Good morning, money nerds! 🤗

If you don’t have a theme or motto for 2024 yet, feel free to steal this one below…

“Life shrinks or expands in proportion to one’s courage” – Anais Nin

This year, I dare you to try all the stuff you’re scared of. What’s the worst that could happen?

OK, now let’s talk about money stuff! 👇👇👇

TO DO

Get a Shower Timer ⏱️

I love long showers as much as everyone else (especially in these freezing cold months!) But did you know that the average shower head spits out ~2.5 Gallons of water per minute?

This week: Get a shower timer ⏰. Something basic like this (or you could set your phone to play music and try to get out after 2 songs)

Even reducing your shower time by just 2 minutes per day will save you 1800+ gallons of water each year, for each person in your household. 😳

MONEY GOALS

Creating Systems… 🔁

Statistically, new year’s resolutions have a failure rate of ~80%. 😓

But what if I told you this isn’t because of insufficient effort or motivation, but rather from a lack of effective systems?…

You see, setting goals is sort of like planning a road trip. If you want to drive from Georgia to California, you’re gonna have a hard time getting there without a map. Planning a route ahead of time and figuring out which roads to take is what ultimately gets you to the beach. Plus, if you drive the same route enough times, navigating will become second nature, and you won’t even need to think about it.

Creating systems is essentially coming up with an actionable plan for how to accomplish our greatest goals.

Here are a few systems you can implement to help crush 2024:

Start Planning Out Your Weeks- When budgets fail, it’s usually because we haven’t anticipated a need, or get caught off guard with an expense. For example, you didn’t realize the lunch plans you made were going to take place at a super expensive restaurant, or you accidentally left the house in a t-shirt, and now it’s 30 degrees out. By planning each week ahead, you can better account for upcoming expenses.

Monthly Check-In on Long Term Goals- Sometimes we neglect our biggest projects and goals, because we simply forget about them! 🤷♂️. So try setting aside one day each month where you can check in with your long term money goals and assess your progress.

Set up Autopay- For example, if one of your goals for 2024 is to max out your Roth IRA, set up auto transfers for $583 each month. By automating your finances, you’ll save both time and loads of mental energy.

Get a Month Ahead- If you’re constantly checking your bank account to make sure you have enough funds in there for bills, you could seriously benefit from working towards getting one month ahead. Being able to pay this month’s bills with last month’s income can relieve stress and allow you to focus on even bigger goals.

Have a Weekly Amazon Order Day- If you struggle with online shopping or placing too many Amazon orders, commit to a single day each week where you are allowed to place orders. Throughout the week you can add items to your cart, but do not check out until your order day. You’ll be surprised at how many items you’ll no longer want to order just a few days later.

Create a Money Mission Statement- Decision making can be exhausting. In fact, decision fatigue can leave you feeling physically and mentally drained. That’s why we suggest creating a Money Mission Statement to help guide you through every financial choice you are presented with.

All in all, without systems, our dreams remain aspirational. By working systems into our everyday lives, we develop healthy habits and get ourselves closer to the life we crave!

Related stuff:

- 🎧 HTM Ep #764: Organizing Your Money for 2024 w/ Alaina Fingal

- 👨💻 The Organized Money: Alaina’s site, her YouTube channel, Insta and TikTok!

- 🤔 Food for Thought: 9 Questions to make your Money Mission Statement

TOGETHER WITH MMI

Overwhelmed with Credit Card Debt? 🛟

Money Management International was founded as a non-profit debt counseling agency. They exist to help good people get out of bad debt and credit situations.

If you’re feeling overwhelmed with credit card debt, our friends at MMI can help consolidate your debt and reduce your interest rates, without a loan or hard credit pull. Start online at moneymanagement.org or call 866-530-9672.

INFLATION

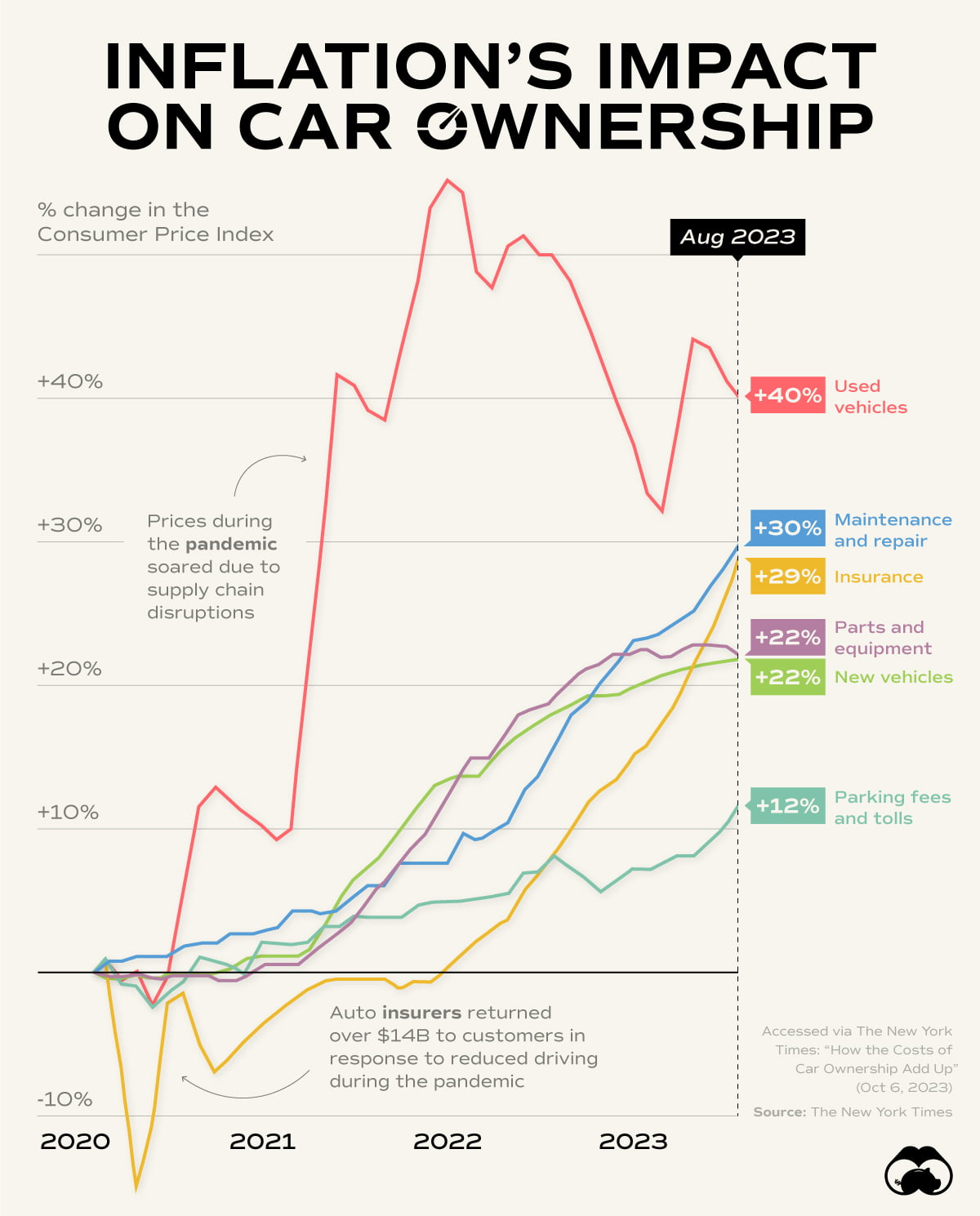

Car Ownership Costs 🤮

Good news — buying a used vehicle is a little cheaper than it was a year ago…

Bad news — Every other cost associated with owning a car has skyrocketed. To service, repair, insure, and fill your car up with gas it’ll cost you substantially more than a few years ago.

Here’s a chart from Visual Capitalist, showing the skyrocketing growth of various car ownership costs👇👇👇

Another huge aspect I don’t see tracked in this chart is financing costs. Interest rates jumped in 2023 which means even smaller purchase prices have higher monthly payments.

Sadly, living car-free is not really an option for most folks these days. But keep in mind there are a couple things you can do to lessen auto expenses…

- Shop for insurance, at least annually. It never hurts to get quotes and look around.

- Drive less! Walking, biking, scootering, carpooling, or public transport can be great options if you plan ahead.

- Delay car upgrades. The longer you drive your old car the more value you’re getting from it as well as protecting your savings.

- Buy in cash. Or if you must get a car loan, make a plan to pay that sucker off ASAP. Loans on depreciating assets are wealth killers.

You’ve heard all this stuff before — but it never hurts to refresh!

Related Stuff:

- 🚘 HTM Blog: How to Buy A Used Car

- 💸 Insurance: How to Save the Most Money Possible

ICYMI

Hot Off the Presses…

Mortgage Rates 🏡

Woot woot! The rate on the 30-year fixed mortgage continues to decline, it’s not down to ~6.61%, which is a 7 month low. Hopefully this provides a bit more relief to those looking to buy soon!

Zoom Out 📉

Via Ritholtz — The Big Picture chart shows 100 years of stock market performance, PE ratios, recessions and interest rates all packed into a single chart. It gives you a great long term perspective on investing.

Miracle Money 💵

103 homeless people in San Fran and Los Angeles were randomly chosen to receive $750 per month for 1 year as a part of a controlled study on universal basic income. Here is the latest interim report showing how it’s going so far (a decent success, as most funds are used for essentials like food, housing, clothing, etc)

FAFSA 👩🎓

The newest FAFSA form just launched for the 2024/25 academic year. And this one has “fewer questions and expended eligibility” per the Department of Education. Woohoo 🥳

HOW *YOU* MONEY

Alice, 49y/o fro Becker, MN 🌳

Occupation: Retail Operations Manager

Salary: $75k

Paycheck deductions: -$789

Mortgage: $1,377 (inc. insurance, tax, PMI)

Other Debts: home improvement – $280 (not heloc or cc), car loan – $330

Living expenses: ~$700

Leftover savings each month: ~$50

How are you investing your excess savings each month?

I invest my side gigs $ into my Roth, emergency savings, goals savings, and throw more at my loan payments and portfolio investments. It varies each month but I automate $100/mth to the emergency fund.

Biggest “craft beer equivalent” splurge:

Favorite shows conventions and concerts

Best savings hack/advice:

Keep on learning and educating yourself. And apply what you have learned to your own situation so you can improve your finances and make strides towards your goals.

Biggest money challenge right now?

Trying to get my fixed expenses to 60% of my income so I have more leftover funds to put towards my goals and the things I love to do.

Recent money win and how did you celebrate?

Moving from a fee-based brokerage firm to Fidelity (I was scared to do it but it actually was very easy). The freedom to invest in what I want now and feel the boost of confidence is a celebration in itself!

**Help us keep these profiles going by filling out this HYM form and sharing your story! (Don’t worry, we won’t publish anything without you approving it first)**

That’s it for now! Cheers for reading, and cheers to creating a happy, memorable and courageous 2024 💪

Best friends out! 🍻