Good morning and happy “choose”day!

Repeat after me…

I choose to be happy today.

I choose to have a positive attitude.

I choose to work hard today.

I choose to spend less than I make, open a Roth IRA, put every spare dollar in it, invest in low cost index funds, watch my wealth compound year over year, become a multi-millionaire baller shot-caller and leave a killer legacy for me and my family!

Oops, got a bit carried away with that last sentence… But the point is — your daily choices and commitments you tell yourself heavily sway the direction you are headed in life.

Today, make good choices. 💪

TO DO

Action of the week: Check your credit report (It’s free)

Visit AnnualCreditReport.com… This is a FREE service where you can check your full credit report *weekly* until the end of 2022.

Thanks to the three major credit bureaus (Equifax, Experian and TransUnion) you can review in detail all the accounts and data points that affect your credit profile, and this site also provides links to help dispute anything incorrect you might come across.

Takes about 3 mins to fill out the form and get your report. No harm in checking it out right meow! 🐈

MONEY MINDSET

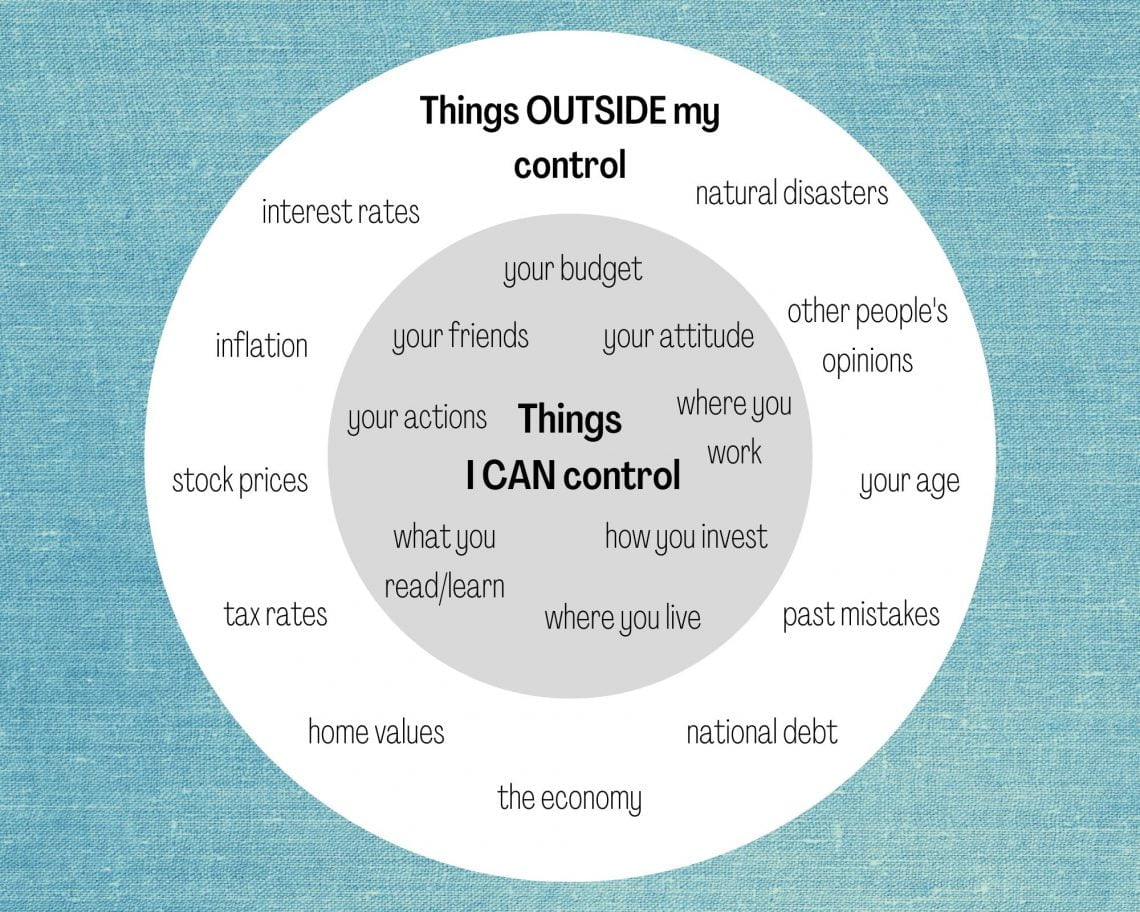

IN your control vs. OUT of your control…

Recessions can trigger stress and anxiety. It effects everyone to some degree.

I know a *very* wealthy person that checks the stock market every day. On days when the market is down, he is grumpy, mopes around the house and snaps at his friends and family. On good stock market days he is happy, friendly and generous.

This has always confused me… Isn’t the point of having buttloads of money to live with complete peace of mind and detachment from market performance? Why let something that is 100% out of your control dictate how you approach life?

If any of you are feeling down, stressed, or worried about our current economic situation, it might be a good time to remember what is in your control and out of your control…

Just like the scary and unknown times a couple years ago:

- We are all in this “recession” together

- Focus on the things you CAN control

- Tough times don’t last. Tough people do.

We’ll cover this topic more in an upcoming podcast. 🔜. In the meantime, here are some thing in your control that you can do to plan for a recession. Whether something bad happens or not, you’ll have done your best to prepare!

Related:

- Best ways to automate your finances

- 14 tips for mindful spending

- Things to do when the stock market crashes

INVESTING

Nerdy (and colorful!) chart of the week… 🤓

You may have seen this before — it’s a breakdown of all the different SP500 industry sectors and how they have performed over the past 15 years (ranked highest performance to lowest).

Courtesy of The Novel Investor 👇

Can you spot any reliable trends in this chart? Do you know which industries are going to have the best performance in 2022, 2023 and beyond?

The answer is no. History tells us that no particular industry dominates in performance year after year.

For example, in 2021 we can see the Energy, Real Estate and Financial sectors (green, pink, blue squares) had the best performance. But the year prior in 2020, they all had the worst performance. Each year brings drastically different results per sector.

All this really goes to prove is that broad diversification across all industry segments is the best way to cover all bases when investing. This is why we recommend wide ranging index funds and never having all your eggs in 1 basket.

👉 For more on diversification, check out Episode 341 “How We Invest Our Money”. **Spoiler alert** — Joel is almost exclusively invested in VTSAX and FZROX (both total stock market index funds), and Matt is 100% invested in VOO which is Vanguard’s S&P 500 ETF.

ICYMI

Noteworthy News and Happenings…

Interest Rates 📉

The US federal bean counters announced a 0.75% interest rate increase last week — the highest rate hike since 1994. They’re doing this to help slow down inflation. It might cause short term pain, but it hopefully eases things long term.

Crypto 💸

Bitcoin has been crashing, now down ~60% year to date. Ethereum is now down over ~70% YTD. Major crypto bank Celsius has “frozen” withdrawals and transfers, suggesting it doesn’t have enough funds to honor mass withdrawals 😳. Jay Z’s new “bitcoin academy” couldn’t have come at a worse time.

Auto 🚘

Tesla just increased prices across all car models, up to $6k more expensive. Inversely, Chevy announced a $6k price reduction for their new 2023 EV Bolts. It’s a tricky balance for auto manufacturers to manage increasing production costs while also trying to sell as many new car units as possible.

Housing 🏠

30 Year Fixed Mortgage rates have climbed to over 6.2%, slowing down home sales and new mortgage applications. While this *might* result in home prices declining, new buyers will still pay equal (or higher) monthly mortgage payments due to higher interest rates.

Healthcare ⛑

Health insurance companies are finally being fined for not complying w/ federal rules to disclose prices to patients. Let’s hope that this is just the beginning of more fines to come, spurring moves towards more transparency that helps us all save $.

Spending Questions 🤔

Check out this list of questions to decide whether you should make that purchase or save the money instead… Should You Buy It?

Millionaire Migrants ✈️

A super interesting Henley Global Citizens Report projects that 88,000 millionaires will move countries this year. Where are the moving to and from? 👇👇👇

COMMUNITY

Watch out for imposter accounts 🥸

Cheers to Jeremy for catching this and sharing! 👇👇👇

Just for the record:

- HTM will never ask you for personal information (or DM you with vague questions)

- We don’t sell any courses or e-books

- We never make specific stock/bond/crypto buying suggestions

Thank you in advance for helping report and block any fake accounts you spot. (and thank you for following the *real HTM Insta page* 😉)

Wishing you all a fantastic week ahead, doing what you do best!

Best friends out 🍻

PS. It’s National Selfie Day today! 🤳📸 Here’s a snap of our ugly mugs.

Join the club and receive our newsletter every Tuesday morning!👇