Advertiser Disclosure

* Advertiser Disclosure: How to Money has partnered with CardRatings for our coverage of credit card products. How to Money and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. Lastly, the site does not include all card companies or all available card offers.

If you’ve always thought that travel wasn’t in the cards for you and your budget, think again. Contrary to popular belief, you don’t need to be a millionaire to enjoy multiple trips each year. In fact, you can completely slash your travel costs by scoring free flights, accommodations, and even rental cars. How? By accruing travel reward points via travel credit card reward programs! 😎

Remember to Follow the Golden Rules of Plastic!

Before we continue – it’s extremely important to point out that credit card rewards isn’t a good fit for everyone. Credit cards should only be used if you know you can handle them responsibly. This means paying them off on time, and in full, each and every month.

It may be tempting to buy a bunch of fun stuff on your card to snag a sweet welcome offer, but you will lose the numbers game if interest begins to accumulate. There’s no point in saving $2,000 in travel if it’s going to end up costing you $3,000 in fees and interest just to do it!

Seriously, stick to the best credit card practices. We can’t stress this enough!!!

Travel rewards at a glance:

Now that we’ve gotten our super important disclaimer out of the way, it’s time for the fun stuff. In this post, we’re going to teach you how to travel at significantly discounted rates (or for free) using credit card rewards.

Typically, there are two main ways credit cards can be used to earn rewards points:

1. Earn Welcome Offers and Rewards Points Via Everyday Spending

Often, travel credit cards will offer generous welcome reward points when opening a new account. A welcome offer is usually earned by spending a certain amount of money within the first few months of opening a card. Then, rewards can be redeemed for travel expenses, like hotels, flights, rental cars and experiences!

2. Utilize Credit Card Travel Portals

Certain card issuers offer online travel portals where you can cash in your points for travel. The most common ones are Capital One, Chase, Citi and American Express.

Travel rewards portals are a convenient and often cost effective way to book flights, hotel rooms and rental cars. Plus, you can sometimes get bonus category points or additional discounts when booking through these portals (even without using points). For example, card_name holders can earn 5 points per dollar on travel purchases booked through Chase’s travel portal.What makes travel rewards awesome?

Traveling can be an incredibly meaningful and fulfilling part of your life. It can open your eyes up to new cultures, cuisines, and remind you that we’re all more alike than we are different. But it can also be super hard on your wallet! 😅

Traveling allows you to get in touch with your adventurous side, or your “don’t call me, I’m drinking out of a pineapple by the pool” side. And by using rewards programs, you can fund your trips without breaking the bank.

You have to spend money to survive. You’ll always have to buy groceries and pay your utilities. Using credit card rewards programs allows you to build up travel credit for your everyday purchases in a meaningful way. Plus, it allows people who would otherwise never be able to take incredible trips to experience the things they’ve always dreamed of.

Even if you don’t earn enough points to make that trip you’ve always dreamed of entirely free, you can significantly reduce the cost, putting it within reach of your travel budget. Cutting the cost of flights or hotels from your trip means you can splurge elsewhere. For example, while traveling for free you can afford to buy excursions, trying new foods, or extending your stay.

When you look back on your trip, what will you remember more? The overnight flight where you snoozed the entire time, or that pasta making class you and your family took with an Italian local? Personally, I’d rather spend my money on the fun stuff. I rest my case.

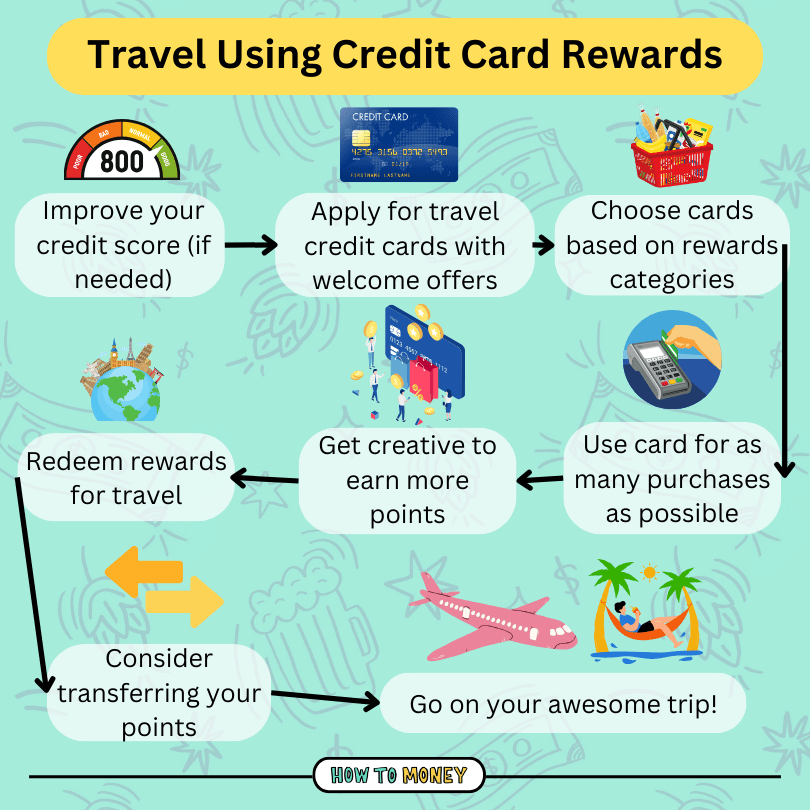

How to Use Credit Card Rewards to Travel

Now that we’ve got your attention, you might be wondering how you can take advantage of traveling with credit card rewards. Luckily, we’ve created the step by step guide below to teach you how to open credit cards, earn rewards, and use them to travel!

Step 1: Improve Your Credit Score (If Needed)

Before you ever open a new credit card, you’ll need to make sure you have a pretty good credit score. You likely won’t qualify for the best travel credit cards if your score is in the dumps. Statistically, people with low credit scores fall victim to ridiculous interest rates, fees and a deeper debt burden. Seriously, no amount of travel rewards are worth hurting your credit or paying interest.

Plus, the best travel cards typically require you to have good credit in order to be approved. According to Experian, you typically need a credit score of 670 or higher to qualify for many premium travel rewards credit cards.

If your credit score is lower than that, spend some time working on building it up. We recommend doing this before you start planning travel. Focus on paying all your existing accounts on time, lowering your utilization, and proving you can handle credit responsibly.

Step 2: Apply for travel credit cards with generous welcome offers.

The first step is to open up a travel card with a generous welcome offer. The bigger the welcome offer, the better.

What’s considered a “good welcome offer” differs from person to person. But if you shop around, you should be able to find one with a welcome offer between 60-80,000 points or miles. This equates to somewhere between $600-800 in free travel.

Remember that a lot of these welcome offers will only be awarded if you meet a spending threshold within the first few months of opening the card. This is typically referred to as the “minimum spend.” Oftentimes, you’ll need to spend around $3-4,000 in the first 3 months of receiving that card to snag that reward.

For example, here is the current offer for the card_name: bonus_miles_fullSo before applying for any of these cards, be sure that you’ll be able to achieve this without overspending! A good idea can be to open up a new reward card when you know you’ll have a lot of expenses coming up. Lots of car maintenance on the horizon? A new home improvement project you’ve been planning for months? Could be a good time to open that new card and grab that significant welcome offer at the same time!

Be sure to also take the annual fee into consideration. Many top-notch cards have an annual fee of around $99. But some card issuers will waive it for the first 12 months. Others have higher annual fees, but those often come with additional perks. More on this later…

Great Welcome Offer Examples:

We’ve got a tool on our website that updates daily, ranking the best welcome offers for various travel cards. But here are some of our favorites if you are just starting out:

Step 3: Choose a card that offers rewards that align with your spending.

Each travel card is built differently, and some might reward you more than others based on different spending categories. So if you want to earn the most miles or points possible, it’s important to pick a travel card that offers rewards on the categories you spend the most on. With the right strategy, you can ensure you’re earning at least double points on every dollar you spend.

Most cards will offer double or triple miles in certain spending categories. For example, 2-3x points for gas purchases, or 5x points for travel. Take a look at your past spending and determine which categories you spend the most money in. Then, try to pick a credit card that offers rewards to match. That way, you’ll earn even more rewards just by spending money as you normally would.

Here are some of the best cards for how you spend:

- For Groceries: The card_name might be a good choice for you. It offers 6% cash back on groceries.

- For Dining out: If you’re a total foodie, you might want to consider the card_name. It yields you 3x points on dining.

- For Business Expenses: Check out a business card like the card_name from Chase. This card gives you the highest rewards for office supplies, and utilities like cable or phone service. Here are some other best credit cards for side hustles

- Just in General: Or, if no category sticks out in particular, you can opt for the card_name. This lets you accrue 2x points per dollar spent, on everything.

Step 4: Use your travel card for as many purchases as possible

Don’t forget to bring that card with you everywhere you go! Since you’re chasing that welcome offer, you’ll want to use your new card for as many purchases as possible.

If you forget to use this new card for even just one big purchase, it could mean missing out on that welcome offer. So make sure to use this card for everything you plan on buying to rack up those points. Just remember to pay off your balance each month in full to avoid interest charges.

Pro tip: Sometimes it can take 1-2 weeks to receive a new card after applying for it. So if you want to use your card for a big purchase right away, many issuers offer a “digital” card which you can add to your phone’s wallet app. Another tip is to call customer service and ask for expedited shipping of your new card. Most of the time, they are happy to oblige and it’s free!

All in all, your main goal is to hit that minimum spend ASAP.

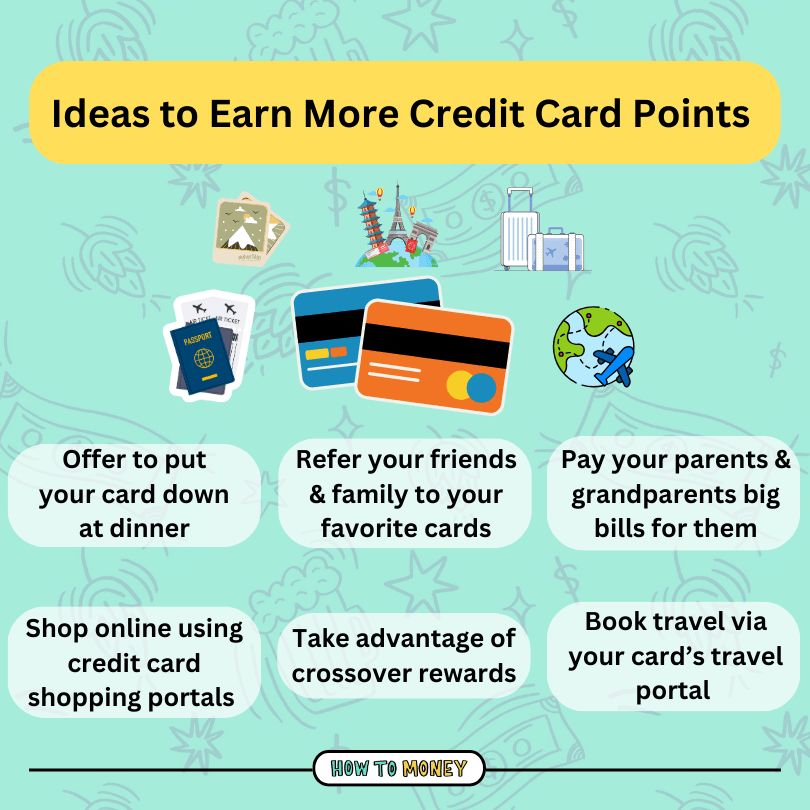

Step 5: Get creative to earn more points!

With a little creativity, you can sometimes earn points at a faster rate than normal, without overspending. Try and brainstorm a few ways you can use your card more, without paying additional fees or buying stuff you don’t need. Remember, overspending is your enemy, because there’s no point getting cheap travel if you pay for it with interest payments!Here are a few things you could try…

Pay for other people’s bills:

One way to earn more points without spending more is to cover other people’s expenses. Whenever you go out to dinner with a few friends, you can always offer to put your credit card down when the bill comes. Then, your friends can give you cash or use Venmo to pay you back for the cost of their meals. You’ll only pay for your meal as planned, but you’ll earn miles for the entire cost of the dinner.

If you’re chasing a minimum spend, or saving up for a big trip, you can also ask your friends or family if they wouldn’t mind you putting a few of their expenses on your card and reimbursing you.

Oftentimes your grandparents or parents pay large bills with old school checks. Sometimes they pay with a debit card! Think about all those unclaimed points they (or you) could be getting by using a credit card instead! If you trust your family and friends enough, ask them if you can pay their bills and get the rewards points.

Bonus for Friend Referrals:

This is one of my favorite ways to score points. It’s super easy. Many card issuers offer referral bonuses for getting your friends and family to sign up for new credit cards as well. This isn’t as hard as you think it is! Because your closest friends will probably wonder how you’re traveling for free so much anyway!! 😉 Letting them in on the secret and sharing the best cards directly with them via your referral link actually helps them travel in a similar manner too.

Many airlines offer the equivalent of about $200-250 worth of travel rewards for referrals. For example, right now the card_name will reward you with 20,000 points for referring a new friend to sign up. That’s worth $200 in travel credit right there!!Always check if your card has a great welcome offer, and be sure to share it with your friends and family members.

Step 6: Redeem your rewards for travel

Once you’ve got that sweet welcome offer locked in, and maybe even earned a few months worth of points for your everyday spending, it’s time to cash those babies in for your next big adventure.

If your credit card has its own travel portal, like Capital One Travel or Chase Ultimate Rewards, this will likely be your best bet for getting the most out of your points. These financial companies act like a travel agent – typically offering competitive rates for hotels and flights.

Sometimes, you can also use your points to reimburse yourself for travel expenses made outside of these travel portals. While you can typically find better deals through the credit card companies’ travel portals, this is especially helpful if you find a sweet deal elsewhere. Just be sure to call your credit card company and make sure those travel expenses will be eligible for reimbursement. It’s also worth noting that these credits can take 1-2 billing cycles to appear. So make sure you have the money in your account to cover it in the meantime.

Lastly, some cards will even allow you to redeem your points for cash back. In this case, you could also use cash back to spend on travel. We’re not huge fans of this method though, because redeeming points for cash often gives you the lowest payout ratio. These cards offer their highest value when you spend the points you’ve accrued on travel instead.

Step 7: Explore transferring your rewards to airline and hotel partners

If you aren’t finding the flights or hotels you’re looking for, some credit rewards programs allow you to transfer your points to other airline and hotel loyalty programs. If you want to book something more specific, or prefer a certain hotel or airline this can be a great option!

You might even be able to make your airline points more valuable by transferring them. For example, if you find a flight for 60,000 miles on your credit card’s travel portal, but it only costs 35,000 miles on the airline’s website, it might make sense to transfer those miles if there’s a one to one exchange rate.

Not all point systems are created equally! So it might make sense to research how to get the best value out of your points. For example, American Express points have a rough dollar value of 0.6 cents each when claiming as cash back or a statement credit. But if you transfer to one of their ~20 airline or hotel partners, each point can be worth up to 2.8 cents. That’s a huge difference in value!

Needless to say, play around with the rewards portal before spending your points. You could stretch them further by knowing how to claim them efficiently.

Step 8: Go on your awesome trip

Now comes the easy part. You’ve booked your flights and hotel using your rewards miles, and now you get to go on your awesome trip! Because you’ve effectively traveled for free, maybe you can splurge a little more on things like food or excursions. Kick your feet up and enjoy the fruits of your labor.

And while you’re at it, be sure to utilize some of the tips on this master list of ways to save money on travel.

You also don’t want to let those points languish for years on end. It’s not a matter of “use it or lose it”, but the value of those points is likely to degrade over time. You racked those points up, don’t be afraid to spend them!

Pro tip: Most of the top travel credit cards have some type of insurance included to protect you when traveling. Lost baggage insurance, trip insurance, or even reimbursement for flight delays! Check all the secondary benefits with your specific card to make sure you’re ready to make claims if something goes wrong.

Step 9: Rinse and Repeat

When you get home from your trip, start the cycle again. Browse the best welcome offers for other credit cards, earn the welcome offers, and travel more! Essentially, you can repeat this strategy to travel for free over and over again…

But just how often should you repeat this? A good rule of thumb is to watch out for the Chase 5/24 rule. Although unofficial, you are unlikely to be approved for a new Chase card if you open more than 5 credit cards over the course of 24 months. So before applying for new cards, make sure you’ve opened no more than 4 cards (from any issuer) in the past two years.

Remember that opening and closing credit cards can affect your credit score. Opening a new card requires a hard inquiry on your credit, which can drop it around 5 to 10 points. However, the negative impact on your credit only lasts one year (although the inquiry remains for 2).

Closing cards can impact your credit as well, because it decreases your available balance, hurting your all-important utilization rate. And if it’s one of your older cards with a huge amount of excellent payment history, it can really damage your credit score.

If you’re looking to take out a mortgage, it could be best to wait to open credit cards until after you’ve closed on that important loan. You don’t want to jeopardize a more important move in life that depends on stable credit.

Instead of closing some of your cards, you could also call your credit card company and ask to downgrade your card to one without an annual fee. That way, your utilization and average age of credit remain unchanged. And, you no longer have to pay that annual fee. Win, win!

Travel Reward Example with the numbers:

Now let’s run through an example of travel paid for with rewards, using real numbers and credit card offers…

Sam has always wanted to travel, but never felt he could swing it on his budget. Luckily, he learns about travel rewards from a friend and decides to give it a go

Sam starts earning his miles…

First, Sam applies for the card_name, which is offering a welcome offer of 60,000 points. In order to earn those welcome points, he needs to spend $4,000 in the first three months of owning that card.Sam adds the card to his digital wallet so that he can start using it right away. He uses it to buy all of his holiday gifts, groceries, and always offers to put his card down at the restaurant when he’s out with friends since he earns 3x points on dining.

At the three month mark, he’s met his minimum spend of $4,000, and gets his welcome offer of 60,000 points. He has also earned additional points because of the spending he’s done, and ends up with 65,000 points in total.

Then, Sam starts chasing a second welcome offer for the card_name, which is currently offering 75,000 miles. He uses it to pay for that car and home maintenance he’s been planning, and that gets him almost immediately to his minimum spend. Since the Venture Card promises 2x miles per dollar spent, he earns an additional 8,000 miles while meeting the minimum spend.Sam spends his miles…

In total, Sam has earned 65,000 Chase UR points, and 83,000 Capital One miles. With spring approaching, he’s burdened with major spring fever. Bitten by the travel bug, he decides to take a trip with his wife to Iceland. He opts to fly from New York City. Since Chase points are worth 1.25 cents each when redeemed through their travel portal, he can get up to $812.50 worth of free travel. He gets a sweet deal on flights for $438 each. Meaning that between he and his wife, they will pay only $63.50 out of pocket for their round trip tickets. Not bad!

Next, it’s time to book hotels. He logs into the Capital One travel portal where he has $830 worth of miles to spend. He books an awesome stay for 7 nights at the Hotel Viking near the city of Reykjavik for just $991. His total cost for his accommodations minus his miles comes to $161.

Sam and his wife are able to take an incredible 7 day international trip for just $224 out of pocket, before food and excursions. That’s more than some people spend for a weekend trip! While he could have traveled 100% for free by himself, Sam is happy that he spent a few extra dollars so he could take his wife along with him for the ride.

Wanna hear the crazy part???

While he’s waiting for his trip, Sam and his wife keep charging their everyday expenses to their card_name and card_name. By the time they leave for their trip, they’ve earned enough miles to reimburse themselves for the money they paid out of pocket for this trip.How much can you really earn?

You may think that you’re only able to rack up points if you live an extravagant lifestyle, or put hundreds of thousands of dollars on your credit cards each year. However, the truth is that even the average person can earn a meaningful amount of points towards travel each year.

Let’s say you open up a travel card, like the card_name. This let’s you accrue 2x miles per dollar spent on anything. Snagging that card and meeting the minimum spend means walking away with a 75,000 mile welcome offer.

Let’s say for a family of four, your annual expenses are about $25,000 each year, not including your rent or mortgage payments. If you earn two points per dollar on all of that money spent, you’re looking at 125,000 miles. All summed up, you can come out with about $1,150 dollars if you subtract that annual fee. And this is assuming you only earn one travel bonus in a year.

Other Reward Travel Strategies

Once you fall deeper down the reward program rabbit hole, you can start to employ different strategies to get the most out of your efforts. Here are just a few strategies you can use to achieve your massive travel goals.

If you know where you want to go…

If you’ve always dreamed of going to a specific destination, join the rewards program that gets you there the fastest. Just figure out where you’d like to stay and how you’d like to go and get there, then open up a credit card with a rewards program associated with those places.

For example, if you want to take a trip to Paris and would like to stay at the Courtyard Paris Gare de Lyon by Marriott, you could open up the card_name and snag a huge welcome offer. If you prefer to fly Delta, you could open up the card_name to cover that flight after you’ve earned the welcome offer for the Marriott card.Just remember that specific airline and hotel cards can often be less flexible than cards with their own travel portals. However, if you are loyal to a particular airline or chain of hotels, they can be a great choice for you. Advanced travel rewards geeks might opt to take the both/and approach!

If you don’t have a destination in mind…

If you don’t have a specific destination in mind, why not get a little adventurous and go where the deals are? Sticking with more a more flexible card, like the

card_name or card_name can be a good move for you.

Then, once you’ve qualified for that welcome offer and accumulated some points, you can keep an eye out for travel deals. You can do this both within their travel portals and beyond. For example, Capital One has frequent travel offers such as 20% off select hotel bookings in multiple cities in Mexico, like Tulum, Chetumal, and Bacalar, as well as 20% off select hotels in Aspen, Colorado. These offers change constantly, so be on the lookout for one that catches your eye!

Travel in “Bestie Mode…”

Another way to completely accelerate your points accumulation is to grab a spouse, family member, or your bestie and have them earn points also. This works especially well if you’re traveling with a family or your spouse. Having both of you earn those major welcome offers, effectively doubles your point-accruing ability in one fell swoop!

Also, remember you can “refer” friends and family to cards you have opened. Make sure they use your custom referral links when applying!

Utilize Business Cards

If you own a small business, or even just operate a side hustle, you might be eligible to open up a small business credit card to earn travel rewards. These cards are known for offering even bigger welcome offers.

Different cards have different rules about who qualifies as a business owner. So make sure to check with them before opening up a card. For example, to qualify for the card_name, you really just need to make some money outside of your 9-5. It could be from something as simple as selling some old belongings on eBay or doing a bit of freelance work on the side.

Bonus- Check out our articles on the 8 Best Credit Cards for Side Hustlers!

11 Tips for Success:

Using travel rewards can have a bit of a learning curve. When you’re a newbie, it can also be a little time consuming. However, there are tons of ways to make it easier. Here are a few tips on how to get the most out of your efforts.

Be Flexible

If you want to stretch your points or miles as much as possible, be flexible when booking your travel. Maybe you’ve always wanted to go to Tokyo, but there’s a sweet deal on flights to Seoul right now. Or maybe you wanted to take a vacation in July, but the flights are half price in March. Remaining flexible on location and travel dates means stretching out the value of those points you’ve accrued, using fewer points to book that trip!

A good idea to help you stay flexible is to create a list of all of the places you want to travel. Then, when one of those places has a good flight deal, you can jump on it!

Label Your Credit Cards

If you’re managing multiple travel cards, you can maximize the amount of points you earn by being strategic with which card you use for which purchases. For example, if you only earn one point per dollar with travel card A on groceries, but you can earn three points per dollar on travel card B, opt to use travel card B for groceries.

If you forget which cards offer certain amounts of bonus categories or point multiples, it can be helpful to label them. You can put sticky notes on each card labeled “groceries” or “restaurants” to remind you of which card to use in which situations. Alternatively, you could make a list of your credit cards and what to use them for in your notes app on your phone!

Don’t Forget About Your Subscriptions

When you’re chasing a welcome offer, every dollar counts towards meeting that minimum spend. Don’t forget to log into each of your subscription accounts, like Netflix or Hulu, and switch it over to the new card you just opened.

You can also log into your utility providers and switch your autopay to your new card if you have autopay set up. This is super important because missing out on that welcome offer is a huge setback in your game plan. So make sure to switch all recurring payments to your new travel credit card.

Make sure you have good credit

Before you start applying for the best travel credit cards, it’s important to have and maintain a healthy credit score. Your credit score is incredibly important. Having a good credit score ensures that you will qualify for the best rates when taking out a mortgage or purchasing a car. It can also mean you’ll have an easier time getting approved for an apartment.

Because having good credit comes with so many important financial benefits, make sure you also prioritize keeping a good credit score by paying off your cards in full and on time. Keep your utilization low, and refraining from closing your oldest credit accounts.

Travel during “Shoulder Season”

If you want to travel while the weather is still nice, prices are more affordable and there are fewer tourists, then take advantage of “shoulder season!”

Shoulder seasons are the months adjacent to peak travel season for your location. For many locations in the U.S. and Europe, peak travel season is during the heart of Summer. Meaning, “shoulder season” includes March and April, as well as September and October. The weather is usually still pleasant in these months, and you can snag those flights and hotels at a greatly discounted price.

Choose cheaper locations to stretch your points

So this tip is totally optional… But if you want to get the most free travel out of your points, consider booking trips to cheaper places. Sure, you could use your miles to take a 24 hour flight to Australia and cover some of your trip. Or, you could take a few domestic trips and travel a few times each year. However, you can decide what makes more sense for you based on your availability and travel goals.

ALWAYS pay your card off in full

So I know we’ve mentioned this previously, but it bears repeating. Always pay off your travel cards on time and in full each month! If you overspend, or pay interest on your purchases, you will not come out on top.

If you’re worried about forgetting to make payments, try automating this area of your finances. Set up autopay for each of your cards so you’ll never miss a payment.

Reimburse Yourself for Travel

If your credit card’s travel portal doesn’t have the flight or hotel room you were hoping to snag, you may not be out of luck!

Certain cards, like the card_name, allow you to reimburse yourself for travel expenses. So, if you’d like to purchase a flight or hotel stay from another website, you can often do so. Once that purchase hits your statement, you can reimburse yourself with a statement credit. This can all be done inside the Capital One app when you redeem points.However, in order to do this, the purchase needs “to code” as travel within their internal system. Sometimes, certain expenses, like theme park tickets, may code as entertainment instead. Be sure to check with your card issuer to ensure this is something your card offers, and that your intended purchase will be covered.

Get the Southwest Companion Pass

What if you could bring a friend with you each time you fly, effectively cutting all of your flight costs in half for two people? If you live in a location with Southwest flights, you can take advantage of their Southwest Companion Pass!

Here’s how it works: When you sign up for one of the Southwest cards and accumulate 135,000 points, you’ll become eligible for a companion pass. This allows you to bring any friend or family member with you on as many flights as you’d like during the duration of the pass. All you’ll need to pay is the fees and taxes associated with that flight!

Better yet, the companion pass is good through the end of the following year. That means if you earn it early in the year, it can be good for nearly two years!

While it can take a while to accumulate 135,000 points, Joel has covered the fastest way to earn the Southwest Companion Pass in this post. Spoiler alert- it involves opening up a personal card and a business card…

Keep an eye out for flight deals

If you want to use your credit cards to travel for free, it can be a good idea to look out for major flight deals. Remember when we talked about being flexible? And when we said that some rewards cards let you reimburse yourself for travel? Well here’s where that can come into play in a major way.

Signing up for newsletters that share the latest flight deals can be a great way to snag flights to an awesome destination at a better price. Going, formerly known as Scott’s Cheap Flights, sends out flight alerts whenever major deals drop. This can save you hundreds of dollars per airline ticket.

You can also use Google Flights to track a particular flight you are hoping to take. You can set this up by searching your desired flight, then toggling the button that says “track prices.” The website will then prompt you to set up a price alert.

By coming up with a list of places you want to travel to when a good enough deal strikes, you’ll be ready to pull the trigger when those discounts go live.

Don’t forget about other perks!

Lastly, many travel credit cards come with some amazing secondary benefits outside of those welcome offers. This can accumulate to hundreds of dollars worth of travel if you utilize them.

First, most good travel cards have no foreign transaction fees, saving you tons of money when traveling abroad. Some, like the card_name offer you free access to airport lounges and will give you a $100 credit for Global Entry or TSA PreCheck. Others, like the card_name, offer a $120 credit for dining out. Meanwhile, the card_name offers its card holders a $50 annual hotel credit, as well as travel protection benefits like auto rental collision protection when you use your Chase card to pay.

Make sure to take advantage of the credit card benefits you might be overlooking to get the greatest value out of that card!

Travel Rewards FAQ:

Using credit card reward programs can be a little confusing when you’re just starting out, but it gets easier. Once you dive into it, you’ll likely find joy in untangling the answers to your questions and figuring out different ways to get the most value out of your rewards. Here are a few common questions most first timers have when they start learning how to travel for free.

Is signing up for credit cards just for the points illegal?

Nope! Remember that credit card issuers want you to use their cards for spending. And they reward you by giving you the points. Just remember that if you have an annual fee, you’ll want to use that card at least enough to earn the points equivalent to cover that annual fee.

What is the Chase 5/24 Rule?

The Chase 5/24 rule refers to the fact that you are unlikely to get approved for any new Chase credit card if you have opened 5 credit cards or more within the last 24 months. So make sure you’ve only opened a maximum of 4 credit cards within the last few years to avoid being denied.

Although it’s an unofficial “Chase” rule, it’s best to assume this practice for ALL credit card issuers. Don’t worry, getting one new card every ~5 months gives you plenty of travel options anyway!

What are the best welcome offers right now?

Welcome offers are constantly changing, so the cards with the best welcome offers today may not be the same tomorrow! That’s why we created a credit card tool on our website that allows you to easily compare the best credit card welcome offers in real time!

Do you pay taxes on credit card points?

My personal favorite thing about credit card welcome offers is that Uncle Sam cannot lay a finger on them. Woohoo! You do not have to pay taxes on your credit card points. In fact, sometimes it feels like they are the only things you don’t need to pay taxes on these days. Amiright???

Does opening a new credit card hurt my credit score?

Because your credit score is impacted by so many different factors, the answer here is a bit nuanced. Yes, your credit score is likely to dip by a few points after opening up the new card. This is because it requires a hard enquiry on your credit report. This remains on your credit report for 2 years, but only negatively impacts your score for a year.

On the other hand, opening a credit card could help your credit in the long run. By increasing your available credit, it can help to decrease your credit utilization. As long as you keep your spending the same.

How many points do I need for a free flight?

Each reward program is built differently, and points have various values. It also depends on where you’d like to fly to, and how expensive that flight is. For example, a flight from Los Angeles to Denver costs about $178 round trip. Meaning, if you snag one welcome offer, you could fly yourself, and maybe even 1-2 guests completely for free.

However, if you’re looking to fly from New York to Honolulu, that 11+ hour flight will cost you over 3x that, weighing in at around $600. In that case, you might need to do a lot of spending on a credit card to accrue enough points.

The Bottom Line:

Traveling using reward points makes it easier to work new and exciting experiences into your budget, even if you don’t have a boatload of disposable income. It allows everyday people like you and I to see the world cheaply, and it rewards us for making purchases we were already planning on making.

But, it’s extremely important to play by the rules and never spend money you wouldn’t usually spend anyway. Free travel isn’t really free if you have to pay for it in other ways!

Even though it can take some time to get the hang of, using credit card rewards to travel can be a worthwhile experience for many folks. We encourage you to give us a try so you can start reaping the rewards you deserve.

Related Posts:

- Free Family Travel w/ Lyn Mettler- Episode 703

- Best Travel Rewards Credit Cards for Beginners

- 12 Ways to Lower your Car Costs

*Advertiser Disclosure: How to Money has partnered with CardRatings for our coverage of credit card products. How to Money and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. Lastly, the site does not include all card companies or all available card offers.

*Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

*User Generated Content Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.