It can be tough to figure out how much of your paycheck you need to invest. Not only does your income need to cover today’s (crazy, fast-rising) living expenses, but you also need to somehow sock money away for future unknown costs. Retirement. Buying a house. Money for family and kids…

Adulting is HARD! 😭

But don’t worry. People far less smart than you and I have figured it out. They’ve lived long, happy, and wealthy lives, by slowly setting aside a portion of every paycheck they make. They’ve built fortunes for the future, while still enjoying the present. You and I can too!

In today’s post, we’ll mix some old-school wisdom with new-age considerations to help you figure out your perfect balance of how much of your paycheck you should spend, save, or invest.

Conventional Advice: Save 10-20%

Cutting right to the chase, most old-school money experts recommend setting aside 10% to 20% of each paycheck to save for future financial goals.

At first glance, do you think this saving target is enough?

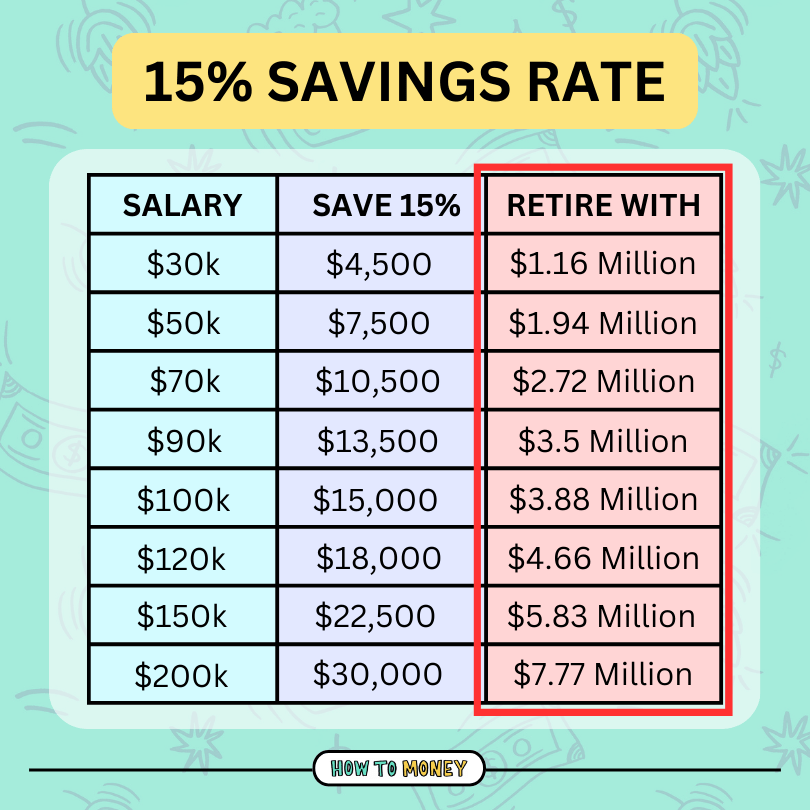

Let’s do some calculations. Below is a table of annual salary scenarios, using the middle ground of 15% as a savings rate. We’ve assumed a 40-year savings horizon and an 8% investment growth rate…

Holy moly! 😳

As you can see, even folks with very modest incomes can become millionaires quite easily. They just need to stay disciplined and continue to save and invest ~15% of each paycheck they earn.

Playing Catch Up

If you’re reading this in your 30s or 40s (or older) you might be thinking, “that’s great, but I don’t have 40 years of work ahead of me. What do I do if I’m behind on savings!?”

If you’re late to the savings or investing game, don’t worry. It’s entirely possible to change your financial trajectory, but it will require rolling up your sleeves and putting in some work.

The thing you need to do is to increase your savings rate.

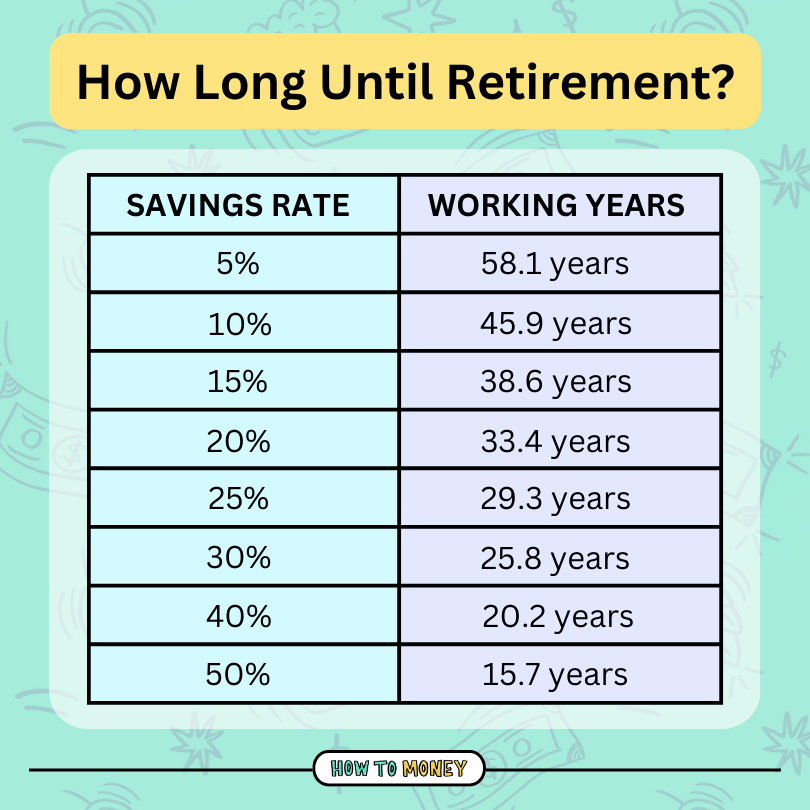

Saving more of your paycheck will reduce the years it takes to build up a nest egg big enough to retire. Here’s a rough guide of how many working years you might need at various savings rates…

If you’ve only got 20 years until retirement, and have $0 currently saved, you’ll need to sock away 40% of your income going forward to reach the same level of financial freedom.

Does that sound crazy? Yes.

Is it impossible? No.

Upping your savings rate in a significant way will require legitimate sacrifices. But, I promise it’s all worth it to ensure you meet your long-term wealth-building goals.

Earning More & Spending Less

Aside from winning the lottery (which is highly unlikely), there are really only two ways to increase your savings rate. These are to a) spend less money, or b) earn more income. (Or, if you want to supercharge your savings, do BOTH!)

The goal is to widen the gap between your income and expenses, which will allow you to save and invest more from each paycheck.

Earning more income:

It’s never been easier to pick up a side gig, earn money online, or fix/sell things for extra cash. Most gig economy jobs you can do on your own schedule, working when and how you want. And the best part – most jobs you can start immediately with no experience!

Part-time jobs likely won’t pay a bundle, but, even just working one single night per week might bring in an extra $400 a month ($5k a year). That’s not insignificant at all!

That being said, working extra hours for quick cash isn’t a great long-term solution. The ideal path to longer-term income growth is to continue to hone your skills in an attempt to make more progress at your regular job.

Asking for a raise can be intimidating, but it’s a very effective way to advocate for yourself in the workplace. It’s important to keep your income growing as you gain more skills and experience. Switching jobs every so often is another great way to up your pay band. Never stop trying to earn more in your career!

Cutting expenses:

Paring back your spending has a double-whammy effect. Not only does it allow you to save more money, but it lowers your cost of living so your overall nest egg doesn’t need to be as big in retirement!

The biggest savings come from the largest spending areas. Budget line items like housing, cars, food, and utilities should be scoured for savings. Here are some ideas to help you cut back:

- Housing: Try and negotiate your rent! Or, move to a cheaper place for a while to save money. Another idea is to rent out a room or house hack to lower your living costs.

- Car costs: Could you live car-free for a while!? Cars are money pits, costing the average American $12k annually. Anything you can do to reduce auto costs is a big win.

- Food costs: Try a no-eating-out challenge! Learning to cook at home will slash your spending amount on food.

- Cheaper utilities: Anything you can do to save money on gas, electricity, and water is a win. Americans have formed bad habits of wasting energy and resources. Change that!

All in all, any money you can save on expenses can be redirected towards investing!

50/30/20 Budgeting

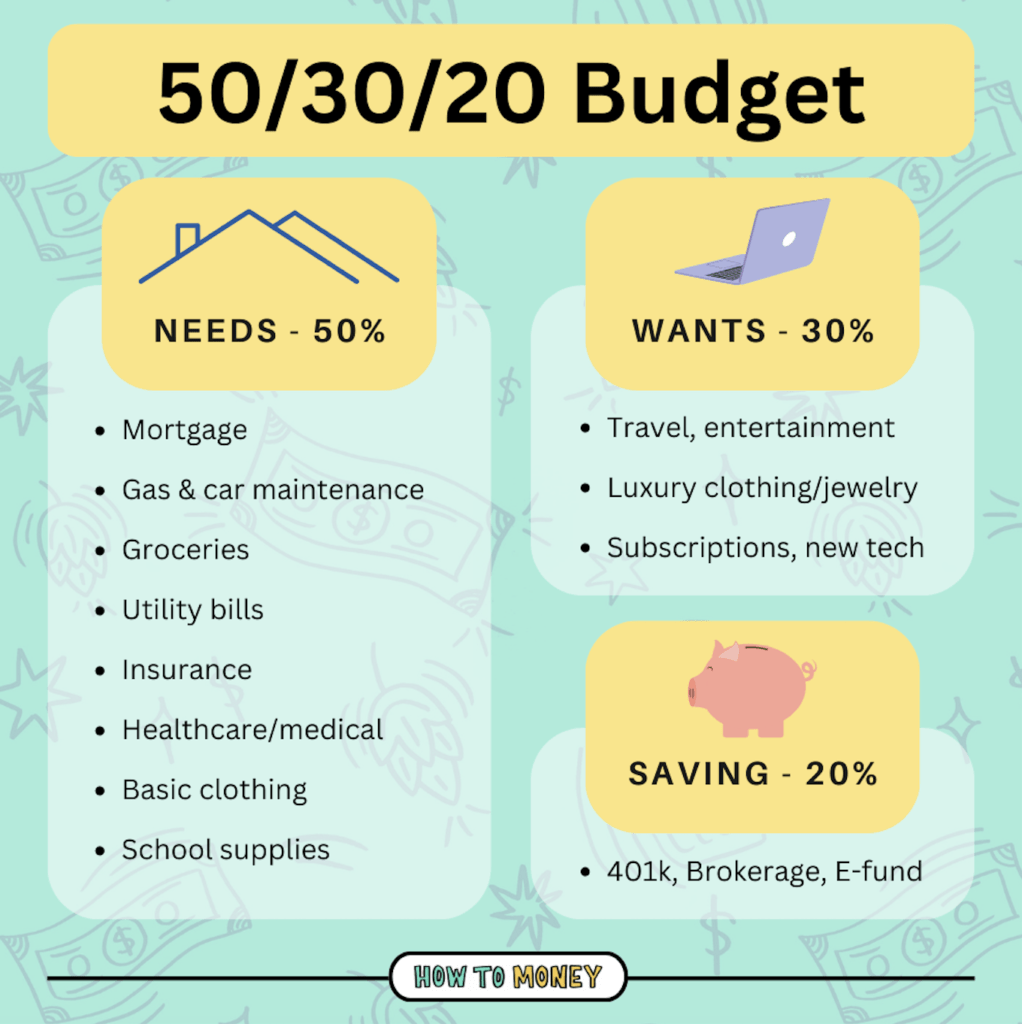

If you’re new to managing money properly, consider starting with a simple 50/30/20 budgeting system. Once you get into a rhythm, you can make tweaks from there.

The 50/30/20 system works like this:

- 50% Needs: Half of your paycheck should be used to buy “needs”. These are life’s necessities, like housing, food, clothing, transport to work, etc.

- 30% Wants: The next 30% of your paycheck can be used for “wants”. This spending is totally discretionary, for all the nice-to-haves in life. Travel, eating out, small splurges.

- 20% Savings: The final 20% of your paycheck can be invested or saved for financial goals. Actually, this is the most important part, so you might consider paying yourself first if you can!

Investing 20% of your paycheck puts you on a very healthy financial trajectory. If you continue to live like this for 30+ years, you’ll retire with millions, and eventually achieve financial freedom.

That being said, saving 20% is just a suggestion. The real amount of your paycheck that you should save/invest is dependent on your overall money goals. We’ll discuss that below!

Saving vs. investing

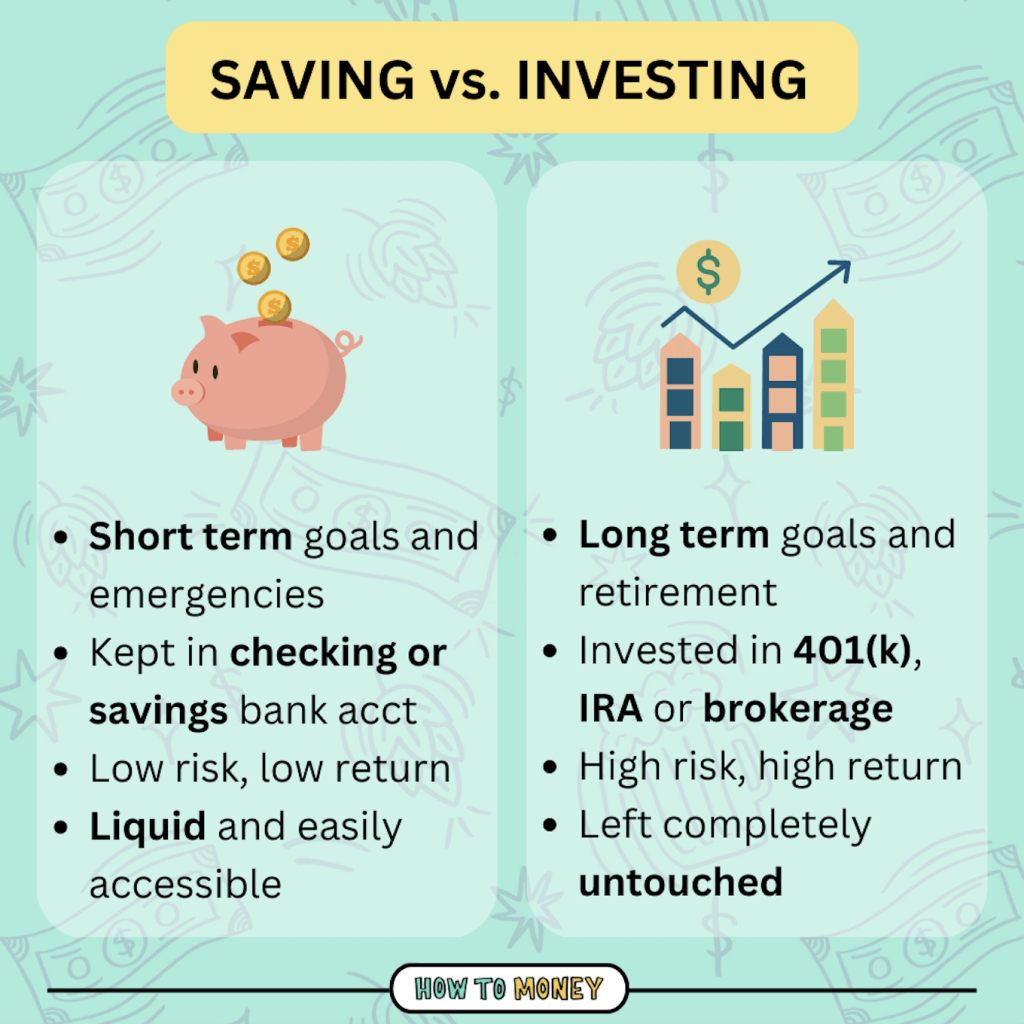

People sometimes use the words saving and investing interchangeably. But there’s a really important difference between saving money and investing money.

Saving money is usually just putting cash into a checking or savings account at a bank. The money doesn’t grow in the same way it does when you invest it. While savings rates have gone up, over time your money works harder when you invest it in the market!

Investing money works differently. When you purchase investments (like stocks, bonds, real estate, index funds) you’re parking money in assets that grow in value over time. The longer you wait and the more time you give those assets to grow, the bigger they become (and the more wealth you accrue!)

Both saving and investing have their place. Typically you save money for short-term financial goals, and invest money for long-term goals.

Short-term financial goals:

Think of short-term savings goals as things you want to pay for or buy in the next 5 years. (Vacations, moving out of your parent’s house, buying a new car, etc.)

You’ll want this money easily accessible, and stored in a safe place. That way when it comes time to spend the money (or if you need to quickly jump on a good deal) then it’s ready for you to grab quickly.

For example, let’s say you want to buy a new car in the next few years and need to save up $10,000. You set a savings goal of $400 per month, and transfer that money to a High Yield Savings Account for safekeeping.

A year goes by and suddenly a deal pops up. Your bet buddy’s dad is selling their old family car and is giving you a sweet discount. It’ll only cost you $5,000! Since you’ve been saving $400 a month in your savings account for a year, you have exactly enough to pounce on that deal and buy the car.

Meeting your short-term savings goals means having cash saved that is readily available.

Long-term financial goals

For any money goals longer than ~5 years away, investing is a necessity. (retirement savings, large house down payments, buying rental properties).

Remember, investing comes with higher risk. Your investment portfolio can go up and down from year to year – real estate, stock market, etc – but over the long haul appreciating assets trend upwards. That’s why it’s crucial to only invest money you don’t need to spend any time soon.

The longer your time horizon, the more investing will help you.

If you’re new to investing, check out our beginner’s guide to index funds. They are the simplest way to grow wealth. No need to overcomplicate things!

Best ways to invest your paycheck:

OK, hopefully by now you’ve figured out how much of your paycheck you should invest, as well as some ways to create margin in your budget to do so.

Now let’s talk about the simplest ways to sock money away, and set up systems to automate the process.

Always snag your 401k match

The biggest no-brainer investment for most people is investing in their company’s 401k plan. Many employers also offer a “match”, meaning if you put money in, they will too!

401k matching is like FREE money. If you’re unsure if you have access to a match or don’t know how big the match is, check and see what your company offers. You might need to make an appointment with someone in the HR department. Then, make sure you don’t leave any of those match dollars on the table!

One of the coolest things about a 401k is that money is automatically deducted from your paycheck (pre-tax!) before any funds hit your checking account. This means you are forced to prioritize savings, and the money grows “out of sight, out of mind”.

Max out your Roth IRA

If you don’t have a Roth IRA currently, open one up ASAP! They are one of the best retirement accounts, saving you a boatload in taxes later in life!

Any money you put into a Roth IRA grows tax-free for as long as the funds are in the account. You can withdraw your original contribution dollars at any time, but you can’t touch the growth or gains without a penalty before age 59 ½.

It’s entirely possible to grow a Roth IRA account to over $1M. After snagging any 401k matching opportunity from your workplace, a Roth IRA should be your next investing priority.

Health Savings Account

Another investment account you should pay close attention to is the Health Savings Account. HSAs can be a great tool to help you avoid tax on healthcare expenses and to invest for your future. There’s no other investment account that comes with a triple tax advantage!

HSAs aren’t available to everyone – you need to have a high-deductible health plan to qualify. While the contribution limits are lower than other types of retirement accounts, the tax advantages are so powerful it’s always worth maxing out if you can.

Other Saving Priorities

Investments aside, there might be other priorities you need to save for first.

Emergency funds are crucial. They protect you from going into debt or borrowing money if/when a disaster happens. As a general rule, a fully stocked emergency fund should be equal to 3-6 months worth of living expenses.

Paying off high-interest debt should be another priority. If you have any credit card debt, variable loans, or a high-interest car loan, throw any spare money towards paying off those debt balances. Having high-interest debt is the kryptonite to wealth building. It handicaps any progress you think you’re making.

The 7 Money Gears is a system we developed years ago. It helps people figure out what saving/investing stage they are at, and what they should do with their money next. Check it out here!

How much of your paycheck should you invest?

Going back to our original question, as you can see there are many factors to consider. While you can follow a generic rule of thumb and save 15-20% of each paycheck, it might make sense to increase or decrease this amount to make sure you’re meeting your current financial goals.

Here are some questions you might want to ponder:

- What are your short-term and long-term money goals?

- How long do you want to remain working?

- What will your life look like in retirement?

- Do you need to earn more income to save at a higher rate?

- Are there any monthly expenses you can cut back on?

- How much of your paycheck should go towards saving vs investing?

Thinking through these will help you develop a better answer of how much of your paycheck you should invest.

And if all else fails, the answer can be: Invest as much as possible! Better safe than sorry. It’s better to have too much socked away than to not have enough money down the road.

The Bottom Line:

Investing part of each paycheck can help you build massive wealth over long periods of time. If you’re young and just starting your career, investing 15% of your salary will make you a millionaire in your working lifetime. If you’re late to the savings/investing game, you’ll need a higher savings rate to play catch up.

Remember, starting small and investing consistently can make a huge difference over time. And using tax-advantaged retirement accounts will help your nest egg grow faster, and more efficiently. It’s never too late to start cutting back expenses, earning more money, and investing for the future. You just gotta DO IT.

Related posts: