There are some expenses in life that are just more difficult to budget for. While your cable bill comes at the same time every month, other bills come randomly, or sometimes annually. So how do we plan for these expenses? The answer is sinking funds.

What’s a Sinking Fund?

Sinking funds are buckets of money you save up to pay for expenses. These are things you know you have to pay for, but don’t fall regularly within your monthly budget. Sinking funds work best when you get specific.

Think new tires for your car- you know that eventually your old tires will wear thin and you’ll have to replace them. But you don’t know exactly when that will be! Either way, you’ll need to be prepared for when that day comes.

Sinking funds are a great way to make sure that if/when an irregular expense pops up, you’ll have the cash on hand to pay for it. And you won’t rely on credit cards or pull from your emergency fund to take care of it. You won’t increase your debt load for a lack of planning.

The best part about sinking funds is that they are totally customizable to your needs. You can incorporate whichever savings categories are necessary for your particular way of living.

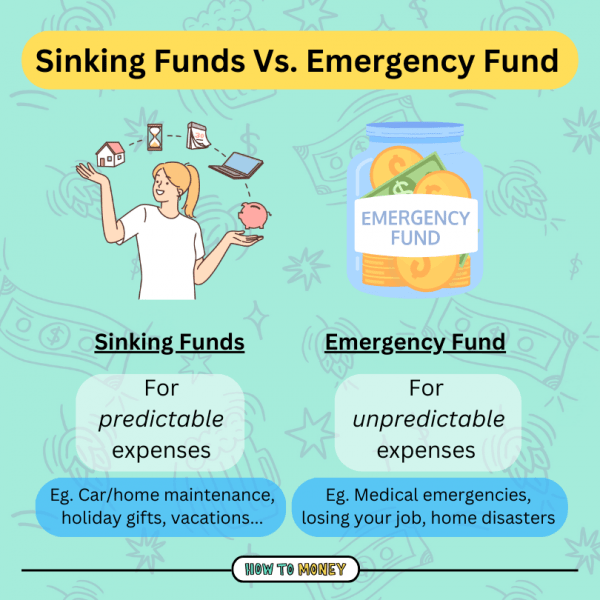

Sinking Funds vs. Emergency Funds

So you might be thinking, “hmmmm saving for irregular expenses? Isn’t that an emergency fund?”

While they do have a few things in common, there is one key difference between emergency funds and sinking funds. Sinking funds are for expenses you can predict, while emergency funds are for expenses you can’t.

For example, you can usually predict that every few years, or probably even more frequently, your home will need some repairs. Therefore, it’s important to set aside some money to go towards that expense every month.

However, you probably can’t predict cartoonishly slipping on a banana peel and ending up in a full body cast. Surprise medical bills, car accidents, or other unplanned expenses are all excellent reasons to tap into that emergency fund. However, if you can predict an expense, it’s far better to save for it in advance using a sinking fund.

The Benefits of Having Sinking Funds

Adding sinking funds to your budget can have a ton of benefits!

Eliminate stress: Sinking funds can help to ease financial anxiety or money worry from your life. When you’ve already saved up for a future expense, you’ll have more options and flexibility when the time comes to pay for it.

Stops you from going into debt: Having the money set aside ahead of time for important expenses can prevent you from relying on credit cards or other forms of debt. It also keeps you from tapping into your emergency fund when these expenses pop up.

Helps achieve money goals: Building up sinking funds can also be a great way to visualize your savings goals, and achieve them more quickly. Getting clear on your financial goals can help you to build strong money habits, because you’ll have something to weigh your money decisions against.

Puts you in control: Best of all, if you struggle with feeling pressure any time big expenses pops up, sinking funds can help to alleviate those feelings. For example, there’s no need to freak out when holiday shopping time comes because that gift money has already been saved ahead of time for that exact purpose!

Need some help figuring out what sinking funds you should prioritize? Make sure to listen to The Why Behind Money episode for some advice on how to align your money decisions with your personal values.

What Sinking Funds Should I Have?

The best thing about sinking funds is that they are totally customizable to your wants and needs. Some of the most common sinking fund categories are for car maintenance, home repairs, and holiday gifts.

The truth is, you could turn almost any savings goal or predicted cost into a sinking fund. Here are a ton of sinking fund ideas to get you started!

Where Should I Keep My Sinking Funds?

If you’ve got a good chunk of cash on hand inside your sinking funds, it’s probably a good idea to store that money somewhere it will grow.

Investing it in the stock market is probably too risky for a short timeline… But you don’t want to keep it under your mattress either earning nothing. The perfect middle ground is to keep it in a High Yield Savings Account.

High Yield Savings Accounts help you earn a good amount of interest on your cash, while also avoiding the dumb fees that many big banks still charge. HYSAs can earn you 10-12 times the national average in interest. This helps your money hold onto more of its buying power and hedge against inflation.

Ally is a great place to keep your sinking funds. We’re big fans of online savings accounts. Ally in particular offers a really helpful savings buckets feature that allows you to “divvy up” your savings within a single account. It’s tailor made for folks trying to set up multiple sinking funds. It really helps you to visualize your sinking funds each time you log in, without having to break out your budgeting spreadsheet.

How to Create Your Sinking Funds

Creating sinking funds is super easy, and the math behind it is very simple. You could even make your kids do it for you! Here are the steps to start getting after your savings goals.

Step 1: Decide Which Sinking Funds You Need

The first step towards implementing sinking funds is to decide what you want each of them to be for. Try thinking about the upcoming months and even years, and make a list of expenses you predict.

Will your car or home need maintenance? Are you moving soon and likely to incur a few costs? Do you plan to take a family trip at the end of the year?

Write these goals down. These will be your sinking fund categories.

Step 2: Figure Out The Amount You Need to Save

Next, you’re going to want to set a goal for how much money you need within your sinking funds. This might require a little bit of research on your part.

For example, if you want to create a holiday sinking fund, it’s a good idea to look at last year’s holiday spending. This will help you come up with a holiday spending plan for the coming year.

For things like home repairs, experts suggest setting aside about 1-3% of your home’s value each year for repairs.

For car tires or oil changes, look at the current prices and see how much things cost.

You get the point. Figure out all your estimated costs and set that as the sinking funds goal to save.

Pro tip: It’s a good idea to round up and shoot to have a little bit extra. That way you don’t have to dip into your savings if the estimated costs exceed your savings.

Step 3: Break Down it Down Into Monthly Goals

Next, it’s time to figure out how much money you will deposit into your sinking funds each month. You can determine this amount a few different ways.

One way is to take your savings goals and divide them by the time in which you hoped to save that amount of money. For example, if you wanted to save up $1,000 for a family vacation within a year, you could put about $83 into your vacation sinking fund every month for a year. Voila! You’ll have the money available to you at just the right time.

If you have multiple sinking funds and not enough savings for them all, try and prioritize the ones that are likely to become due first. For example, let’s say you have $500 to put towards your sinking funds each month. And let’s say your sinking funds are for home maintenance, car maintenance, holiday gifts, medical expenses and a vacation. (that’s a lot to save for! – which ones do you fund first?) Well, If you know you’ll be needing to replace the roof before the year is out, you might opt to put $300 towards your home maintenance sinking fund and split $50 towards each of the rest of them.

If you’re having trouble meeting the goals for your sinking funds, it could mean that you need to either increase your income or lower your expenses. Consider negotiating some of your bills, or try implementing mindful spending techniques into your everyday life!

Step 4: Actually Save the Money

The final, and most important step is to begin to implement your new savings strategy. Having a plan is great, but nothing will actually change if you don’t stick to it.

Add your savings buckets to your monthly budget. And make sure to actually deposit those funds to your high yield savings account.

Can You Have Too Many Sinking Funds?

Yep! Biting off too much can lead to slower progress. For example, if you have $500 to put towards 10 sinking funds, you can only put $50 each month towards them.

Whereas if you have 5 sinking funds and put $100 into them each month, you’ll reach those savings goals much quicker. It’s a good idea to start with a few, and you can add more if you feel like you need them.

So much of personal finance is about our mindset, and achieving a few goals quickly will give you the confidence to keep at it. The more we achieve, the more we believe that we are good with money, and the more we save and grow our wealth for the future.

The Bottom Line:

Sinking funds are a great way to save for expenses you can predict but that don’t fit into your regular monthly budget. Having the money set aside for when you need it saves you from scrambling for funds or going into debt. Plus, it gives you more peace of mind and puts you in the driver’s seat of your spending.

Well, that’s all we have to say about sinking funds! We hope this post helps you to implement this helpful savings strategy into your everyday life. Be sure to check out these related posts for more helpful money advice.

Related Posts:

- 12 Ways To Stop Dipping Into Your Savings

- 7 Ways To Save More Money This Week

- Setting SMART Money Goals

- Should I Buy It Checklist

Feature pic by Katie Harp on Unsplash