pa·tience

(noun)

The capacity to accept or tolerate delay, trouble, or suffering without getting angry or upset.

“As Jenny’s investment portfolio continued to decline, she practiced patience, drinking delicious craft beers and staying calm because she knows the market will recover (and more) over time”

Good morning, money nerds!!!! ☕️☀️

Not sure who needs to hear this right now: PATIENCE is the most underrated quality that successful people possess.

Good things take time… Promotions, pay increases, compound growth, experience/knowledge, strong relationships, etc… Hang in there, peeps!!

“Patience is also a form of action” – Auguste Rodin 💪

TO DO

Increase your 401(k) contributions! 🏷

We love 401(k)s, because auto-deductions from your paycheck are the best way to “set and forget” your savings. Increasing your contributions might sting a tiny bit when you first make the change, but as time rolls on you’ll get used to the smaller paycheck amount and forget you’re even saving more!

If you have room to invest a little more, NOW is the time to do it. (Actually, 2 years ago was the time to do it… but stock prices right now are almost the same as they were 2 years ago — so you’re getting a second chance right now!)

So right now: 1- log in to your workplace retirement dashboard. 2- increase that auto-deduction by 1%. 3- barely notice the difference today while you experience compounding returns tomorrow!

Small sacrifice today = bigger gifts later for your future self 😉

DISASTERS

Surviving Financial Storms 🌀

*First off, our hearts go out to all those affected by Hurricane Ian. 💙 We’ve donated some money to relief efforts — a tiny amount in comparison to people’s losses — but anything helps! Wishing you all a speedy recovery.**

Physical disasters like hurricanes always get us thinking about financial disasters… These can happen anywhere, anytime, and the worst part about financial disasters is that often people feel helpless and might suffer alone. 😔

So we wanted to throw out a few notes about financial emergency preparedness. Maybe it’ll help peeps out there plan for, endure, or recover from a financial disaster:

Things you can do NOW:

- Build up a cash emergency fund. A nerdy study once found that $2,467 is the minimum perfect amount that people should save to cover most common emergencies. (that’s the minimum, but we recommend 3-6 months of living expenses for a full emergency fund!)

- Get insurance (and REVIEW IT!). Whether it’s life insurance, health, car, house, renters, or alien abduction insurance (yes that’s a thing) make sure you are covered for the things that might happen to you! Review your policies regularly — *before* a disaster happens.

- Make an emergency plan. A will, a playbook, a prenup, a EFFAK (emergency financial first aid kit)… These tools help you follow directions when a disaster happens, vs. acting on emotions.

DURING a financial crisis:

- Seek help (you are not alone!!). The sooner you face issues and seek help, the quicker you can recover. If you’re in crippling debt, reach out to MMI or NFCC — both are free resources with amazing support. DisasterAssistance.gov is a great resource for large natural disasters.

- Face the damage head on. It’s temping to ignore financial problems, but facing things quickly gives you an advantage. For debts, contacting credit agencies proactively can help you negotiate extensions, payment plans, etc.

- Watch out for scams. Sadly, there are folks out there looking to take advantage of those in desperate situations. Don’t give out personal information to untrusted parties, and beware of “too good to be true” help sources.

AFTER financial disasters:

- Rebuild your emergency fund. Prioritize paying down debts and getting back to a stable place as quick as possible.

- Research tax breaks. Depending on the disaster you might qualify for tax deductions or fee relief. Declared state of emergency disasters, certain medical expenses and even some investment losses maybe qualify for tax deductions.

- Learn, move forward, and help others! Experiencing a financial disaster means you’re better prepared to face (or avoid) things happening again in the future. Sharing what you know and any past mistakes also helps others fall into the same bad situations.

Other great financial preparedness info:

- 📝 Checklist: A thorough financial preparedness checklist via SmartAsset

- 🏛 Via the IRS: Tax relief in disaster situations

- 💻 HTM Blog: Everything you need to know about Emergency Funds

- 🚒 Ready.gov: A big bunch of Financial preparedness resources

FAMILY FINANCE

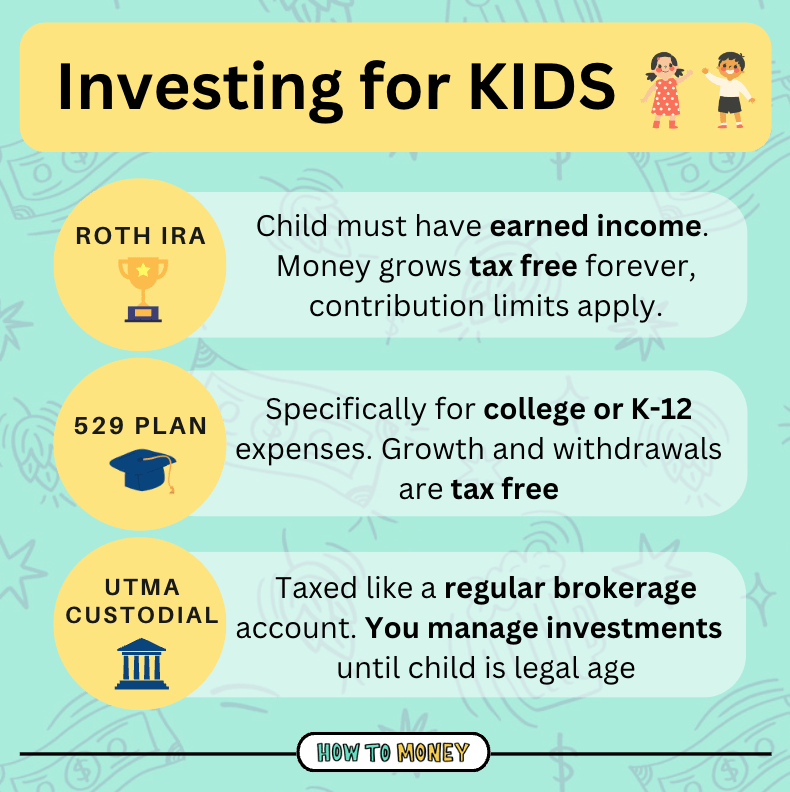

Saving for your kiddos future…

Before we talk different account types, it’s important to think through these points…

1. Teaching kids how to *make their own* money trumps > gifting them money. Making your kids’ financial life too easy sometimes backfires.

2. Make sure your own financial stability and retirement is on track *before* giving to kids. Setting yourself up first gives you a more solid foundation to help them in bigger and better ways, later.

That being said, investing for kids mostly comes down to how you envision the money being spent later in life. Here are some options and how they work… 👇

🏆 Roth IRA: Kids can have Roth IRAs! But, they must have *personally* earned income for whatever is contributed to the account. There are all types of ways for kids to earn money, and even if it’s small amounts like $20/month for doing yard work, walking dogs, babysitting, etc. All money grows tax free in a Roth, forever, and contributions can be withdrawn anytime, for anything.

👩🎓 529 plans: These are designed to cover future education expenses (either college or K-12). There are 2 types of 529 plans… The most common is a standard savings plan where contributions that are invested, grow tax free and can be taken out anytime to cover tuition, room & board, text books, etc. The other type is a prepaid tuition plan where you can lock in today’s rate for future tuition at eligible public or private colleges. (only some states offer this!)

You can withdraw contributions at any time from a 529 plan. But, any growth from the account is subject to income tax + a 10% penalty if you use the money for anything other than education. If you’ve accidentally overfunded a 529 plan (kid’s college was cheaper than expected or didn’t go to college) you can change the account beneficiary to a different family member (here’s a list of who the IRS counts as eligible fam members)

🏛 Custodial Brokerage: Also known as UTMA or UGMA accounts… This is basically a regular brokerage account under the kids name, except you act as the “custodian” responsible for managing the account until the kid turns legal age. There aren’t any tax advantages for accounts like this, but they are probably the most flexible as the kid is free to do whatever they want with the money/account when they have access to it.

Again, we’d like to stress the importance of teaching kids how money works — how to earn it and how to manage it — early in their life. No matter how much you gift them now or later, the basic principals of personal finance are crucial to success.

Related resources:

- 🎙 Podcast Episode 427: Raising financially savvy kids (59 mins)

- 💻 NerdWallet: Roth IRA for Kids! (5 min read)

- 🎥 Saving for College: How to save money in college (2 min video)

- 📝 Checklist: End of Year Financial Planning Checklist

- 👨💻 More HTM blog posts!: How to teach kids about money, and teaching kids how to invest

ICYMI

Buzzing around the water cooler…

Networking 👩💻

Remember last week when we said you should reach out to a few old connections to keep your social/business network strong? Well, LinkedIn did a massive social experiment using 20 million people over 5 years, trying to figure out the best “people you may know” algorithm… Long story short: “weak ties” are the most valuable type of connection when trying to land a new job.

US Dollar 📈

USD is growing stronger compared to other foreign currencies, which is both good and bad news… It’s great for US travelers headed overseas (because our dollar stretches further) and also for people importing things to the USA. But it’s bad for travelers coming to the USA, and companies that are based here and selling overseas. Here are all the winners and losers per NPR.

Shopping 🛒

Target is hosting it’s DealDays event this week Thursday –> Saturday. And Amazon just announced it will host another Prime Day, next week on October 11th-12th. Could be a great chance to snag discounts on holiday gifts and items you are going to buy anyway. (But please please please don’t get tricked into buying crap that you don’t need!)

Spending Stats 💸

In 2021, the average American spent just over $60,000 a year… But where does all our money go? Check out this interactive comparison chart showing how Americans spend their money, by generation.

Super Savers 🤑

CNBC had a great article about the financial habits of super-savers… Some cool trends –> 48% drive older vehicles, 39% don’t travel as much as they’d like, 39% clean their own homes, and 38% attempt to DIY most things.

Geoarbitrage 🏝

Want to retire overseas? Here are 8 countries that offer retirement visas and have a low cost of living. Oooooh let’s all move to Belize!!!

RIP Coolio 🪦

Sadly, he passed away last week. One of his famous lines from gangster’s paradise… “I’m 23 now but will I live to see 24? The way things are going I don’t know”… We’re glad you made it all the way to age 59, Coolio — thanks for sharing your talent with the world.

HOW *YOU* MONEY

Sophia, 30y/o from Upstate NY! 🌼

Occupation: Commercial Painter

Salary: $17.63/hour

Paycheck deductions: -$375/month

Rent: -$800/month (includes utilities, internet and furnishings)

Other debts: Student loans, $28k remaining, payments on pause

Living expenses: -$400-500 (depends on travel, gifts, special events) August was $600 with $100 for a wedding, $100 for a used bike, and more.

Leftover savings each month: ~$900!!

How are you investing your excess savings each month?

I save in a Roth IRA and a 401K. Other savings are in the bank, which I know isn’t the best. But eventually I want to scale up my reselling business.

Biggest “craft beer equivalent” splurge:

Bicycle items! I may buy a trailer soon for $200. When softball league is in season, going to a restaurant with the team is a splurge. I typically don’t eat out.

Best savings hack/advice:

SELF-DISCIPLINE! I resist impulse buys, convenience purchases, carry no subscriptions, limit online shopping (this is HUGE), buy as much as possible used, and am careful to budget grocery shopping (I see groceries as a big category where people justify extra spending). I consider myself very fortunate to not care about “keeping up with the Joneses.”

Anything else you want to share?

The biggest impact on my savings has been selling my car. I bought one off a relative in May ’19, in cash, and sold it in March ’21. Now I use my bicycles to get almost everywhere. I repair them myself at the community bike store I volunteer at, which amounts to huge savings! I usually don’t take the bus except for during active snow storms. I use Amtrak to see family in the next city east.

Recent money win, and how did you celebrate?

My net worth reached 100k!!!! This is savings, investment accounts, and all money in the bank after deducting the student loan balance. I also reached $1,000 in profit from Craigslist sales for this year, where I sell curb-shopped items.

What’s your biggest money challenge right now?

Spending my hard-earned money on experiences I will enjoy. I err on the side of too frugal. I also could upgrade a lot of my items but just don’t.

**Editors note: Sophia is an absolute rockstar!!! We just love how disciplined she is and how she socks away a decent percentage of income even on a modest salary. Very inspiring!

**Have YOU got an interesting story or money profile to share? We’d love to hear it (and share it). Fill out the How You Money form here**

That’s a wrap! Have an awesome rest of the week, living your best life.

Best friends out 🍻

*****

* Advertiser Disclosure: How to Money has partnered with CardRatings for our coverage of credit card products. How to Money and CardRatings may receive a commission from card issuers.

* User Generated Content Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.