the house for any unused items and throw them up on Facebook Marketplace or eBay. You’ll find yourself with more money and less clutter. Double win!

You could also try finding some freelance work that suits your skills. Websites like FlexJobs and Fiverr allow you to sift through gigs/short term jobs that could earn you some extra money in the short term. Just be aware that they do take a pretty hefty fee. So if you can find freelance clients on your own, via word of mouth, that might be the better option.

If you want to make some extra money on a more consistent basis, check out our podcast episode on Creating A Dope Side Hustle. Also see side hustles for couples if you want to make money with your partner!

8. Borrow Instead Of Buying

If you need an item that you’ll only use a few times, consider seeing if you can borrow it from a friend or neighbor before you purchase it. Not only is it a great way to deepen your relationship with your community, but it’ll help you to keep more of your dollars in your bank account!

“Buy nothing” groups on Facebook are a great way to find others who are willing to lend or borrow items. Sometimes, people even list things that they’re willing to give away for free!

9. Get An Accountability Partner

Difficult tasks are often made easier when you have a buddy! We know that some people find talking about money to be taboo. But the more you talk about it with friends, the less fearful the subject becomes, and the more we can learn from each other.

Ask a friend or partner to be your accountability buddy! Make a deal that anytime you dip into your savings, you’ll have to text each other and tell them what it was for. Even taking just a small step afterward to acknowledge your spending can deter you from taking money from savings unless it’s absolutely necessary.

10. Exercise Instead Of Spending

Okay, I know that no one wants to read this, but hear me out!…

Often, when we open up that Amazon tab during work and start shopping, we’re looking for a quick dopamine fix. But shopping isn’t the only way to get a hit!

Engaging in physical activity can result in the release of dopamine and serotonin, which boosts your mood. And best of all, it’s free, and comes with lasting health benefits. Next time you feel like dipping into your savings to shop, try putting that item on a 48 hour wishlist and going for a walk outside instead!

11. Wait For A Good Deal

So you’ve put those new shoes or that new bike on a 48 hour wishlist… and you still want it after waiting. That’s great! We want you to use your money in ways that can make you happy now, while also saving for the future. However, that’s no excuse to make an uniformed purchase.

If you’ve decided you want an item, spend a few minutes looking for a deal! Deal sites like Slickdeals, Dealnews, and Woot can sometimes save you a few bucks. You could also sign up for the company’s email list and wait. They’ll email you the next time there’s a sale, which could save you a significant amount of money. All it takes is patience on your part. Just be sure to unsubscribe after you make a purchase to avoid temptation later on.

Another idea is to create a good deal, buy asking for a sizeable discount. Try anything to help you stop dipping into your savings account to afford things.

12. Go For A Smaller Splurge

You don’t need to spend big bucks to have a special day or treat yourself. Sometimes the smallest (and cheapest) little treats have the same impact. A specialty coffee, a craft beer, or a new accessory may do the trick instead of a heavy spend item.

A lot of people in the personal finance community love to rag on the $5 coffees. But the truth is, if you were going to spend $50 on a big splurge, a $5 purchase is certainly an improvement! Having a plan for smaller treats for when you really want to buy something is one of the best ways to save money in life.

The Bottom Line:

Having a healthy emergency fund is super important to your over financial wellness. But if you keep dipping into your savings for non-emergencies, you might end up getting really screwed when a real one pops up.

Hopefully these tips can help you stop dipping into your savings account while still affording what’s important to you in life. Be sure to check out these related posts for more helpful tips on boosting your savings!