Ask yourself these important questions before quitting your job to help decide if it’s the best decision for you right now.

Good morning, happy people! It’s Tuesday today, a great day to… T ally your expenses 🧮U pdate your savings goals 📝E at homemade meals 🍳S pend less than you earn 💸D eclutter your house 🏠A utomate your investments 📉Y ell at anyone…

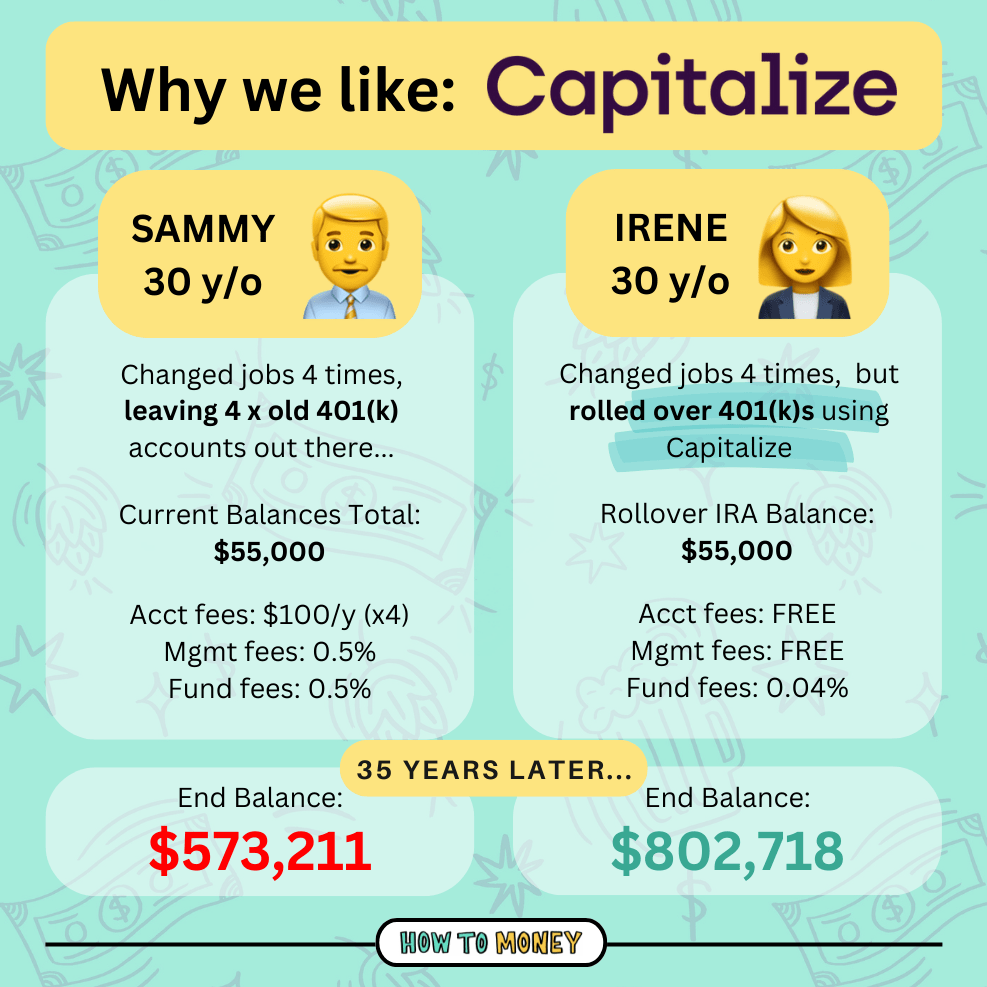

How long is your financial to-do list? If you’re trying to build wealth and accelerate your investing progress, chances are you’ve got a lot on your plate. I hope this isn’t too annoying, but I’m…

Ask HTM: Buying New or Used Cars in a Crazy Market, Stocks vs Real estate, & Converting or Rolling Over a 401k – Episode 580

- October 17, 2022

- Tagged as: 401k, atlanta, biking, Capitalize, craft beer, credit score, Dave Ramsey, emergency fund, Entrepreneurship, Fidelity, Financial Independence, investing, IRA, Life Hacking, M1, money, money podcast, parenting, personal finance, podcasts to listen to, retirement investing, rollover, roth ira, saving for retirement, saving money, Vanguard

Hey there, top of the morning to you! 🎩 Have you ever heard of the “arrival fallacy”? Arrival fallacy: The false belief that “once we make it, once we attain our goal or reach our destination, we…

Good morning, money nerds 🤓 Returning to work after a long weekend can be overwhelming. Feels like 5 days of work to do, but only 4 days to do it in… which means running at 125% of…

Spring Cleaning Your Finances like an Adult – Episode 494

- March 30, 2022

- Tagged as: 401k, atlanta, biking, craft beer, credit score, Dave Ramsey, emergency fund, Entrepreneurship, Fidelity, Financial Independence, investing, Life Hacking, M1, money, money podcast, parenting, personal finance, podcasts to listen to, retirement investing, rollover, roth ira, saving for retirement, saving money, Vanguard