Whether we should rent or buy is one of the most common housing dilemmas people face. As housing costs have risen over the past few years, the answer may be even more difficult to come by.

The best answer to the rent vs buy question depends on many financial and lifestyle factors, and realistically we can’t make that decision for you. However, in this guide we hope to give you as much guidance as possible so that you’re in the best position to make the right choice for you!

Why is housing so expensive right now?

Unless you live under a rock, you’ve probably at least heard someone around you mention that home prices have skyrocketed. Housing affordability has deteriorated rapidly over the past few years for a number of reasons.

First, remote work became much more common during the pandemic, and many workers were no longer bound to a specific city or location. These folks were able to keep their remote jobs, and move to different parts of the country. Even those who stayed in major metropolitan cities like New York or San Francisco wanted more space, typically to accommodate spending more time in their homes. Mix all that (plus stimulus money flowing freely) with the lowest mortgage rates we had seen in a century and you’ve got the perfect recipe for a crazy housing boom!

Over about a two year period between March 2020 and June 2022, we saw roughly a 45% appreciation of home values across the nation. According to real estate expert Lance Lambert, we’re living in the most expensive period of housing for new homebuyers since 1984.

To worsen the affordability storm, we’re also dealing with a major supply issue. In September of 2023, the median cost of a home rose 2% compared to the previous year, and there were 300,000 fewer homes available on the market. Nobody wants to sell these days either because folks with locked in lower interest rates are staying put instead of moving. The outcomes is an expensive and stagnant housing market.

Renting ain’t cheap, either

Renting isn’t rainbows and sunshine either right now. Although the rental market has been cooling down in some areas, rents are still much higher than they were in pre-pandemic years. Single family home rentals have increased 35.7% and multi-family homes have increased 23.1% since early 2020.

It’s also important to mention that wages have gone up substantially too. And that just because prices have increased doesn’t mean you can’t still find a perfect situation for yourself. Don’t get discouraged! With hard work and patience you can still find a way to make the numbers work for either situation. We’ll discuss some ways to save money on housing later in this post.

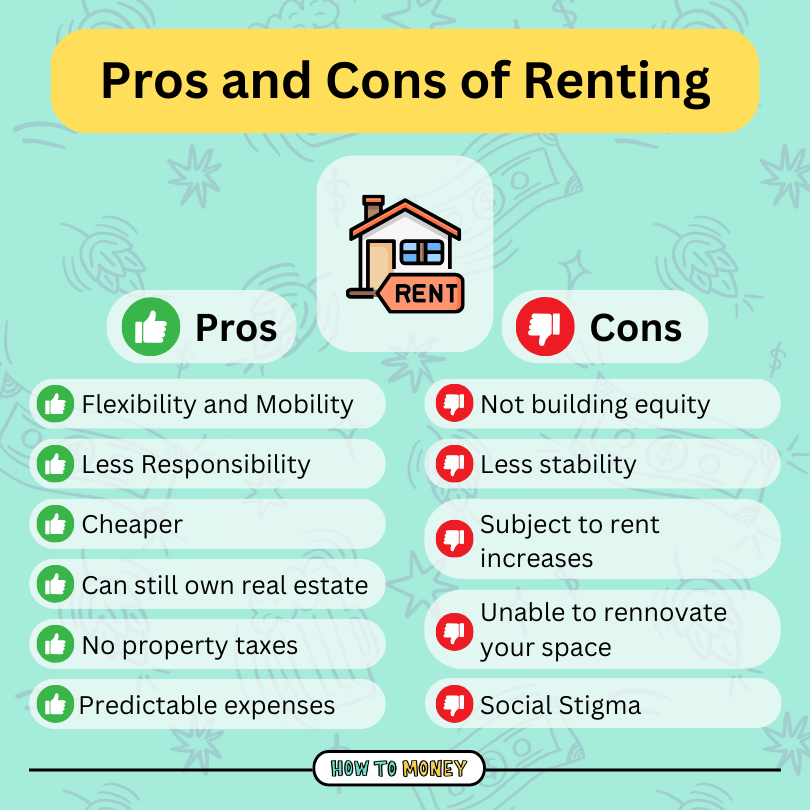

The Pros of Renting

There’s a misconception in the USA that you need to own a home to build significant wealth. But that’s simply not the case. You can still grow your net worth in a big way while renting. In fact, renting comes with its own unique benefits that can have a positive impact on your life!

1. Flexibility and mobility

Perhaps the greatest benefit of renting is that you’ll have tons of flexibility to move as often as you want. Instead of taking out a 30 year mortgage, which is quite an obligation, your commitment to a property will be much smaller. So if you move somewhere and you’re not happy with your decision, you can easily move again whenever your lease is up.

Plus, if you need to relocate for a new job or a budding relationship, you’ll have an easier time doing so at the drop of a hat.

In fact, even if you’re looking to buy, it could be a good idea to try renting in your desired area before you commit to buying a home. You may decide that you don’t like living in that particular neighborhood as much as you thought you would!

All in all, renting works out beautifully for those who live a flexible and mobile lifestyle.

2. Less responsibility

Leaky shower? Broken appliance? No need to stress if you rent, just call your landlord!

One of the top benefits of renting is that you are not responsible for fixing the place up, which can help save you both money and sanity. Imagine a life with no repair work and no yard work. Glorious, right!?

3. It’s often cheaper

Although this isn’t a hard and fast rule, renting is cheaper than owning a primary residence the vast majority of the time. That’s particularly true in the most expensive cities in the country.

When renting, you won’t need to to pay for things like property taxes, HOA fees, or home maintenance. All of that extra money you would be spending could be invested instead, and will grow faster than if you sunk it all into home equity.

The price disparity between renting and buying right now is nothing to scoff at. In fact, renting a two bedroom apartment can save you nearly $1,200 each month compared to purchasing a starter home.

Even if you have a down payment saved up, buying a house might not be a slam dunk right now if it means you’ll be spending double the amount for similar space. Now, if you really want to buy a house, that might not be exactly what you want to hear. But when life gives you lemons, make lemonade! You could always rent for a few extra years, invest the difference, helping your retirement savings to skyrocket in the mean time.

4. You can still own real estate if you want

Just because you decide to rent your primary residence doesn’t mean you can’t own real estate!

“Rentvesting” is when you rent the place where you live, but still invest in other real estate projects. You could buy a rental property elsewhere – maybe in a cheaper part of the country, giving you the opportunity to build equity while also having the flexibility of being a renter.

Or, you could opt to purchase REITS, which stands for “Real Estate Investment Trusts.” REITS are a way to invest in real estate by purchasing stock in companies who own, operate, and manage real estate portfolios.

Related: House hacking is the best of both worlds. It’s where you own the place you live in AND you rent part of it out. A roof over your head that’s also throwing off income? Priceless.

The Cons of Renting

Although renting may be cheaper, it’s not the superior option in every case. And it does come with its own challenges. Be sure to consider the downsides before deciding to rent over buying.

1. Renting doesn’t build equity

The biggest downside of renting is that you won’t be able to profit from any type of appreciation of your residence. When you own a home, some of your “investing” will be taken care of over time because you can count on your house increasing in value over many years of ownership.

But if you rent, you’ll need to be much more diligent about investing elsewhere. For all the dollars you save by renting, those should be invested, maxing out accounts like your 401k or Roth IRA.

2. Rent increases can be insane

Unfortunately, just because you have a great renting deal right now doesn’t mean that will always be the case. Rent increases can be hard to stomach in certain cities, and your landlord might inform you at the end of your lease that your rent is about to jump up by hundreds of dollars each month. That can feel like a punch to the gut.

We saw this a lot during the pandemic. Still, rents didn’t go up nearly as much as new mortgage payments. Plus, at the time of writing this, rents are softening, giving the tenants more power to push back on what they pay.

3. Limited Control and Stability

If you want to make your space feel like your own, you’ll have to get really creative with customizations, and make peace with the fact that you won’t be able to make any major renovations. Command strips are about to become your best friend.

If you want to take on any projects, you’ll need to ask your landlord or property management company for permission first. Things like painting, putting holes in the walls, switching out appliances and gardening may not be allowed. Plus, if you’re keen on bringing your furry friend with you, you’re likely going to limit your apartment selection and have to pay an additional pet fee.

On top of that, sometimes landlords can force you to move, even if you’d otherwise prefer to stay. Even if you get along perfectly well with your landlord, they could sell your building, kick you out for major renovations, or ask you to leave so that someone they know can move in. In most states they can simply choose not to renew your lease. If you want more stability, buying a home could be a better move for you.

4. Social Shaming

Because traditional personal finance advice typically emphasizes the importance of buying a home, you may have to deal with hearing some opinions you don’t quite remember asking for. Especially from older family members who built their fortunes buying their 22 acre beachfront house for $14,000 back in 1942.

Walking a nontraditional path is hard, and criticism can come from all angles. Sometimes the worst comes from your own loved ones! However, there is no shame in renting. If someone gives you a hard time about deciding not to buy, remember that it is your life, not theirs. You need to do what’s right for you and your finances.

Pros of Buying

Tons of people dream of owning a home, and for good reason. Buying a home also comes with its own unique benefits, especially lifestyle ones. Here are just a few reasons why you may want to consider buying a home.

1. Building Equity

When you own your home, you’ll benefit directly from property appreciation. Over time, real estate gets more and more valuable, and this means your net worth grows accordingly.

At the same time, each month when you pay your mortgage, you are simultaneously paying down your mortgage balance, increasing your equity.

In a way, paying your mortgage is sort of like “forced savings,” because you have no option to not pay your mortgage. And, if you pay your mortgage off after about 30 years, you’ll have no more payments and a valuable asset to live in for the rest of your days. Even better, your property will likely continue to appreciate, making it a solid lifelong investment.

However, it is worth noting that your home may not be the best investment option available to you. Compared to the S&P 500, real estate has poor historical returns. You’ll need to account for ongoing maintenance, which usually costs approximately 1% of the price of your home each year. Buying a home can be a great personal decision, but it’s rarely the best investment choice.

2. Pride and Sense of Permanence/Belonging

Homeowners can rest well at night, knowing they have complete control over their housing situation. When you own your home, no one can force you to move, and you can do pretty much whatever you want to the appearance of your home in many cases. Unless you opt to buy a home in a neighborhood with an HOA, that is. You want to paint a clown mural on your walls? Go for it! I just won’t be coming over to visit…

Plus, you might find that you feel more connected to your community when you buy a home. Because you’ll likely be in that home for a longer time, you’re more likely to want to put down roots, build relationships, and take care of your property. Especially since its value is connected to your bottom line.

3. Mortgages are flexible

Mortgages also come with some options that can make them great financial tools. You can refinance mortgages, or take out a HELOC (home equity line of credit), which you can use to pay for projects like home renovations or tuition.

Plus, mortgages are considered good debt. Because you are borrowing money for an asset that appreciates in value (at a fixed, low interest rate), buying a house is a much better debt to take on than something like a personal loan or credit card debt.

4. You might get tax advantages

Homeowners can enjoy additional tax advantages that renters don’t have access to. Interest paid on your mortgage can be deducted from your taxes, and you’ll be able to deduct property taxes and state taxes as well.

Plus, if you’re a small business owner or are self-employed, you may even be able to take a home office deduction.

Tax benefits vary widely in value, because everyone’s financial situation is different. So it’s important to take this benefit with a grain of salt, because it might not be as applicable to your situation as you think!

5. House Hacking Capabilities

And perhaps the best benefit of purchasing a house is that you unlock the potential to “house hack.” House hacking is a form of real estate investing where you rent out part of your home to somebody else while you live there. The tenant will then pay you rent, which you can put towards your mortgage, essentially slashing your living expenses.

House hacking can completely transform your home from being an okay investment to a completely optimized one. For example, if your mortgage is $2,500 per month, and you rent out your basement apartment for $1,500 per month, you will have reduced your monthly living expenses to just $1,000. This could be much vastly cheaper than renting, plus you still get all the benefits of ownership that we’ve described above!

Downsides of Buying a Home

Buying a home is not without its pitfalls. Certain downsides of homeownership may have you longing for your renting days. Be sure to watch out for these challenges before pulling the trigger on that new home.

1. It’s Expensive!

Tell me something I don’t know, right!?

Buying a home costs a lot of money. And that has only become more true over the past few years. But even if you’re prepared to save up a hefty down payment for those increased home prices, many people forget to factor in things like closing costs, maintenance, insurance, taxes, and other unexpected expenses!

The truth is, your home could end up being a bigger money pit than you originally thought. So if you want to buy a home, it’s a good idea to budget extra money beyond your down payment for those additional costs.

Plus, you can’t forget the time and effort that goes into buying and maintaining a home. Long gone are the days when you could call your landlord anytime something breaks. Now, it’s up to you to make sure repairs are taken care of in a timely manner. And you can’t just ignore those problems, because they’ll often result in even bigger expenses for you down the line.

2. You could lose money

Most people think that houses always just go up in value. And while that may be true in the long run, you might not live in that house long enough to see a meaningful rise in value. Plus, if you enjoy a modest rise in value, but move too quickly, the costs associated with selling a home, like real estate agent fees, attorney fees, notary and filing fees can seriously cut into any profit.

While homes can appreciate significantly over short periods of time like we’ve seen recently, homes can also decline in value rapidly over a short period of time. For example, during the Great Recession, the median home price dropped 29% between July of 2006 and January 2009.

The bottom line is, if you’re looking to purchase a house for just a few years, you’ll likely want to run the numbers. In the short term, there’s no guarantee your home will appreciate in a significant way. Ideally, you’ll want to be ready to commit to a home for around 7-10 years before buying, unless you plan on house hacking.

3. Moving is Hard

If you’re renting a home and decide you want to move across the country, all you’ll need to do is wait for your lease to end, and handle the logistics of finding a new place and getting your stuff there. But if you own a home and are looking to move, it’s an entirely different equation.

First, you’ll need to sell the home you’re in, paying a multitude of fees. Plus, the process of selling a home can take a few months. On average, it takes about 54 days to sell a home. Then, there’s also the process of buying your new place.

Buying a home just isn’t as flexible as renting, so if you aren’t sure that you’ll want to be in this home long term, it may be a better idea to hold off.

4. Accidentally Becoming “House Poor”

As we mentioned before, buying a home is expensive, and you need to make sure that you aren’t putting too much of your monthly income towards housing. Spending all your savings just to get into that new home will affect your ability to accomplish other important financial goals, like saving for retirement or paying off your student loans.

Even if you own a home, you still need to continue to invest for retirement. As a general rule of thumb, you want to make sure that your housing costs are no more than 30% of your gross income, including basic utilities. While we know this won’t be possible for everyone, depending on your location and other personal factors, this is a great guideline to keep in mind.

Financial Considerations of Renting vs. Buying

If you’re deciding whether to buy or rent, your finances are likely going to be one of the key factors that influences your pick. Here are a few important financial aspects to consider throughout the process.

Mortgage vs. Rent Payments

When it comes down to monthly payments, owning a home comes with far more costs than most people think.

Most people think only of their mortgage when it comes to budgeting for their housing costs. But it’s not just about your principal, interest, taxes and insurance. There are a ton of random costs and events that occur every few years that people rarely think about. Essentially, your mortgage is just the minimum you’ll be expected to pay for housing.

For example, a new roof might cost you $20,000 every 15-30 years. That’s $55 per month that you’d better be socking away if you own a home!

Experts recommend setting aside 1-2% of your home’s purchase price each year for maintenance. That means, if you purchased your home for $500,000, you should set aside about $5,000-10,000 annually for home maintenance. That translates to an extra $416-833 each month!

On the other hand, your rent is the maximum you will pay for housing. Since your landlord is responsible for all repairs, you won’t need to worry about setting aside extra money for home maintenance. Basically, when it comes to renting, what you see is what you get!

Before deciding whether to rent or buy, make sure to factor in the hidden costs of buying that many folks forget to factor in.

Interest Rates Affecting Affordability

If you purchase a home using a fixed rate mortgage, your interest rate won’t change throughout the duration of your loan. While your mortgage payments may fluctuate due to increasing or decreasing property taxes or homeowners insurance, the amount you pay towards your mortgage and interest will not change.

Unfortunately, this isn’t the case with all types of mortgages. If you have an adjustable rate mortgage, or ARM, the affordability of your mortgage could be affected over time as interest rates fluctuate. Although ARMs typically come with lower initial interest rates, they can change following market trends, potentially making your payments more expensive down the line.

The hard truth is that if you can just barely afford your home with the initial interest rate, you can’t actually afford that house.

Long Term Appreciation

If you own a home, it’s more than just a place to live. It’s also an investment.

Over the years, your home will likely go up in value. This is called appreciation. On average, the annual home value increase has been 4.3% since 1991. While in recent years we’ve seen real estate prices soar, it’s important to note that this may not always be the case, and therefore, you shouldn’t count on it.

As far as different types of investments go, this is far from the greatest return on your money you can get. For example, the S&P 500 has returned 9.9% over the past 30 years. But, although long term appreciation of homes is lower than what most people think, if you are renting, you won’t benefit at all from the appreciation of your home.

Investing the difference

It’s worth noting that if you decide to rent solely for the financial benefits, you must put all of your excess cash into investments, otherwise the equation may not work in your favor.

For example, if you bought a home today for $400,000 and enjoyed an average appreciation of 4% annually, in 30 years, assuming you stay in that home, your home would be worth $1,297,359.

Because we want you to be investing for retirement even though you own a home, let’s say you also max out your Roth IRA for 30 years as well. You would retire with $1,202,637.65 in your retirement account. And your total net worth would be $2,499,996.65.

Now, if you decide to rent, let’s assume you also max out your Roth IRA for 30 years, snagging that $1,202,637.65 nest egg. But by renting, you save about $1,000 each month on housing costs, finding a two bedroom apartment for just $1,700 per month. If you invested that extra $1,000 each month, in 30 years you’d be looking at an additional $2,062,843.31 once you reach retirement. All in all you would have a total net worth of $3,265,480,96!

In this scenario, renting would net you over $750k more in retirement vs. buying a home!!

However, the numbers only work if you invest the difference in monthly payments vs the rent amount. If you only invested half the difference, you’d be sitting with about $265,000 less than had you purchased that home.

As you can see, while renting is typically cheaper, you’ll need to crunch the numbers yourself to see what makes sense for you and your personal situation.

Here’s a great calculator to use!!

Lifestyle Factors

We know that the decision of whether or not you should buy a home is not all about the money. There are so many lifestyle factors at play that could sway your decision one way or the other. Make sure to consider these key lifestyle factors before making this life changing decision.

1. Do you currently have, or plan on having kids?

While it’s entirely possible to successfully raise kids while renting, owning a home does come with some perks that could be especially helpful. You may find that you need more space to accommodate the many toys, play pens, and mountainous stacks of diapers. Plus, having the stability of owning a home can ensure your kids can remain in the same school district if that’s something you want to prioritize.

Your little ones will also likely get to enjoy the benefits of community stability. Getting to know their neighbors for the long term and taking part in local clubs and activities is a big deal in childhood. And as a bonus, you’ll have more control to customize your home to your family’s specific needs too.

This isn’t to say that all of this isn’t also possible to accomplish when renting- but it’s often easier if you own your home.

2. Traveling a lot

If you plan to travel a lot during the next few years, it may not necessarily make sense for you to purchase a home. Mortgages are expensive, and if you plan to travel for months at a time, you won’t want to be paying for months when you aren’t even home!

The exception? Perhaps you could rent your home out when you’re traveling, using a website like Airbnb, that way you can recoup some of those expenses.

P.S. If you are a big traveler, then you’ll definitely want to check out our post on traveling with credit cards points, which can help you to save hundreds of dollars on your next trip!

3. Work stability

Your work stability could also be a major factor in deciding whether or not to buy or rent a place to live. If you’re at the start of your career, or in a position that could require you to relocate, renting is almost always going to be a better option for you. Renting is just more flexible, allowing you to have an easier time moving, and you won’t need to worry about not being able to afford a mortgage should your employment change.

4. Overall quality of life

At the end of the day, whether to buy or rent often boils down to personal preference and the stage of life someone is in. Different strokes for different folks, right? If you’re able to manage the finances either way, you should do what you believe will make you the happiest.

In the financial example we used earlier, both situations resulted in becoming multi-millionaires eventually in retirement. Both renting and owning can give you the opportunity to build wealth. So if you’re going to be wealthy either way, you should make the decision based on what path brings you the most joy.

Questions to ask to help you decide whether to rent vs buy

If you’re still feeling stuck between buying a home or renting, here are a few questions that could help to sway you one way or another!

1. Do you have a down payment saved up?

This one is pretty self explanatory, but if you don’t have a down payment, you cannot buy a house. Ideally, we’d like to see you save around 20% for your down payment to avoid having to pay PMI, or private mortgage insurance. However, if you’re planning on house hacking or renting this home, that 20% down payment becomes less important. Either way, if you don’t have the money you need right now to afford that home, renting is the obvious choice.

2. How long will you live there?

Again, buying a home tends to make the most sense when you plan on owning that home for at least 7-10 years. So if you’re thinking of buying a two bedroom home, but plan on having 8 kids in the next 5 years, you might want to hold off on that purchase!

The exception? If you plan to rent out that property after moving to the next one, you’re in the clear. Remember, it’s about how long you hold onto that property, not necessarily how long you live there.

3. How much responsibility do you want?

If you’re buying a home, I hope you’re ready to be out there every Sunday mowing the lawn! Home ownership comes with a ton of new responsibilities. Long gone are the days when you could call your landlord when the hot water isn’t working. Now, you’d better go down to the boiler room and figure it out!

Here’s the hard truth. Some of us just aren’t up for the responsibility of owning a home. It’s kind of like having a part time job on top of the job you have, so depending on how busy you are, you might not be ready to have more added to your to do list.

4. How much debt do you have currently?

Unfortunately, having too much debt can affect the affordability of your home. In order to ensure that you’ll be able to afford your home with ease, try calculating your Debt-to-Income Ratio. You can do that by adding up all of your monthly debt payments, and dividing it by your monthly gross income. Be sure to factor in your prospective mortgage payments.

If you can, try and keep that DTI under 30% to allow yourself extra breathing room, but generally 43% is as high of a DTI as you can have and still qualify for a mortgage.

5. How much monthly payment can you afford?

Before you buy a home, you want to make sure you can afford your monthly mortgage payment. And don’t forget about all those sneaky monthly costs that come with it, like insurance, taxes and home maintenance.

If you aren’t sure how much you can afford, these simple calculators can help to give you a ballpark idea.

6. How stable is your employment?

If your employment is less stable, it’s probably a better idea to rent until you have a steady situation. You don’t want your job situation to change and suddenly find yourself unable to pay your mortgage.

This also could be the case if your employment is reliable, but you’re required to travel a lot for work. If you want to buy a home, make sure you wait until you’re ready to settle down in one area for the foreseeable future.

7. What are your biggest goals right now?

At the end of the day, if home ownership is your biggest financial goal, we want you to achieve that! Focus on saving up that down payment and getting yourself into a position where you can afford to comfortably buy a home that you plan to live in for a good long while.

However, if you have other financial goals you would like to prioritize, like retirement investing, or saving for education, renting may help you to achieve these goals faster.

8. Are you planning on house hacking?

Again, house hacking changes the entire equation. Because your house will be generating more cash flow into your life, you’ll be able to purchase it without necessarily needing that 20% down payment saved up.

Buying a duplex, triplex, or fourplex is an ideal investment. You can live in one of the units and rent out the rest. Another option is to buy a house with an ADU (accessory dwelling unit) on premises. If you can rent out a detached space to a tenant, it drastically changes the financial aspect of renting vs. buying.

The Bottom Line:

If the numbers are the most important to you right now, renting is a cheaper option than buying across most of the country. It also gives you more flexibility to move and travel. However, if family, home and community is your number one priority, and you can afford to purchase a home without straining your finances, a home can come with some serious lifestyle benefits.

At the end of the day, whether renting or home ownership is better for you depends on your personal preferences and dreams in life. The answer isn’t one size fits all. Everyone needs to make that decision for themselves.

Either way, if you continue to invest for retirement and make wealth building a priority in life, the decision won’t matter quite as much as you think it will over the long run.

Anyway, we hope this helped to provide some clarity about what to consider when making this decision. Be sure to check out some of our other posts for more tips on how to save money on housing!

Related Posts: