Good morning, happy people!

It’s Tuesday today, a great day to…

T ally your expenses 🧮

U pdate your savings goals 📝

E at homemade meals 🍳

S pend less than you earn 💸

D eclutter your house 🏠

A utomate your investments 📉

Y ell at anyone in your path! 😱

(Oops, actually it’s probably not good to yell at anyone… I just couldn’t think of anything money related for Y).

I’ll keep brainstorming. But in the meantime, here’s this week’s money highlights and happenings 👇👇👇

TO DO

Label your credit cards 💳 ✍️

Most people have a few credit cards in their wallet or purse. But they use them ineffectively, foregoing awesome rewards!

So this week: Use a label maker or sharpie to mark which cards should be used for which spending category to get the highest reward. (For example, our Blue Cash Preferred® Card from American Express has “Groceries” on it because we get 6% cash back on those swipes!)

Label your cards, people! Bonus points if you label your partner’s cards for them too 😘

FAMILY MONEY

Relationships and Finances Survey 🫶

Speaking of partner’s credit cards, I just came across this survey from Finmasters which asked couples about money discussions in their relationship.

Fun findings!:

- 86% of American couples talk about money in some form or fashion! (not just married couples… more than half of people just dating said they have finance discussions) 🥳

- 36% of couples say discussions about money have had a positive effect on their intimacy. Ooh la la 😘

- 56% of people won’t spend over $100 without consulting their partner. Trust is a must! 💁♂️

This is all great stuff! But…

Not-so fun findings:

- 53% of people say they keep financial secrets from their partner. (hiding cash, secret credit cards and sneaky purchases) 🤐

- 54% of couples try to avoid money conversations (because they are not comfortable, or it leads to fights) 😭

- 90% of respondents reported arguing with their partners about financial issues. 👎

I guess that last point isn’t so shocking. We all have different upbringings and beliefs so it’s understandable that disagreements happen at one point or another.

The trick is to make disagreements and conversations productive. You are on the same team, after all, so the more you strategize and work together, the further you can go – together.

Good couples finance resources:

- 📖 Book Rec: Smart Couples Finish Rich by David Bach (Comes with a few couples worksheets and goal planners to keep your money conversations productive!)

- 👨👩👧👦 Friends of HTM: Rich & Regular, Marriage Kids & Money, One Big Happy Life (all great blogs/pods/youtube that focus on family finance)

- 🎙 Podcast Eps 440 & 475: How to Stop Money Arguments and our Interview with Financial Therapist, Ed Coambs!

- 👨💻 HTM Blog Post: Should I get a prenup?

TOGETHER WITH CAPITALIZE

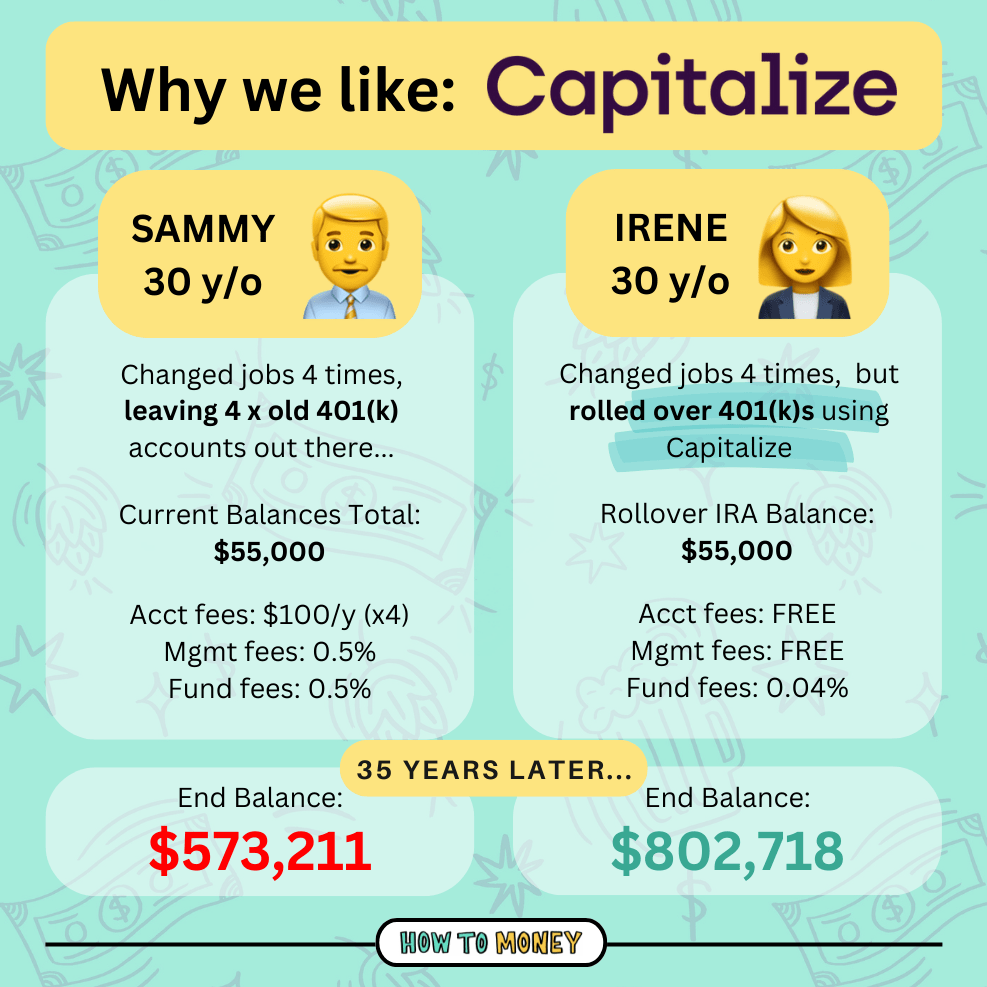

An example of 401k rollover savings…

Avoiding fees is one of the many reasons you should probably roll over your old 401k accounts. Tiny little fees (that you probably don’t even know you’re being charged) can eat away at your growth over time.

Capitalize is a free service, but YOU need to take the first step and reach out for help. Even if you have small balances (for instance Joel’s wife just used Capitalize to rollover an old account with $18k in it) it’s still important to grow your money in the most efficient, low cost account possible.

So if you have an old 401k and you’re not sure it’s 100% working for you, check out Capitalize!

INVESTING

12 Month I-Bond ROI Calculation (including penalty) = 6.51%

I-Bond rates are going to “reset” on November 1st…

But if you purchase I-bonds before the end of October (order must be submitted before the Oct 28th), you can take advantage of the current historically high interest rate — 9.62% — locked in for the next 6 months.

(After 6 months you’ll get the next rate, which is expected to be 6.48%.)

Here’s a graph of historical I-Bond interest rates from Bloomberg going all the way back to 1998. 👇👇👇

You might already know this, but I-Bonds must be held for a minimum of 12 months. After that, you can cash them out BUT you still pay a penalty if sold before 5 years. (The penalty is forgoing the prior 3 months of interest).

So here’s a scenario of total ROI, assuming you buy $1,000 worth of I-Bonds in the next 4 days, and cash them out in exactly 12 months:

Initial investment: $1,000

First 6 months interest: +$48.10

Second 6 months interest: +$33.95

Early cash out penalty: -$16.79

———————————————–

Total returned to you: $1,065.08

Total ROI = 6.51%

Not bad for a guaranteed return in uncertain times.

Should YOU buy i-bonds right now? —> This is impossible to answer, because everyone has a different risk profile and investment goals. But I will say this: If you are trying to “time the market” by moving your money in and out of stocks/bonds or whatever looks exciting at the time, this is a losing mentality in the long run. As a long term investor, think loooong term.

More resources:

- 🛒 Where to purchase I-Bonds: TreasuryDirect

- 🎬 Gifting I-bonds Video: Rob Berger YouTube Video (Step by step walk through – how to use i bonds as gifts to juice the rate. it’s an advanced strategy but a cool one)

- 🤓 More nerdy math: Buying I Bonds in October

- 🎙 Podcast Ep 341: How WE invest our money

ICYMI

Circling around the interwebs…

Apple Bank? 📲

In the coming months, Apple will be offering high yield savings accounts (backed by Goldman Sachs) to Apple Card users. These accounts will have no fees, no minimum deposit or min balance requirements. Interest rates are yet to be announced!

Quitting Penalty 👷♀️

Apparently more companies are charging employees for job training if they quit too early. Just something to watch out for if you’re switching employers and they offer certifications or specialized training, read your onboarding paperwork carefully! pssst. Read this if you’re wondering “Should I quit my job?“

2023 Tax Brackets 🏛

The IRS have released next year’s income tax brackets, as well as updated standard deduction amounts and several other code changes. (They update this stuff every year to adjust for inflation, so hopefully these new deduction amounts will ease your taxes a bit? 🤷♂️)

Mortgage Rates 📈

The average 30 year fixed mortgage rate is now 6.92% according to Freddie Mac! Hasn’t been this high in over 20 years 😭

Recession Prep ☔️

Here are a few strategies people are using to help plan for a potential recession… (top ones are delaying major purchases, paying down debt & reducing holiday spending). We fully support these priorities — whether we’re in a recession or not! 😆

MoveMap 🗺

This is a super cool tool that helps you find a new place to live based on your lifestyle (and cost) preferences.

FRIENDS OF HTM

Community Spotlight: Paco de Leon 🌻

Paco is a super positive, empowering, creative luminary who helps artists and freelancers realize their full potential in life! (She’s also killer at personal finance!)

Earlier this year Paco published a book Finance for the People — in which she’s not only the author, but also the illustrator! 🎨 If you’re a visual learner, you’ll love her drawings and diagrams breaking down messy financial concepts in easy and fun ways.

Check out her Insta, blog, and here’s also a cool 4-min TED talk she did which gives you a sneak peak into her genius. 😉

Have an awesome week! And happy halloween this weekend!!! 🎃👻💀

Best friends out 🍻

*****

* Advertiser Disclosure: How to Money has partnered with CardRatings for our coverage of credit card products. How to Money and CardRatings may receive a commission from card issuers.

* User Generated Content Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.