Budgets are often viewed as a four-letter word. Only 32% of couples keep a written budget of any kind (and I can’t imagine the numbers being much higher for single folks).

Most people know they need to budget, but just thinking about where to begin can be overwhelming! Apps, spreadsheets, envelopes, receipt filing… it can get confusing pretty quick.

But our goal in this post is to simplify the daunting task of budgeting and explain a few simple and approachable methods that might actually help you ‘stick to it’ this time.

Reasons You Need a Budget

Most people balk at the idea of starting and keeping a budget. But we want to help you realize that budgeting can actually help you achieve your greater goals & provide you with some peace of mind when it comes to your money situation.

Budgeting can help you:

- Get out of debt quickly (and stay out)

- Live within your means and achieve goals you’ve never been able to.

- Save money on things that provide little value to your life

- Spend MORE money on stuff that does provide value (mindful spending)

- Avoid fights that plague your relationship when it comes to money

- Prepare for emergencies

- Ultimately achieve financial freedom and retire comfortably!

Whether you’re in a load of debt and struggling to make ends meet, or have massive dual incomes with no kids, a simple budget can improve your life. It puts you in the drivers seat of your financial life.

Ok, let’s get to the different budgeting methods and how they work…

4 Easy Budgeting Methods

There is no single perfect approach to budgeting. That’s why we’re offering multiple suggestions. Everyone has different strengths, personality types, and financial situations.

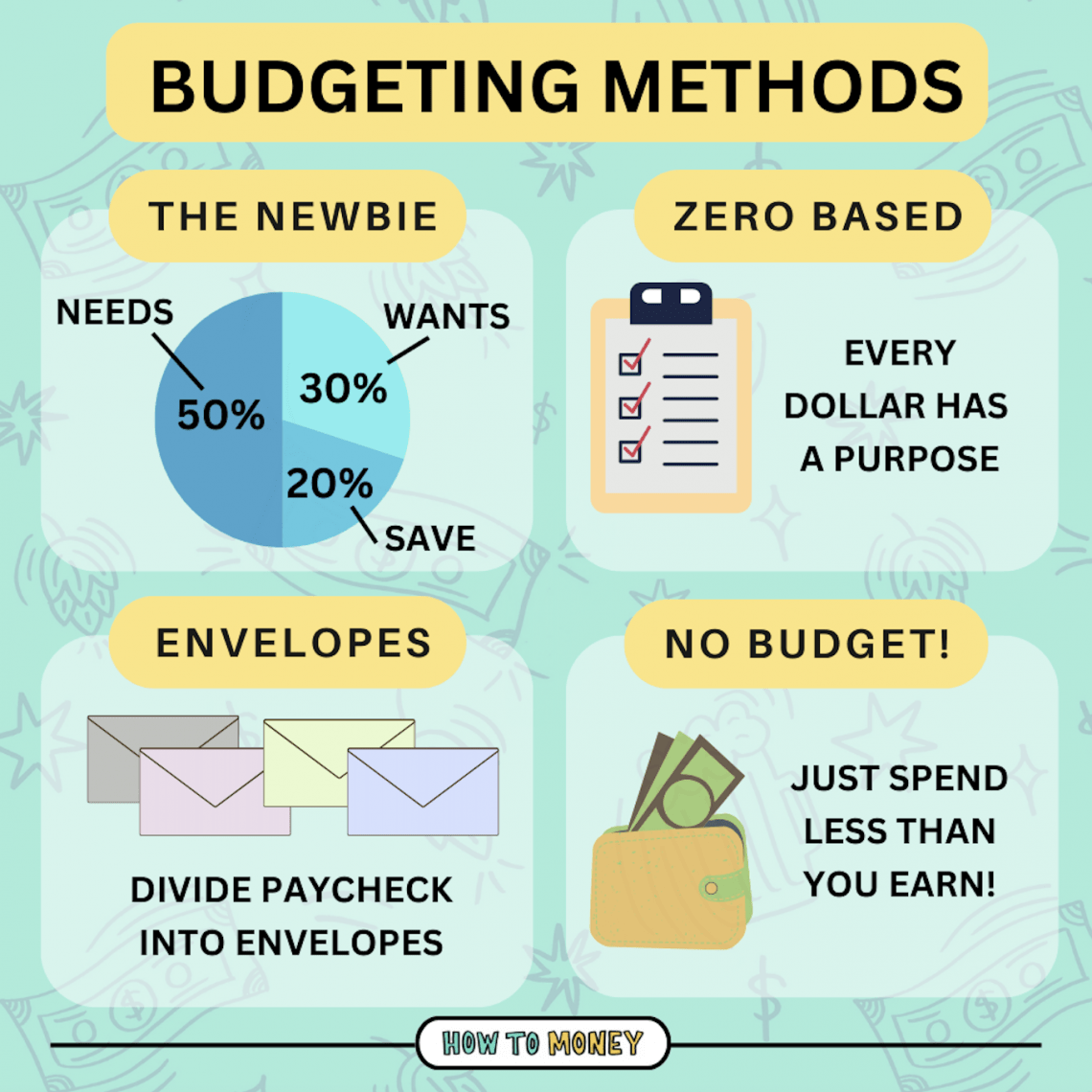

Here are the methods we’ll go over in this post.

50/30/20 Budget (aka “The Newbie”)

If you have no idea where to start then the 50/30/20 budget is probably best for you. This is a less rigid approach and can act as a guiding light if you’re looking to keep things simple.

Here’s how it works:

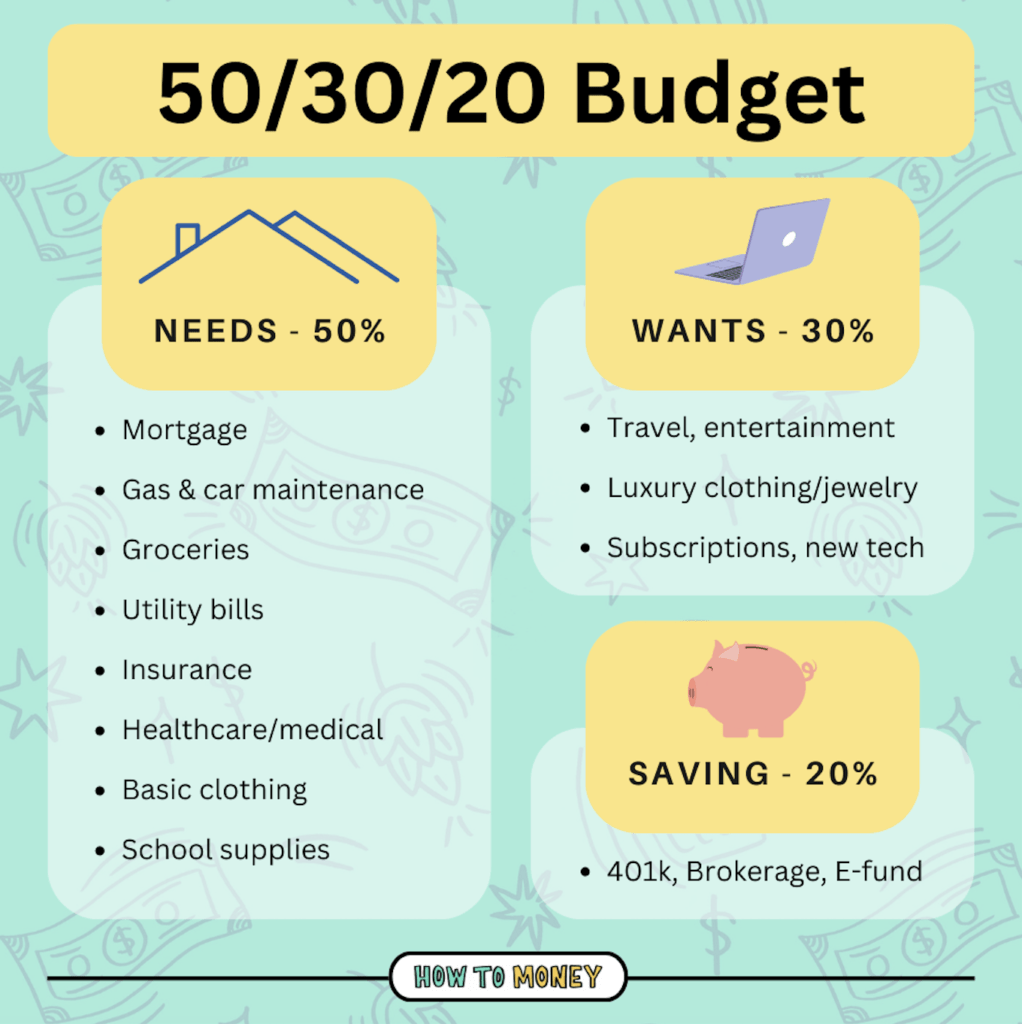

- 50% of your budget is for needs

- 30% is for wants

- 20% should be dedicated towards savings (investing or debt paydown)

First, take your monthly income (after taxes and deductions) and split the number in half. This is what your goal is to spend on living necessities. Stuff like housing, food, transportation, insurance, utilities, and childcare – really anything you MUST have to live and be healthy.

If your current spending is over 50% of your take home pay, you have a mission now to pare back and look for areas to save money. (Hint: start with the biggest cost items like your car, insurance, saving on utilities, etc.) Look to save money in any area possible.

Next, 20% of your take home pay should be set aside for savings. This could be allocated towards paying down credit card debt, a car loan, student loans, or investing. (If you don’t have a basic emergency fund of $2,467, definitely prioritize that first!)

Lastly, the “leftover” 30% of your pay can be for wants and non-essentials. It’s important to have fun and enjoy the fruits of your labors, but remember this budget category comes LAST. Needs and savings should always trump “wants.”

Related: Needs vs. wants and budgeting for both

Envelope Budgeting (aka “Cash Stuffing”)

If you tend to overspend when you use plastic (credit cards or debit cards), then envelope budgeting might be best for you.

The way this works is you have actual physical envelopes that you fill with money for categories like eating out, groceries, clothes, and whatnot. 📩 Then when it’s time to pay for something, you can only use the money that’s within the envelope labeled for that type of purchase.

For example, let’s say at the beginning of the month you put $200 into your “restaurants” envelope. Each time you head to the taco truck for lunch or have happy hour with friends that month, you take that envelope with you and are only allowed to spend a maximum of what’s inside. When the money runs out, you literally have no more cash to spend at restaurants and you’ll need to wait until the next paycheck to replenish that envelope.

This method helps you stick to a strict budget because there is literally a finite amount of cash in your each of those different envelopes. You can’t overspend, even if you wanted to.

Another newer term for the envelope system is “cash stuffing.” It’s more or less the same concept except you stash your money in all types of things like jars, folders, piggy banks or even empty liquor bottles!

You can get creative and choose whatever works for you. But at the end of the day this budgeting style is designed to curb overspending. It helps folks who have trouble getting into problematic debt habitually.

Zero-Based Budget (The “Type A”)

A zero-based budget makes a lot of sense for the person who wants everything accounted for down to the single cent. If you’re highly organized and great with spreadsheets, you can harness those strengths to really make your money work for you by giving every dollar a name.

Here’s how it works:

- Take your monthly income

- Subtract all of your expenses

- If you have money leftover → assign it a purpose!

- The goal is to have $0 at the end

What we love about the zero based budgeting system is when you track every single dollar you’re able to see exactly what you’re spending money on. Trends reveal themselves over time which you can then work on improving.

One of the best zero based budgeting software apps out there is YNAB (You Need A Budget). Not only does it help track all of your transactions automatically and categorize them, it encourages you to have a $0 balance at the end of every month. The average user saves $600 in the first 2 months of using YNAB, and $6,000 in the first year!

One last note about zero based budgeting… It allows you to spend a little more money on the things you enjoy in life. If you are already someone who prioritizes saving/investing, then your “leftover” money each month can be funneled towards more joyful endeavors. Budgeting is not always a chore – creating and sticking to a budget can be really rewarding!

The No-Budget Budget

If you really don’t like numbers and tracking, you can simplify things by just making sure you earn more than you spend, and invest the difference. This is typically best for high income earners who keep minimize their largest expenses ( like housing and transportation) and automatically save 20%+ of their income. These are already people with good financial habits.

When you prioritize saving and investing, that’s called paying yourself first. You’re putting away chunks of money (into your 401k, savings or brokerage accounts) as soon as you get paid. This money is enough to set you on track for a comfortable – or early – retirement.

As for all the leftover spending money, it doesn’t matter what you spend it on, it’s totally up to you. Once you’ve prioritized the biggest financial goal (being financially independent at some point) you can do whatever you want with your money!

It is a luxury to not have to budget. Budgeting is an absolute necessity for most folks. But if your income eclipses your spending needs by a wide margin, you can afford to be less stringent when it comes to tracking your dollars.

Budgeting with a Variable Income

If your income bounces around throughout the year, budgeting is still important. Actually, it’s probably more important! Because some months you might not have enough income to cover your full expenses, putting you in a temporary deficit.

In cases like this, we recommend zooming out and setting a quarterly or annual budget. In those bigger earning months, set aside larger chunks of money in your budget categories. Think of this like a 2-3 month emergency fund for each budget item. That way when the lower income months come, you’ll have plenty of cash to pay for things without going into bad debt.

For variable income budgeting, you might use slightly different techniques, or a combo of the budgeting styles used above. The most important thing is to maintain a larger margin or surplus to smooth out the ups and downs of variable income.

Helpful Budgeting Software(s)

Spreadsheets are probably the easiest and most common budgeting tool. You can easel create your own, of use a template from someone else. Here’s one that Matt’s family uses (click file → make a copy), and also an episode we recorded about making a bare bones budget!

You Need A Budget (YNAB) is a killer tool that has helped many a crappy budgeter. Although it costs a little money (under $9 a month), the average user saves over $600 in the first couple months after signing up. They have a free 34 day trial, and also YNAB is always free for students!!

Mint.com is a great FREE software. But, its budgeting capabilities are secondary to it’s expense tracking capabilities. Many people use Mint.com to track all their transactions, and then download them all into a spreadsheet for inputting into their spreadsheet budget.

Personal Capital is also a FREE tool for expense tracking. Like Mint, it has some budget capabilities but it wasn’t built to help you achieve budgeting greatness. One cool thing about Personal Capital is the net worth tracker. This encourages you to save more and get out of debt faster. It’s a great all around tool, and since it’s free, there’s no harm in signing up!

All in all, when you can automate your finances and budgeting system, it will save you time and motivate you more. It’ll also help you stop dipping into your savings account to afford stuff!

The Bottom Line: Everybody Budgets Differently

A good budget isn’t static, it’s fluid. The reality of inflation and the shifting over your own personal goals should cause you to tweak it a couple of times a year.

And it’s important to make the budgeting process enjoyable enough that you’ll stick with it each month. We recommend using the style that fits your personality type, as you’ll have a better chance of success. And consider budgeting alongside a good friend or a favorite beverage to increase your chances of success. 😉

Life isn’t perfect, which means budgets aren’t either. Be flexible in your approach to budgeting. Each month you’ll have new challenges, one-off expenses, and abnormalities. You’ll definitely make mistakes and screw up on occasion – and that’s completely OK! The important thing is to keep going even when setbacks occur. And feel free to switch to another system that might work better for you if the first one you adopt isn’t doing the trick.

At its core, budgeting is basically imposing at least some amount of hardship on yourself so that hardship doesn’t get imposed on you by outside forces. By budgeting well and spending less than you make you’ll much more easily avoid the real money hardships that plague so many folks.

Budgeting isn’t an attempt to constrain your happiness. A good budget can actually help you funnel your money towards the things that matter most! And opting for the right budgeting approach will help you do just that consistently and effectively.

Related posts: