If you keep up with the news, chances are you’ve heard the murmurs of a looming recession. But before you run out of your house in your slippers and start screaming about the “end of days,” allow me to reassure you…

Just because intelligent folks are predicting a recession doesn’t mean there is going to be one.

There’s a funny saying that economists have successfully predicted 9 of the last 5 recessions. But individual forecasts are a dime a dozen. And even if we do enter a recession, the truth is that there are plenty of steps you can take to minimize its effect on your life.

What even is a recession?

A recession is when the economy hits a rough spot and stops growing. This is typically accompanied by a drop in consumer spending, lower economic output, a higher unemployment rate, and retracting investments.

However, for it to officially be a recession, this must happen for two consecutive quarters, or six months.

So are we in a recession?

According to the general definition, we are not currently in a recession. For quarter three of 2022, the Bureau of Economic Analysis reported that the U.S.’s GDP increased by 2.6%.

In the summer of 2022, there was a semantic debate over whether or not the U.S. had entered a recession. Although we reported two consecutive quarters of negative GDP growth, we also saw increased corporate earnings and a strong labor market with approximately two jobs for every one person searching.

This is why it’s so important to take the news with a grain of salt and focus on the things in life that you have control over. Economists and finance gurus have been predicting an economic crash for years, but the truth is that recessions are just a part of our economic cycle. They historically occur every 5.9 years, on average.

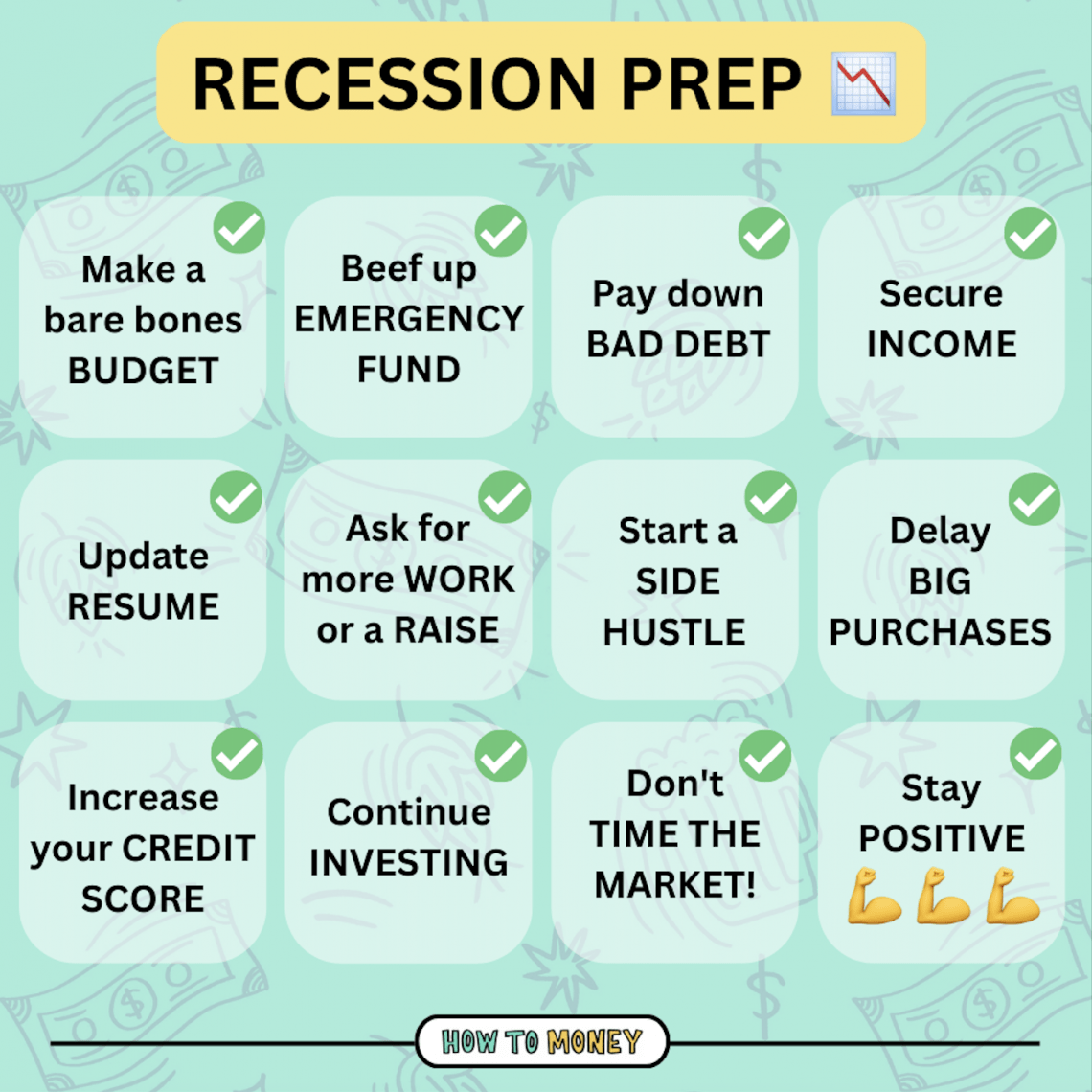

Below are some tips on how to “recession proof” your finances! Even if a recession somehow never hits, these steps will still improve your overall financial position. No time wasted here!

Ways to Prepare for a Recession:

- Create a bare bones budget

- Build a strong emergency fund

- Attack high interest rate debt

- Secure your income

- Make hay while the sun shines

- Ready your resume

- Start a side hustle

- Hold off on big purchases

- Work on boosting your credit score

- Continue Investing

- Don’t try to time the market

- Mentally Prepare

1. Create a “Bare Bones” Budget

One of the best ways to prepare for a recession is to create a “bare bones” budget. This is a budget which only includes the essentials, like housing costs, food costs, and utilities. Let’s be honest, a Netflix subscription might be nice, but it’s not a necessity.

You don’t have to use it right away (and may not ever have to!) but it is a good exercise to find out what your baseline expenses are.

Creating a budget that only includes what you need to get by lets you know what you’re capable of, and can provide peace of mind knowing you can switch into “eco” mode at a moment’s notice!

Even in the absence of a recession, creating a bare bones budget can help you develop more financial flexibility! For example, if you were considering switching career paths to a lower paying industry, having a bare bones budget would allow you to know exactly how much money you need to get by.

If you’ve avoided budgets like the plague until this point, here are 4 easy approaches to budgeting you might like to test out, including how to budget on a variable income.

2. Build A Strong Emergency Fund.

Another important way to prepare for a recession is to build a strong emergency fund. Emergency funds are a great way to make sure you don’t have to incur high-interest debt in the case of an emergency.

According to a CNBC poll, only 44% of Americans can cover a $1,000 emergency expense using savings. That means that many Americans would have to resort to using credit cards or borrowing from friends or family to get through a tough time. It’s crucial to sock away some money for those potential (and inevitable) rainy days!

We want you to achieve an emergency fund of somewhere between three to six months of living expenses, but even a basic emergency fund of $2,467 can help you get through most emergencies. It’s amazing how much relief building up your savings can provide.

If you’re finding that talk of recession is causing you to bite your nails, it may be worth considering backing off of your investing regimen temporarily as you work to pad that emergency fund. Check out this 7 money gears guide to help put your financial priorities in order.

Read further: Everything you need to know about emergency funds

3. Attack High Interest Rate Debt

If a recession strikes and you lose your job, the last thing you want to be worrying about is paying off credit card debt. Unfortunately, many Americans are going into debt to pay for higher costs due to inflation.

If you have debt with a variable interest rate, it’s important to do your best to pare it down now before a recession strikes. Consider trying the debt snowball repayment method if you want to see some quick wins, or the debt avalanche method if you’re a numbers nerd!

Rising interest rates have lead to the credit card companies raising the rates they charge their customers. There’s no time like the present to make a plan to crush your debt!

4. Make Yourself Invaluable At Work

If you’re worried about losing your job in the case of a recession, now’s the time to focus on your career and make yourself indispensable at work!

When you take on more responsibility, you establish yourself as a leader in your office. If you’re seen as providing more value, and the company is forced to lay people off, you’ll be one of the last on that chopping block. In situations where the office would fall apart in your absence, you’re definitely less likely to get the boot when economic times get tough.

If you want to know where you stand at work, it can be helpful to schedule a chat with your boss to make sure that you’re living up to expectations. Ask if there are any additional responsibilities you can take on – or better yet – don’t ask, just start doing it!

5. Make Hay While The Sun Shines

Come to think of it, a chat with your boss could be the perfect place to consider asking for a raise. I know a lot of people wish that salary increases were uniform across the board, but the truth is that you need to advocate for yourself in the workplace!

Come prepared with some examples of recent achievements and be ready to discuss the value you bring to the team. Be reasonable with your ask, and do some research on the average compensation for your role and experience before bringing this conversation to your boss!

Food for thought; check out this podcast episode, The Unspoken Rules of Career Success. This will give you some ideas of how to provide more value at work, and get compensated accordingly.

6. Ready Your Resume

If your resume is collecting digital dust on your desktop, it may be time to update it to make sure it includes your most recent accomplishments and up-to-date skillset. That way, if you’re affected by job cuts, you’ll be ready to hit the ground running!

Another financial housekeeping item that can pay massive dividends if a recession occurs is to keep in touch with your network. Reach out to a few of your industry connections and set up a coffee date! Even if you aren’t looking for a new job, it’s important to invest in those connections as you would with any other relationship.

No one likes to feel like people only reach out when they need something. So it’s important to network regularly with folks in your industry throughout the year.

7. Start A Side Hustle

Another great way to feel more financially secure is to diversify your income. Are you a great photographer? A dog walking pro? Have an extra room in your house? Starting a side hustle could help to protect you from total loss of income should you lose your job.

When choosing your side hustle, try to pick something that you could convert to a full time business if you needed to. Remember that not all side hustles are created equal. While it’s easy to download an app and drive for Uber or Lyft, that isn’t scalable. It also comes with some downsides like increased car maintenance costs.

Want to start a side hustle, but aren’t sure what direction you want to go in? Check out our episode on creating a dope side hustle. Even for those not trying to prepare for a recession, side hustles are always good to pursue! Also check out these side hustle ideas to start with your partner.

Pro tip: Be sure to check out the best credit cards for side hustles. Using a separate card for business expenses makes accounting and taxes simpler, as well as earns you sweet rewards points!

8. Hold off on Big Purchases

Planning a two month vacation to an all inclusive resort in the Greek Islands? If you’re worried about how you might be impacted by a recession, you may want to think twice.

Now, I’m not saying that you can’t go on a trip or make any big purchases. However, it’s important to carefully plan for these cash outlays. Make sure to consider any recurring expenses or secondary costs before committing to an expensive buy.

You could also think about cheaper alternatives instead of delaying plans completely. Instead of blowing $10k on a lavish trip, explore ways to travel cheaply. Scaling down purchases is a great way to prepare for a recession.

9. Work On Boosting Your Credit Score

During recessions, lending standards tend to get more stringent. If getting a mortgage or a business loan is something that may be on the horizon for you, make sure that your credit score is looking healthy!

Here are a few immediate things you could do to boost your credit score:

- Ask for a credit limit increase. This lowers your overall utilization which has a high impact on your credit score.

- Become an authorized user on someone else’s account. This let’s you “credit piggyback” on someone else’s good history.

- Add a new credit card to your mix. This might temporarily lower your score due to a new hard inquiry, but it should raise it quickly afterwards with good utilization.

Whatever you do, keep making payments on time and continue eradicating consumer debts.

10. Continue Investing:

A lot of people ask how they should change up their investing strategy to prepare for a recession. Our answer for most folks? Don’t do it.

Dollar cost averaging and investing in index funds is still the best way to go when it comes to benefiting from a recession. If you aren’t looking to touch your investments for 10+ years, just stay the course and automate your finances. In general, the market tends to go up more than it goes down, so try not to worry about temporary bumps along the way.

If you’re going to be tapping into that money sooner, it may be a good idea for you to consider your asset allocation. This Vanguard quiz can help you better understand your personal risk tolerance. Balancing your portfolio with bonds and cash can help prevent big swings in your retirement accounts!

Related:

11. Don’t Try To Time The Market.

Although it can be tempting to try and wait for a big dip in the market to start investing, it’s important to remember that timing is a fools errand. When we try to time the market, we’re more likely to miss out on big investment gains while we’re sitting on the sidelines.

For example, a study by Merril Lynch shows that over a period of thirty years, model portfolios could underperform by almost half of their value by attempting to time the market. It’s one of the most common reasons people lose money in the stock market.

As scary as it can be to watch your funds drop, it’s important to keep investing during a recession. You don’t want to miss out on the upswing (which can happen quickly) when the market recovers!

12. Mentally Prepare.

Possibly the most important thing you can do to prepare for a recession is to adjust your mindset and think positively. If turning on the news causes you to sprint to your computer and panic sell, you may want to consider taking a news break.

Don’t check your investment portfolio multiple times a day like you’re waiting for your crush to text you back. Don’t even check it once a day or once a month. Try only looking at your portfolio once a year, or at most, every six months. And if you’re having a hard time controlling yourself, consider giving your password to your spouse, or a family member you know you can trust.

Also remember, you are not alone! Our Facebook community is a great place where money nerds all support each other through good and bad times. Surrounding yourself with seasoned financial brainiacs can be just the positive influence you need when the economy is tough.

It’s easy to think that you’ll be able to stay the course when the economy is running on all cylinders. But make sure you’re mentally prepared to stick it out when rainy days strike! Taking action and selling stocks during a recession can do great harm to your future. So have a plan for what you’ll do when tough times inevitably come along.

The Bottom Line:

No one can predict the future. That doesn’t stop the financial news media from trying.

But even if we don’t encounter a recession anytime soon, taking these steps can still put you in a better overall financial position.

It’s also important to recognize that, independent of the economy, you may experience a personal recession in the form of a job loss, medical issues, or unexpected expenses. It’s important to be prepared for individual financial setbacks too.

Whether the economy hits an all time high or low this year, if you prepare for a recession in advance you’ll feel much more at ease and ready to weather any storm!