Good morning, money nerds.

Ok, the holidays are over. The fun is finished. Time to get back to our boring work and regular life… 😩

Wait, what!? Just because the holidays are done, that doesn’t mean the fun has to stop! In fact, the way we see it, the celebrations are JUST BEGINNING! Why? —> Because happiness and excitement exists everywhere, every day, in regular life. (You just gotta find it)

Something to keep in mind as you head back to the grind. “Business as usual” still includes regular celebrations.

OK, onto the money stuff! 👇👇👇

TO DO

Take A Defensive Driving Course 🏎️

Here’s a money saving (and kind of fun!) idea to consider this year: Take a defensive driving course!

It’ll often save you big bucks on insurance over multiple years. Check with your insurer for details before proceeding, but if you can get a reduced premium it might be well worth it! You can even take driving courses online at a site like AARP (no minimum age to join).

A cool $25 and 45 minutes could save you hundreds of dollars on your car insurance. Plus, you’ll be more confident behind the wheel- win/win! 🤜 🤛

2023 RESOLUTIONS

Goal Setting 101…

You’ve probably seen this video of Brian Tracy’s famous goal setting speech floating around on social media lately.

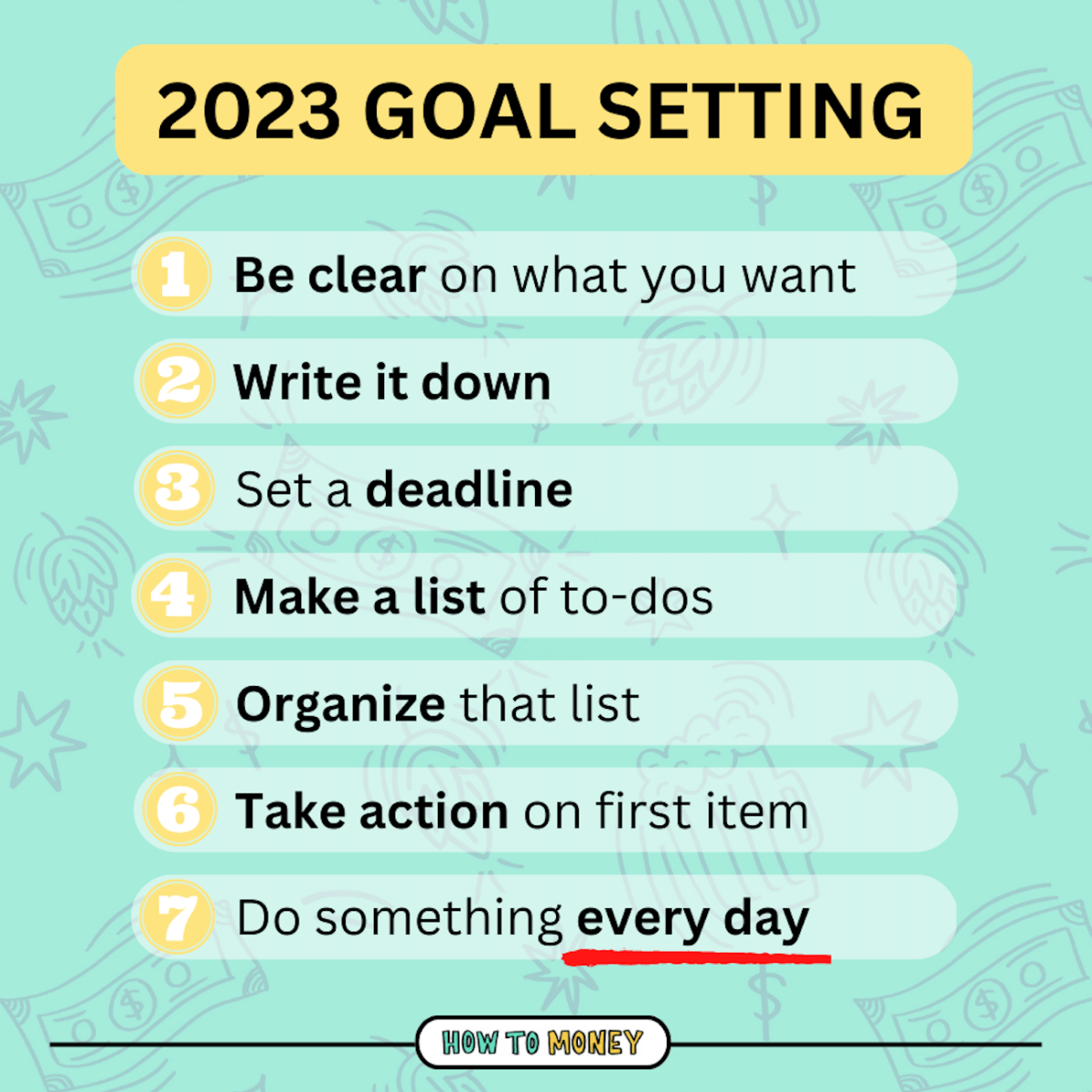

It’s a simple yet proven method to setting (and achieving!) goals. Here’s a short list of the steps 👇👇👇

Not sure what goals to set? Here’s a few things that might help:

- Money Mission Statement: This guide helps you to hone in on what’s important and to discover the changes that you need to make.

- 🎬 Goal Setting Workshop: (10 min video, Jim Rohn) Another classic exercise to help you solidify, write down, and organize your goals.

- 🪩 2022 Personal Annual Report: From Brain Food Blog – 7 questions to help reflect on the past year and plan for a killer new year.

- 📝 Annual Finance Checklist: Pick one of these and get started early!

- 🎙️ Money Challenges: Episode 458 we cover the no-spend challenge, sell your stuff challenge, and a couple other savings goals to try.

TOGETHER WITH POLICYGENIUS

Did you know…? Insurance rates are regulated by law… This means that an insurance company (or agent or broker) can’t give you a sweetheart rate or discount just because they like you… They must play fair when setting rates.

BUT… Each insurance company uses a different method of calculating risk, which is what sets the rate premium and why some policy rates are cheaper than others.

That’s why independent brokers like Policygenius are awesome. You just enter your info once, and they shop around with all the insurance companies and find the most affordable policy to suit your situation. Check them out for home, life, or renters insurance. A quick search might save you big bucks this year!

SAVING

Changes to 401k, IRA, & 529 Plans

Stuffed inside the 4,155 page Federal Spending Bill that was recently signed into law, there are a number of changes to retirement accounts. Here are some of the major ones worth noting. 👇👇👇

- Delayed RMDs: Starting this year, required minimum distributions will start at age 73, instead of 72. (The age will keep increasing over time, reaching age 75 in year 2033).

- No Roth 401k RMD: Starting in 2024, the RMD requirement for Roth 401k accounts will be removed completely. (Roth *IRAs* already have no required withdrawals)

- “Super catch-ups”: Starting in 2025, catch-up contributions to retirement accounts will increase for people aged 60-63 only. The amount will be 50% higher than the standard catch-up (eg. $11,250 instead of the current $7,500 max.)

- Auto Enrollment: Starting in 2025, companies with over 10 employees that offer retirement plans will automatically enroll new hires and nudge them to save more. Basically this means you’ll have to actively choose to not invest (which is less likely to occur due to status quo bias).

- “Lost and Found” 401k accounts: The Department of Labor will be creating an official “lost and found” for people that forget and lose track of old retirement accounts. (similar to the missing money database, but for retirement accounts)

- Rollover 529 Plan –> Roth IRA: Starting in 2024, unused 529 plan funds can roll over to beneficiary Roth IRAs which makes 529 accounts way more appealing. Some caveats: there’s a $35,000 lifetime limit, available only for accounts open for 15 years or more, and would be subject to annual Roth contribution limits.

There are a handful of other law changes and rule adjustments, and we’ll continue to cover everything on upcoming episodes. As with any big law changes, it takes a minute to decipher them (and figure out ways to take full advantage!)

More details:

- 💻 Humble Dollar: 11 Retirement Changes

- 📝 Senate Finance Committee: A comprehensive summary straight from the horse’s mouth

ICYMI

Newsy News News…

Don’t File Too Early ⚖️

All you early tax filers… The IRS says you might want to hold off until late February or early March to submit your tax return. Surprise 1099s might come later than expected and missing those forms might mean having to re-file.

2023 Money Dates 📆

Here are some deadlines in 2023 for healthcare open enrollment, tax filings, FAFSA applications, medicare enrollment, etc. Stick ’em on your calendar!

AI Savings Bot 🤖

DoNotPay (a robot-lawyer service) announced they have invented a chat-bot that will negotiate discounts with online customer service reps for you! It’s not fully launched yet, but will be a game changer for anyone nervous about calling and asking for discounts.

Housing 🏡

According to Zillow data, here are the 10 best metros for first time home buyers in 2023. “This list is based on 4 metrics: mortgage affordability, rent affordability, the inventory-to-buyer ratio which indicates available supply, and the share of listings with a price cut”.

Minimum Wage ⬆️

Starting this year, 21 states and 41 cities/counties have just raised their minimum wages. MA and WA have now reached $15 hourly pay floor for the first time, joining CA and much of NY. 🥳

Just for funsies 🤑

Check out our new post on How to Go Broke in under a year. Yes, this is a spoof post and you should actually do the opposite to build and retain wealth in life!

FRIENDS OF HTM

Ericka Young – Rewrite Your Money Story

Ericka Young is the financial coach that she never had!

As a newlywed couple, Ericka and her husband discovered that it’s actually pretty easy to become just like the average US household, piled in debt… But Ericka was determined to change her family tree! She learned how to increase her savings, decrease her debt, and now helps others who are seeking financial freedom in their lives.

Check out Ericka’s website to see what she’s up to. And if you’re interested in working with her directly, you can find her on LinkedIn, Instagram, and FB! (We also interviewed Ericka on Episode 517 where she shares her expertise!)

Cheers to a great day, great week, new month, new year, and awesome LIFE ahead!!

Best friends out 🍻

*****

***some of the links in this newsletter are affiliate links and we receive a small commission if a product is purchased. Don’t worry, we only recommend stuff that we believe in 💯***